Museveni engages workers over NSSF mid-term access

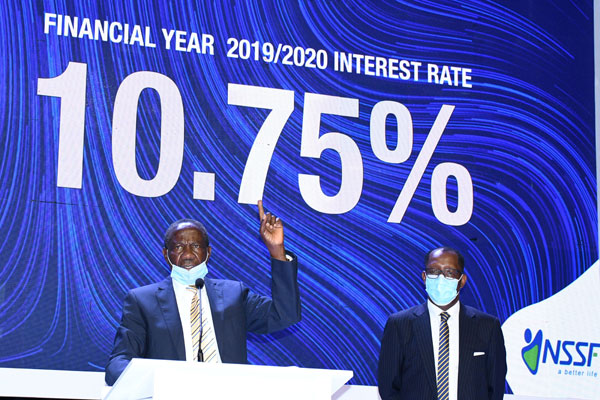

Finance minister Matia Kasaija (left) and NSSF managing director Richard Byarugaba during the NSSF annual meeting on September 28, 2020. Mr Kasaija is opposed to mid-term access in the Bill. PHOTO | KELVIN ATUHAIRE

What you need to know:

- Sources close to the Gender, Labour and Social Development ministry and workers’ unions, who requested to remain anonymous in order to speak freely, said following the March letter from Finance minister Matia Kasaija to the President, the latter has since been consulting to understand the workers’ views before he signs it into law.

President Museveni has asked the Ministry of Gender, Labour and Social Development to engage workers on the long-awaited National Social Security Bill pending his assent.

This would inform his final position on the Bill that was endorsed by Parliament in February.

Sources close to the Gender, Labour and Social Development ministry and workers’ unions, who requested to remain anonymous in order to speak freely, said following the March letter from Finance minister Matia Kasaija to the President, the latter has since been consulting to understand the workers’ views before he signs it into law.

“President Museveni contacted the Gender ministry to help him understand workers’ views on the Bill. The Gender ministry has since requested us to share our views on why Parliament passed the contentious Bill in February and was waiting for the President’s signature, only for Mr Kasaija to write, opposing mid-term access to the NSSF money,” the source said.

The workers through their umbrella body, the National Organisation of Trade Unions (NOTU), have since written a detailed position, justifying why the President should assent to the Bill.

“We are requesting the President to sign the Bill because it is very good for the economy. It is going to create a saving culture for workers,” said the NOTU chairperson, Mr Wilson Owere, in a telephone interview yesterday.

“We request him (the President) to ignore the [Finance] minister’s argument because the Bill is in the interest of workers,” he said.

When pressed further, Mr Owere declined to divulge more details.

The Bill proposes that savers aged 45 years and above can get at least 20 per cent of their savings. But the finance officials have been opposed to the NSSF proposals from the onset, insisting the Fund won’t be sustainable once about Shs2.9 trillion is withdrawn. The NSSF savings currently stand at Shs13 trillion.

“The big man contacted the workers and they have defended their position. Finance ministry is only fighting mid-term access. They want NSSF on their side. This proposal originated from Cabinet and it was approved that investment is handled by Finance ministry and Gender ministry handles the social aspect,” the source said.

Senior Presidential Press Secretary Don Wanyama had not answered our repeated calls by press time.

On Tuesday, MPs tasked State minister for Gender, Labour and Social Development Peace Mutuuzo to explain why the President hadn’t assented to the NSSF Bill.

The MPs further inquired about the minimum wage Bill, which was returned to the House, arguing that many people were laid off during Covid-19 lockdown and others continue to be exploited without government intervention.

While Ms Mutuuzo advised that they wait for the President’s communication on Labour Day, she said Cabinet had advised her ministry to audit all companies, which were employing people and “critically examine implications of the minimum wage on investors and employment.”

In an interview with Daily Monitor yesterday, Ms Mutuuzo was non-committal on the progress of the consultations between workers and the President. She referred this newspaper to the ministry’s permanent secretary, Mr Aggrey Kibenge, who said he wasn’t aware of any such consultations.

Workers MP Sam Lyomoki yesterday said they had written to the President and clarified the workers’ position.

“We are waiting for a signed Bill. It is very clear the minister has his own interest. But we are for the interest of workers and the Bill is for social security while for him he is looking at financial gains. The minister’s concerns have been taken care of. He was misleading the President. This is not a financial Bill. He is secondary,” Mr Lyomoki said.

Nssf savings

Employees contribute Shs5 per cent of their monthly pay to NSSF while employers contribute 10 per cent of the salary. According to NSSF statistics, 93 per cent of savers retire with less than Shs50m on their account. There are about 2.5 million savers with NSSF. Of these, 1,500 retire every month with an average payout of Shs15 million.