Prime

Govt needs to drop the habit of supplementary budgets, says Citibank researcher

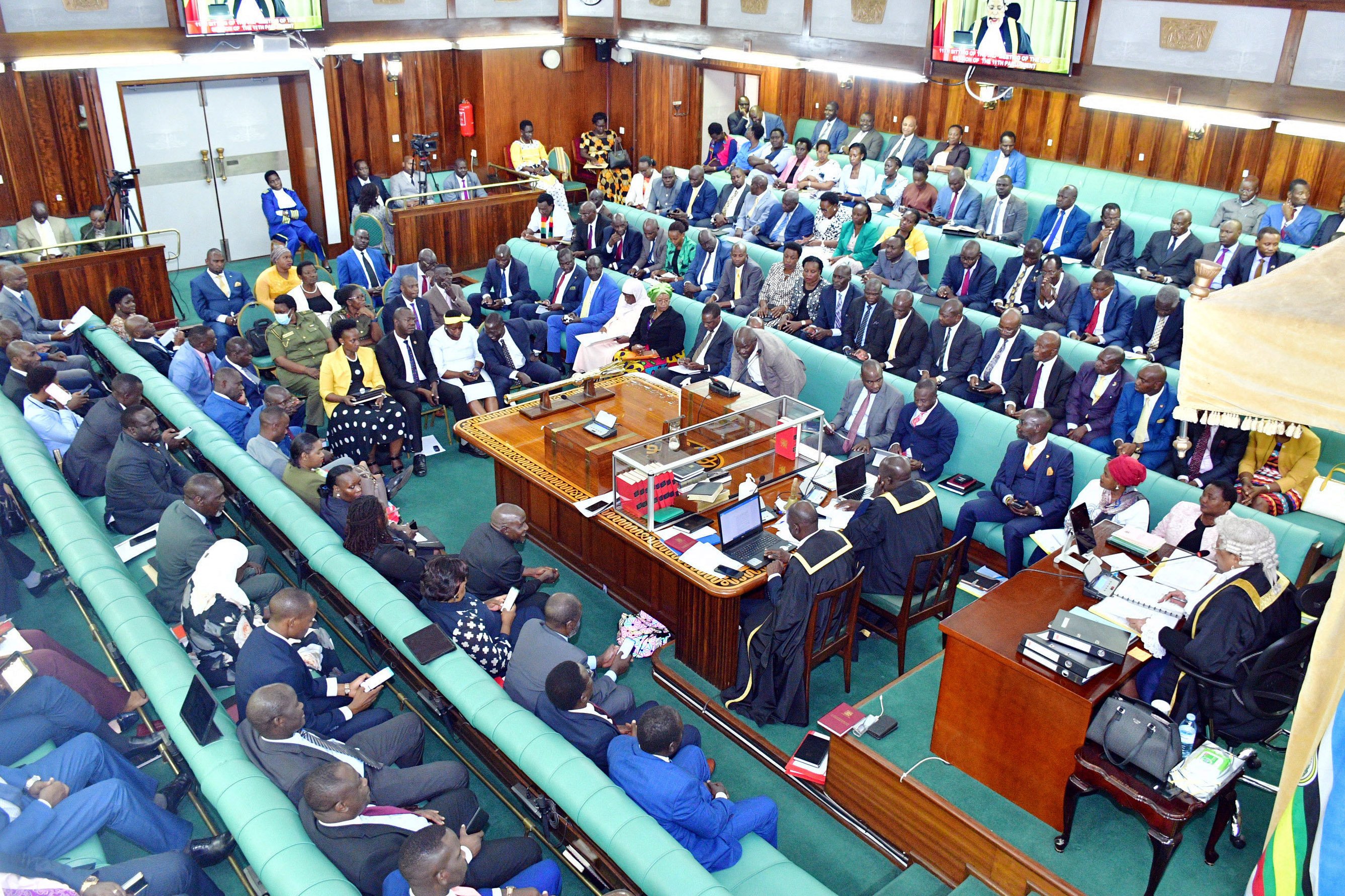

Government has over the years made it a habit to table supplementary budgets before Parliament every financial year to finance recurrent expenditure. Photo / File

What you need to know:

- A Citibank researcher says supplementary requests should only be entertained during emergencies and must never become a tool for recurrent expenditure

Citibank has told government to stick to approved budgets and stop the habit of having supplementary budgets.

Such requests, Citibank argues, distort budget planning and lead to excessive borrowing.

This comes at a time when government has twice tabled two supplementary requests in the 2023/24 financial year leading to a Shs7.57 trillion off-budget expenditure, thus pushing the budget from Shs52.7 trillion to Shs60.2.

Speaking in an interview on Wednesday in Kampala, Dr David Cowan, a Citibank Africa economist and managing director in charge of research, said Uganda needs to reform its spending by sticking to approved budgets.

“The policy should be no to supplementary budgets. Supplementary [requests] should be an emergency. When you have a budget you stick to it. That is the point. You have to go back to the basics of having a budget because it is the budget that determines what you are going to spend. You should only have a supplementary in exceptional circumstances,” he said.

Therefore, Dr Cowan said, instead of building an unsustainable supplementary request system, government should instead create a contingency plan that will be key in supporting the country’s fiscal consolidation process that has been under implementation since 2019.

The Ministry of Finance has made it a priority to reduce budget deficits and public debt under the fiscal consolidation agenda.

Uganda has seen an unprecedented surge in public debt due to Covid-19-related effects and a slowdown in economic growth worsened by the Ukraine – Russia conflict, a push-back by financiers and development partners, who have threatened to cut funding due to the enactment of the Anti-Homosexuality Act.

The country currently has a public debt in the excess of Shs98 trillion and is expected to expand further before the end of the 2023/24 financial year in June.

Government spends more than 30 percent of tax revenue, which creates provisioning challenges for development expenditure.

However, in the last three years, government has put in place measures to increase domestic revenues, targeting a 16 percent tax to gross domestic product from under 14 percent to reduce borrowing.

Dr Cowan said there was need for Uganda to increase revenue collection, noting that this is an important and sustainable facet instead of putting focus on expenditure cuts, which could negatively impact development projects needed to propel the poor.

Uganda’s fiscal deficit stands at 5.6 percent of gross domestic product, which Dr Cowan says was above the 3 percent East Africa Community Fiscal Convergence Criteria.

During the 2022/23 financial year, Ministry of Finance data noted that the fiscal deficit stood at Shs10.3 trillion, which is equivalent to 5.6 percent of gross domestic product, which although above planned, was lower than the 7.4 percent registered in 2021/22 financial year.

Selective on projects

According to Dr Cowan government needs to become selective on projects it undertakes in a particular financial year, after which it can focus on key projects that have a multiplier effect.

Dr Cowan also indicated that international oil prices are expected to remain stable, trading at between $80 and $85 per barrel in 2024 due to increased production from the US.

“We don’t see oil prices rising so much. It may drop to $70 or go up to $90 per barrel but we don’t see it rising to over $100 in the extreme,” he said.