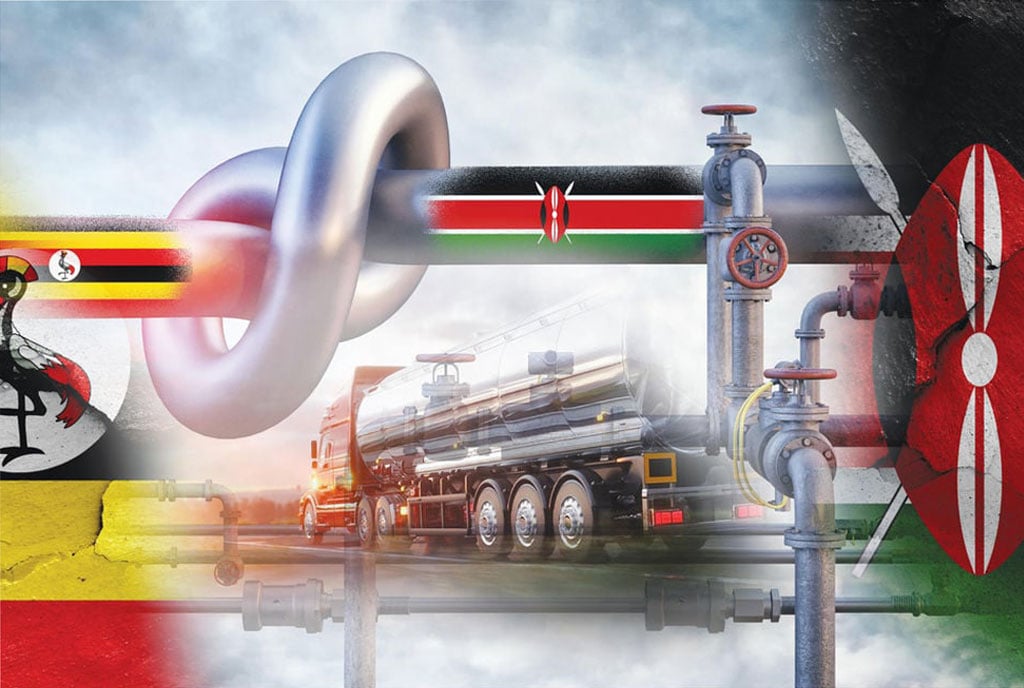

Fuel trucks from Malaba border. Uganda National Oil Company has assumed full responsibility for the importation of petroleum products into the country. PHOTO/ MICHAEL KAKUMIRIZI

|Prosper

Prime

2024: The bumpy road ahead for Uganda’s economy

What you need to know:

2024 may just be as unpredictable as the past years. But one thing is clear: Uganda won’t leave behind her economic woes from 2023 such as the rising public debt that has crossed the Shs90 trillion mark.

The year 2023 simply ushered in many unfinished businesses into the New Year. In the eyes of sector players, regulators, economic analysts and researchers, the year 2024 is gearing up for a continuation of the good, the bad and the in-between that occurred over the previous 12 months in the economic arena.

It is no brainer that the year 2024 will be the time the economy comes to terms with the government years of overzealous borrowing. Already, the country’s coffers are wobbling with public debt to the tune of about Shs90 trillion.

This huge public debt, will ultimately drain the country of the much needed resources to finance key sectors of the economy in the Financial Year 2024/25 as a huge pie of the budget will be committed towards servicing the country’s debt obligations.

This situation has been worsened by the dwindling revenue collections. Currently, over Shs600 billion in revenue shortfall has been recorded in the first half of this financial year, according to the Finance Ministry.

Finance Minister Matia Kasaija holds the national budget briefcase in June last year. Over Shs600 billion revenue shortfall has been recorded in the first half of this financial year. PHOTO/ DAVID LUBOWA

For those exporters who were accessing the U.S market under African Growth and Opportunity Act (AGOA), 2024 is bad news after the US removed Uganda from the AGOA preference scheme due to the country’s recently passed Anti Homosexuality Act, 2023. For the same reason, World Bank on August 23, 2023 suspended new funding to Uganda.

As a result , Mr Kiiza Africa, a development Anthropologist and PhD Fellow at Hamburg University, argues that this year will provide the real test to Uganda’s economic resolve to withstand both external and domestic pressures.

External pressure

Importantly, much of the economic shocks that the country endured in the just ended year was imported. For example, the roots of the Covid-19 pandemic which resulted into locking down of the economy for the best part of two years, originated in China.

After lifting the lockdowns in early 2022, the global petroleum demand rose faster than supply, increasing fuel and crude oil prices, making it costly to access inputs and markets. The average petrol price increased by nearly 21 percent and diesel went up by about 16 percent. This pain that the economy endured throughout 2023 will play out again this year despite marginal relief in pump prices.

As the economy was trying to regain its pre-pandemic levels, the Russia-Ukraine war broke out in February 2022 - another external factor - leading to a significant increase in international prices for food, fuels, fertilisers, and other essential commodities - driving inflation to double digits – ripping the 5 per cent standard cap.

According to the deputy Governor of the Bank Uganda, Mr Michael Atingi-Ego, global happenings will always have a bearing on the domestic economy given that Uganda is not immune to things happening at international level.

The central bank deputy governor noted in an exclusive interview that whatever happens at the global level will have an impact at the domestic or national level, citing global monetary policy that has tightened financial markets ability to provide affordable resources, affecting growth that could have been seen in this year.

Revised global growth

OECD outlook projects global GDP growth of 2.7 per cent this year compared to 2.9 per cent projected in year 2023. This mild global growth will result into reduced demands for export globally with Uganda being one of the economies bearing the brunt.

The USA is also expected to raise interest rate to 3 percent in 2024. However, election related stimulus may relieve the impact of such a policy stance, according to the head of the macroeconomics department at the Economic Policy Research Centre (EPRC), Mr Corti Paul Lakuma. Additionally, he argues that a rise in US interest rate may put pressure on the need to match such an action in Uganda to compete for capital flows largely for keeping essential energy imports affordable.

A man sells food in the market. The pain that Uganda’s economy endured throughout 2023 will play out again this year despite marginal relief in pump prices. PHOTO/ MICHAEL KAKUMIRIZI

With the inflation coming down from a global average of over 8 per cent to slightly over 6 per cent in the just ended year – 2023, and further and projected to drop to about 5.4 per cent in this year (2024), means, according to Mr Atingi-Ego, that monetary policy will be tighter until beyond this year. The implication for that is that interest rates will remain high, affecting portfolio flows and cost of financing, including for Uganda.

He said: “As a result of tight monetary conditions, financial conditions at global level will remain tight going into 2024.”

Some good news for Uganda is that inflation is coming down. As per Bank of Uganda reports, annual headline inflation has since reduced from 10.4 per cent in January 2023 to 2.6 per cent in December 2023 - the lowest in East Africa. This, according to Mr Atingi-Ego, will cheapen imports in terms of import prices.

And the downside to this, thanks to the tight monetary policies at global level, is the hit that the country’s export will have to grapple with. According to Mr Atingi-Ego, “the demand for our exports in some parts of the world will reduce and this will affect our capacity to borrow money to fund the government budget.”

Boom in regional trade

As for Mr Lakuma, also a senior research fellow EPRC, trade fortune is eminent this year.

“I see a boom in the trade between Uganda and the EAC and COMESA. This could approach $ 3 billion worth of Uganda’s exports to the EAC and or COMESA,” he said when contacted, before adding, “however, I see a slowdown in China’s demand for African commodities in the first half of 2024; albeit, a sharp increase in demand is expected in the second half of the year.”

The slump in demand, according to researcher Lakuma, is largely due to unprecedented low growth forecast, estimated at 4 percent - the lowest in more than two decades.

However, he is of the view that optimism among the Chinese people, about 2024 and what the year signifies in the Chinese calendar, may lift consumer demand and production in the second half of the year.

Fuel imports

President Museveni believes the economy wasn’t being shielded from fuel cartels who, time and again tend to influence pricing, which dealers promptly transfer to the final consumer at the pump. And for that, Uganda National Oil Company (UNOC) has since assumed full responsibility for the importation of petroleum products into the country.

With this transition, backed by law - the Petroleum Supply (Amendment) Act, 2023, UNOC now holds the exclusive role of importing petroleum products, which will subsequently be distributed to oil marketing companies (OMCs).

This governmental intervention was prompted by Kenya’s policy shift from the Open Tender System (OTS) to Government-Government (G2G), a process deemed overly prolonged with numerous stakeholders whose profit margins could impact pump prices.

This move has since caused apprehension from the “middlemen.” The matter is now in court.

Oil and gas developments

This year will also define the extent to which fortunes from oil production will accelerate the economy, going forward or resuscitate the curse tagline associated with the oil resource.

Although the first drop of oil is expected to begin flowing by the end of 2025, the current ongoing stage is the most lucrative phase of the development for the private sector and the citizens to partake.

About $10b will be injected in this phase following the signing of the Final Investment Decision (FID) in February 2022, finalising terms of the ongoing drilling and pipeline construction project. So this is the year the domestic private sector should ensure they retain as much as possible of the total investment being injected into this phase.

Trade and investment

In 2024, the 13th Ministerial Conference (MC 13) of the World Trade Organisation will take place in Abu Dhabi from February 26 to 29. Its time Uganda and the other least developed countries take a position or get relegated to the periphery of international trade.

Meanwhile, the Uganda – United Arab Emirates (UAE) Business Convention held before the turn of the year lived to its hype in many ways. The benefits of the meeting with currently the leading market for Uganda’s exports in the Middle East and Gulf countries looks sets to thrive even more this year.

The Emiratis, unlike many other delegations, look more interested in pursuing win-win business relations and opportunities than perhaps the country is prepared for. Uganda Investment Authority (UIA) is looking at between $500 million to $1 billion coming into the economy this year, resulting from deals arrived at during the convention. No wonder, the Emiratis are looking at developing cold storage infrastructure at Entebbe international Airport possibly to ease trade between the two nations.

Regional integration

The EAC has expanded with the recent admission of a new member- the Republic of Somalia, bringing the number of Partner States to eight; namely Uganda, Kenya, Tanzania, Rwanda, Burundi, South Sudan, Democratic Republic of Congo and now Somalia.

With the EAC still struggling with Non-Tariff Barriers, trade wars, non-implementation of key decisions by new members, and nonpayment of membership fees by nearly 80 per cent of the Partner States, this puts the rather bloated EAC at a critical point of no return, argues Mr Kiiza.