Prime

BoU to start buying gold domestically

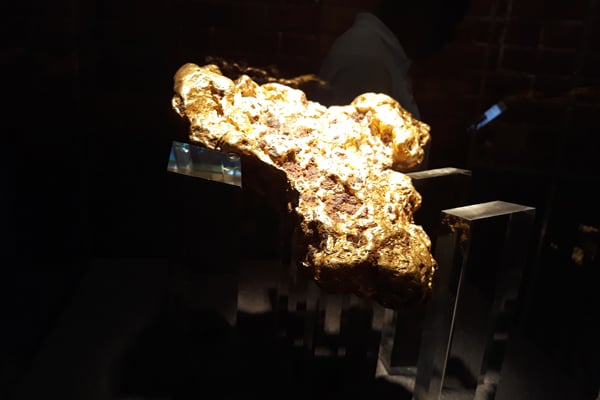

Bank of Uganda says gold will be purchased from local miners and processed to at least 99.5 purity levels before it is converted into monetary gold. Photo / File

What you need to know:

- Bank of Uganda is seeking to boost foreign reserves, amid a reduction in foreign currency inflows

Bank of Uganda has said it is in the process of initiating a Domestic Gold Purchase Programme to rebuild the country’s foreign reserves, amid a reduction in foreign currency inflows.

As of April 30, the stock of reserves had reduced to $3.4b or 3.2 months of future imports of goods and services, which is slightly lower than the 3.4 months registered in April 2023.

In its State of the Economy report for June released yesterday, Bank of Uganda said the gold purchase programme seeks to mitigate a decline in foreign reserves and address associated risks in the international financial markets.

“This initiative is also expected to support government’s ongoing value addition to the minerals and import substitution strategy by reducing imports of raw gold into the country,” the report reads in part, noting that by purchasing gold directly from artisanal miners, the Central Bank will also support livelihoods of small-scale miners”.

Dr Adam Mugume, the Bank of Uganda director research, said yesterday “we are in the process of diversifying international reserves to include monetary gold”, noting that gold will be purchased from local miners and processed to at least 99.5 purity levels, before it is converted into monetary gold.

“Purchasing foreign currency from the domestic market has been constrained by low inflows as a result of dwindling budget support, combined with higher interest rates which have limited flows into emerging and frontier economies like Uganda. This will also support value addition to Uganda’s natural resources,” he said.

Globally, the International Monetary Fund says, in the third quarter of 2022, central banks added $20b worth of gold to their international reserves.

Uganda’s forex market has developed and deepened over time, according to the Absa Africa Financial Markets Index, backed by a strong shilling, which remains the strongest in East Africa.

Bank of Uganda also indicated that despite tight global financial conditions, the shilling has broadly remained stable with an appreciation bias since March 2023 following two successive increases in the central bank rate, which lured back offshore investors.

The shilling has retreated from the recent peak of Shs3,942 per dollar in August 2023 to below Shs3,800, gaining by 2.7 percent between March and May, extending gains in June, supported by increased inflows from coffee receipts, and non-governmental organisations.