Prime

More Ugandans to access financial services through agent banking

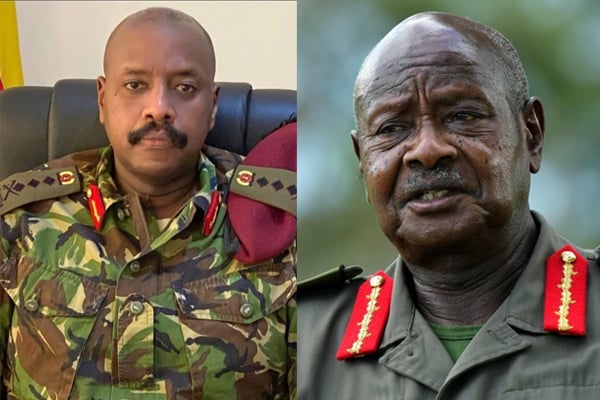

L- R: Barry Ryan- Group CEO Fintech Group, In the middle is Vincent Ondiff- CEO - Fintech Uganda and last George Ondego - Technical & Infrastructure Manager - Fintech Group. PHOTO BY RACHEL MABALA

What you need to know:

- The regional manager of FINTECH, Mr Vincent Carolius Ondiff said: “We have partnered with UBA to deliver Payments Clearing Settlement and Information Security Solutions).”

- Agent banking is an extension of banking services outside the conventional bank branches to, where a licensed and supervised financial institution contracts a third party operator (agent), who is approved by Bank of Uganda, to provide permitted financial services on its behalf.

KAMPALA

Although banking has been in Uganda for over one hundred years many local Ugandans still don’t have access to financial services due to limited commercial bank outreach in their locality coupled with high cost of financial services.

It is against this background that Uganda Bankers Association has partnered with three Information Technology Solution firms to bring more people into banking system using Agent Banking System which is cheap and efficient to open bank accounts.

Agent banking is an extension of banking services outside the conventional bank branches to, where a licensed and supervised financial institution contracts a third party operator (agent), who is approved by Bank of Uganda, to provide permitted financial services on its behalf.

In other words it is a new banking method where transactions are carried out by an appointed agent on behalf of your bank.

The Agency Banking System or platform is being anchored by the three technology partners which includes Eclectic that provides the software platform, Efficiencie that provides the pin pads, Bluetooth printers and phones/tablets and FINTECH that provides the POS devices.

The executive director of Uganda Bankers Association (UBA), Mr Wilbrod Owor said this afternoon at UBA head office in Muyenga, Kampala that the introduction of Agent Banking System will increase the number of account holders in Uganda as well as improving on the financial services.

“Through the Agent Banking System, we expect to increase the number of bank holders from the current 7.4 million to 11.6 million in the next three years,” he said.

The regional manager of FINTECH, Mr Vincent Carolius Ondiff said: “We have partnered with UBA to deliver Payments Clearing Settlement and Information Security Solutions).”

Mr Ondiff said they’re providing the software for 18 banks in Uganda.

“We are supporting almost 75 per cent of the banks in the country. We have already provided software to 2,500 customers and we’re going to increase the number of customers to 10,000 in the near future to help the general public get hooked into electronic system instead of moving with and keeping money in their homes,” he said.