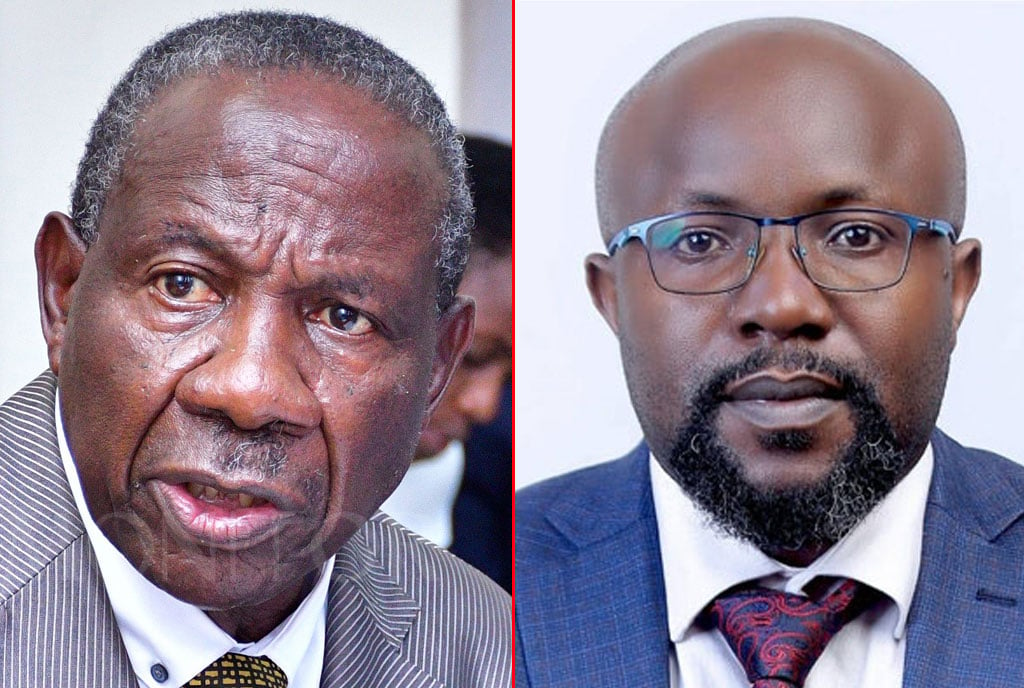

Finance minister Matia Kasaija and Vision Group CEO Don Wanyama. PHOTO/FILE

On September 24, Vision Group, which is listed on Uganda Securities Exchange as New Vision Publishing and Printing Company Limited, told each of its shareholders in a notice that it had reached an understanding with the government about an intervention to take on a new type of shares in addition to what it has in the news corporation.

The government would ultimately pump some Shs25b into Vision Group in a bid to rejuvenate its fortunes. The media house is facing a cash crunch, and its investors are wary that no other sustainable cash flow venture can sustain it at the moment except the state’s intervention.

So, what is the deal?

Vision Group approached the government through the Finance ministry and both sides agreed that the number of shares to exchange should be 156.25 million. Currently, the company’s total number of outstanding shares is 76.5 million. So, this deal will only triple them.

The distinction in this case is that the government is purchasing preferential shares, which are not included in the company’s share structure. As a result, shareholders will need to discuss and decide on these shares at the upcoming annual general meeting on October 16.

Currently, New Vision has ordinary shares. These are the usual type of shares, which give you a say in the company’s decisions and a share of profits. Preference shares are the new ones in the media enterprise’s capital structure that are a bit special because the government, while it might not get to vote on company decisions with them, gets its share of profits before ordinary shareholders.

The profits in question are fixed at three percent of the share's value.

The government wants to buy 156.25 million of them valued at slightly more than Shs25b to add to its majority stake in the media company where it currently has around 40.5 million shares valued at Shs800m of the company’s total 76.5 million shares which are valued at Shs1.5b. With the new shares issued, the company’s total shares will be 232.8 million, valued at Shs26b.

“Before this process can be finalised, New Vision will require its shareholders to approve this investment and the terms that have been negotiated with the Government of Uganda, being the proposed investor,” the media enterprise told its shareholders in a text.

A few of the things they need to agree on are raising the share capital, issuing preference shares at a par value of Shs160, and assigning these non-cumulative, non-redeemable, convertible, preference shares to the finance minister, who is presently New Vision's majority shareholder.

Additionally, they need to agree to pay the finance minister a three percent dividend rate out of profit if New Vision turns a profit.

What is different about these new shares?

These new shares are non-cumulative, meaning if the company doesn’t make enough money to pay the three percent profit in a certain year, the government, which is their new shareholder, won’t get the unpaid amount in the future and won’t make up for it later.

They are also non-redeemable in a sense that once the government buys them, New Vision can’t buy them back from it. So, the state will keep them until it decides to sell them, or they are converted into ordinary shares.

The Government of Uganda, through the minister of Finance, is the largest shareholder at 53.34 percent, leaving 46.66 percent stake taken up by the public where they both receive dividends and capital gains from the company in exchange.

Previously, pundits predicted that the government would cede its stake in the media giant, but it now looks like the state thought otherwise to rescue the company from its financial woes. This was especially so since alternatives to corporate bonds and commercial debt have many actors and strings attached.

A share issuance to the stock market would also not have been successful since the publishing powerhouse has no green indicators on the bourse lately, with both its profits and capital gains tanking in the last three years, which has left shareholders with anguish and yet there are good stocks on the bourse as well.

Last October, Vision Group told its shareholders in an annual report that “the company manages the capital structure and makes adjustments to it in the light of changes in economic conditions and the risk characteristics of the underlying assets.” It added that “in order to maintain or adjust the capital structure, the Group may adjust the number of dividends paid to shareholders, return capital to shareholders, issue new shares, or sell assets to reduce debt.”

What happened prior?

New Vision attempted to salvage this situation by working with the Ugandan government and a sectoral committee led by the prime minister. The committee, which included all ministers whose work was connected to New Vision, attempted to decide on a suitable course of action to lessen the financial effects of the pandemic.

Following that, on January 18 and 19, meetings were held, and it was decided that New Vision would formally submit a complete business proposal request for the capitalisation of Shs25.356b. This request was agreed to be funded by the finance minister. The proposed capitalisation was even included in the current 2024/2025 Financial Year Budget.

“With this capital injection, New Vision is now looking to power its strategic ventures by enhancing its digital platforms, expanding its outdoor advertisement, modernising its printing press operations and implementing automation and business process optimisation,” the company said.

Who are the company’s shareholders?

The Finance ministry holds 20.4 million shares, or 26.67 percent, in Vision Group, valued at Shs401 million. The junior Finance minister (Privatisation) owns an identical stake, giving both entities a combined 53.34 percent ownership.

The National Social Security Fund (NSSF) follows with a 19.61 percent stake (15 million shares), worth Shs294.9m.

The Bank of Uganda’s Staff Retirement Benefit Scheme for top earners holds 2.23 percent (1.7 million shares), valued at Shs33.5m, while the scheme for lower earners owns 1.28 percent (979,399 shares), worth Shs19.3m.

Other notable shareholders include ICEA, with 0.74 percent; Tullow Oil’s staff retirement scheme at 0.58 percent; and individual investor Wazunula Samuel Mangaali with 0.67 percent.

Retail investors collectively hold 16.01 percent, or 12.24 million shares, valued at Shs240.7 million.

Altogether, Vision Group’s share capital amounts to Shs1.5 billion across 76.5 million shares.

Is the Group ringing any changes?

To make this deal possible, Vision Group will have to change two of its rules.

First, it will update its official document to reflect that it now has a much larger amount of share capital, which means it can operate with more money from the shares.

The second rule is to make these new government preference shares convertible so that they can be changed into ordinary shares later and not redeemable shares, which means they can be bought back by New Vision.

This gives the company more flexibility in managing its shares and investors.

According to Article 7 of New Vision's Amended Memorandum and Articles of Association, any modifications to the rights associated with a class of shares must have the approval of three-fourths of the class' issued shares or a special resolution approved at a different general meeting of the class's shareholders.

Any shareholder present may request a poll at such a meeting, which requires a quorum of at least 10 shareholders holding one-third of the issued shares of the class.

Furthermore, Article 35 of the Amended Articles of Association for New Vision stipulates that the company may raise its share capital by a regular resolution, which will then be divided into shares of the specified amount.

What do the financials look like?

New Vision has seen losses in three of the last four years, with 2022 being one of the rough patches. And as these losses mounted, its market value has decreased as well.

There has been a looming possibility that its plummeting value could lead to its removal from the stock exchange more so because at present Vision Group’s market value has dwindled to just Shs11 billion from Shs41.78 billion in 2017.

Many of the company’s retail investors are looking to sell its stock, but are struggling to find buyers. This has even plagued its stock price which has stayed still at Shs153 for the three years now.

There are currently 76.5 million of its common shares listed on the stock market, with a value of Shs19.66 per share.

“These new shares will not be listed to the stock exchange. It’s basically a private deal but since the media enterprise is owned by shareholders with ordinary shares, it will have to be agreed upon in the company’s annual general meeting which is in October for them to have a say on a deal that will change their capital structure,” said Mr Denis Kizito, the director of market research at Capital Markets Authority.