Oil-related revenues rise by 54% ahead of first oil

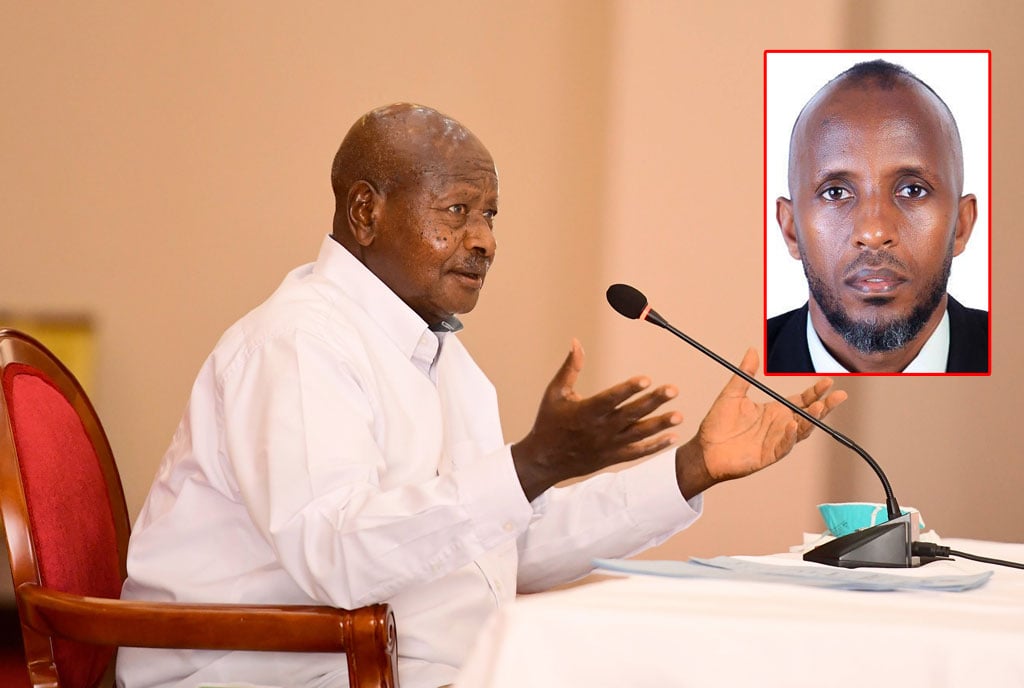

Oil-related revenues have been increasing due to a rise in oil and gas investments. Photo / File

What you need to know:

- The increase signals a rise in oil-related activities as the country moves closer to commercial oil production expected next year

Oil and related products tax revenues increased by Shs44b in the period ended June 30, 2023.

The increase signals a rise in oil-related activities as the country moves closer to commercial oil production expected next year.

In details contained in the Petroleum Fund report for the period, government indicated that the Petroleum Fund, managed by Bank of Uganda, received revenue (tax and non-tax) totaling to Shs125.9b, which was a 54 percent increase from the Shs81.9b reported in the same period in June 2022.

The report, by Accountant General Lawrence Semakula, noted that tax revenue contributed the largest share of Shs118.6b (94 percent), while non-tax revenue contributed Shs7.4b (6 percent). The tax revenue was largely generated from corporation and withholding taxes due to increased oil and gas activity following the final investment decision that was announced in February 2022 and drilling of production wells that commenced in January 2023.

On the other hand non-tax revenue was mainly generated from increased surface rentals and training fees paid in signature bonus by Uganda National Oil Company and DGR Energy Turaco following the signing of production sharing agreements for Kasuruban and Turaco Blocks respectively.

The report further indicates that during the period under review, there was no withdrawals recorded on the Petroleum Fund to support budgetary funding and reserve investment. However, the Fund registered Shs499.8m worth of foreign exchange losses.

The report further indicates that the value of the Fund has more than doubled to Shs246.6b from Shs121.1b, less of Shs19.6b, which Uganda Revenue Authority had already collected but was yet to be remitted to the Fund.

The report also reveals that the Petroleum Fund currently maintains three accounts, two of which are in the Bank of Uganda, while the third one, opened on June 23, 2017, is in the Federal Reserve Bank of New York to facilitate investment under the Petroleum Revenue Investment Reserve.

The two accounts in Bank of Uganda are denominated in shilling deposits, while the other in the Federal Reserve Bank of New York is denominated in US dollars.