Prime

Double registration of Saccos is cumbersome

There has been an enduring concern that the savings culture in Uganda is low, but this is improving by the day. The emergence and quick spread of Savings and Credit Cooperatives, commonly known as Saccos in Uganda, is arguably the single biggest initiative that is helping to improve the saving culture.

Saccos, at a micro level, have become a pillar for resource mobilisation and availing timely credit that is needed for investments for economic empowerment and growth. Saccos are predominantly involved in accepting savings from and providing loans to their members.

Many Saccos also invest the savings in certain investments with the expectation of receiving good returns for the benefit of the members.

These financial transactions carried out by Saccos require effective government regulation to check the possible abuse, misuse, wastage and embezzlement of the members’ financial contributions and savings. The existence of government regulation is, therefore, to avail adequate consumer protection to the different members of Saccos.

Although many founding members endeavour to put in place written constitutions to govern operations of Saccos, these remain susceptible to breach and need to be buttressed by a comprehensive regulatory framework with the force of law. This is what informed the making of the Tier 4 Microfinance Institutions Act, 2016, which took effect on July 1, 2017.

The purpose of the law is to, among others, provide for the licensing and management of tier 4 microfinance institutions in Uganda.

The tier 4 microfinance institutions which comprise Saccos, non-deposit taking microfinance institutions, self-help groups and community-based microfinance institutions are required to be licensed and monitored by the Uganda Microfinance Regulatory Authority.

Specifically for Saccos, this recent development has caused additional or heightened regulation. By their nature, Saccos are cooperative societies that are required to be registered with the Ministry of Trade under the Cooperative Societies Act.

However, these prior existing obligations to the commissioner of Cooperatives are now just the first of a two-step registration process for Saccos in Uganda.

Every registered society that is duly registered by the Ministry of Trade, is also required to apply for a licence annually from the Uganda Microfinance Regulatory Authority.

The rule set is that a Sacco should be duly registered by the Ministry of Trade and duly licensed by the Uganda Microfinance Regulatory Authority to use the words, ‘’Savings and Credit Cooperative’’ or ‘Sacco’ in its name.

Both these regulators have been given far-reaching and sometimes overlapping regulatory powers, including the authority to cancel the registration or license of non-compliant Saccos.

The dual regulation is burdensome and may have the unintended effect of making Saccos fail or refrain from complying with the regulatory requirements. The risk is that these unregistered Saccos may continue to operate unregulated and render the savings deposits at risk.

It should be recognised that many Saccos are comprised of unsophisticated members that are vulnerable as their savings could be embezzled by unscrupulous leaders. The extended regulatory compliance obligations may also divert the focus and resources of the Sacco from its core activities.

Whereas it is commendable that the government has moved to regulate Saccos in Uganda, dual regulation may work against the intended purpose of consumer protection.

The overlapping and duplicity attributes of the dual regulation will cause confusion and compliance fatigue for Saccos that choose to comply or even discourage other Saccos from complying at all.

A simplified regulation that is cost (and time) effective is what is required for Saccos in Uganda.

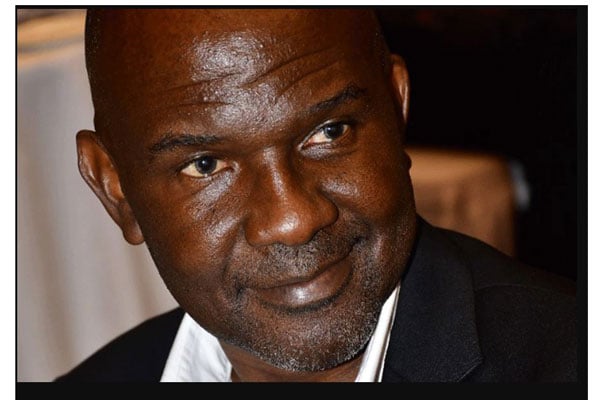

Mr Balaba is a tax and legal consultant working with Ernst & Young, Kampala office