Prime

Banks closure: MPs summon Mutebile, Kasekende

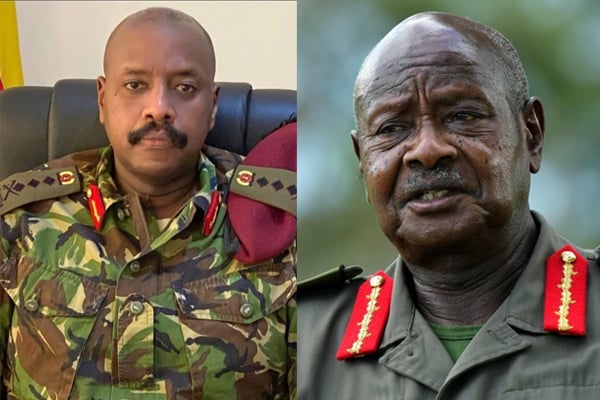

Parliament’s Committee on Commissions, Statutory Authorities and State Enterprises (Cosase) has summoned Bank of Uganda Governor Emmanuel Tumusiime -Mutebile (L) and his deputy Louis Kasekende (R) to respond to wide-ranging wrongdoings unearthed by the Auditor General at the central bank. FILE PHOTO

What you need to know:

- The issues raised by the Auditor General’s special forensic report relate to unaccounted for money, missing land titles and customer loans that were inherited from closed banks which were sold at an undervalued rate.

- The closed banks are Teefe Bank (1993), International Credit Bank Ltd (1998), Greenland Bank (1999), The Co-operative Bank (1999), National Bank of Commerce (2012), Global Trust Bank (2014) and Crane Bank Ltd (CBL)

Parliament’s Committee on Commissions, Statutory Authorities and State Enterprises (Cosase) has summoned Bank of Uganda Governor Emmanuel Tumusiime -Mutebile and his deputy Louis Kasekende to respond to wide-ranging wrongdoings unearthed by the Auditor General at the central bank.

Mr Mutebile and Mr Kasekende will appear before the committee on October 31 as the committee begins a broad inquiry into irregular dealings at BoU that were uncovered by a forensic report by the Auditor General that investigated the closure of seven banks.

Cosase Chairman Abdu Katuntu Wednesday indicated that the committee will begin with the entire Board of Bank of Uganda with directors of defunct banks also lined up for cross-examination.

“We will use the Auditor General’s report in relation to the defunct banks and how they were managed by Bank of Uganda. We will have officials from the board of Bank of Uganda to respond to issues that were raised by the Auditor General,” Mr Katuntu said.

The issues raised by the Auditor General’s special forensic report relate to unaccounted for money, missing land titles and customer loans that were inherited from closed banks which were sold at an undervalued rate.

Auditors discovered that assets worth Shs23 billion that were formerly owned by GTB were not transferred to DFCU in the purchase and assumption agreements when the bank was closed in July 2014.

The assets included cash balances (Shs6.6 billion), amounts due from other banking institutions (Shs 2.3b) ,other assets (Shs5.1 billion), amounts due from group companies (Shs9 million), property and equipment (Shs5.6 billion), intangible assets (Shs758 million) and deferred tax (Shs2.4 billion).

All the former Board members of the defunct banks will also be cross-examined by the committee.

The closed banks are Teefe Bank (1993), International Credit Bank Ltd (1998), Greenland Bank (1999), The Co-operative Bank (1999), National Bank of Commerce (2012), Global Trust Bank (2014) and Crane Bank Ltd (CBL).