MTN enters online shopping market

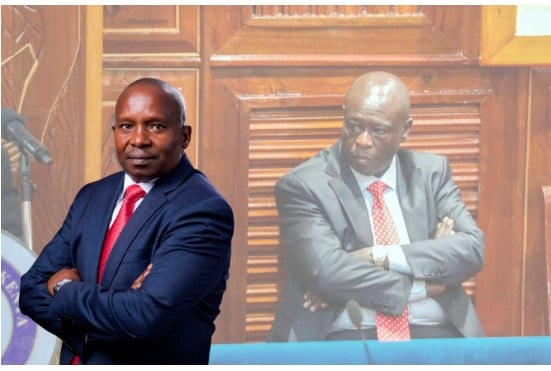

MTN's entry into the e-commerce space comes four years after it liquidated its 18.9 percent stake in Jumia Group. Photo / Edgar R Batte

What you need to know:

- MTN’s entry into the e-commerce space comes after it exited Jumia at group level about fours years ago

MTN will next month launch an online shopping store, expanding its service portfolio into e-commerce.

The store is expected to be operated under the Market by MoMo brand and will first be launched in Uganda before expanding into other markets.

Mr Richard Yego, the MTN Mobile Money managing director, told Monitor on Wednesday that they had planned to operate the e-commerce business under the mobile money unit but Bank of Uganda guided otherwise because “our license doesn’t permit us to operate a marketplace”.

The store will, therefore, be operated under a new company - Group FinCommerce, a subsidiary of MTN Group Fintech.

“It [will] be operated by our sister company called Group FinCommerce. Our license doesn’t permit us to operate a marketplace,” he said.

The move comes four years after MTN Group exited Jumia, Africa’s largest e-commerce business, where it held an 18.9 percent stake at Group level for seven years.

MTN had earlier indicated that whereas it had built partnerships with e-commerce companies in different markets, there were massive opportunities for an in-house operated platform.

The telecom’s entry, therefore, opens up a new battleground in a market whose potential is yet to be fully exploited.

Jumia continues to dominate the e-commerce space in Uganda, operating with several third-party companies, among which include Fintechs that provide payment platforms.

MTN, however, says it will leverage its mobile money network to create new competition with existing e-commerce businesses.

Existing e-commerce platforms are largely concentrated in the urban centres of Kampala, Wakiso, Jinja, and Entebbe with multiple pickup areas upcountry.

Mr Brian Mutungi, the MTN Market by MoMo country manager, yesterday said beyond the Simcard and mobile money services, MTN customers should be able to do online shopping at their convenience.

“We are trying to build a one-stop center. From, voice, SMS, data, mobile money and now shopping. We started this journey in 2022 and now we are officially opening to the public this November,” he said, noting that they had partnered with a courier company that will do home and officer customer deliveries.

However, Mr Ibrahim Bbosa, the Uganda Communications Commission (UCC) head of public and international affairs, said yesterday that it was important that MTN prioritizes obtaining the necessary courier license from UCC, before launching door-to-door delivery services.

“According to the Uganda Communications Act of 2013, postal services, including courier delivery, fall under the jurisdiction of [UCC]. Therefore, offering courier services without a license is not permissible and could lead to legal complications,” he said.

Market by MoMo will largely depend on mobile money as a payment platform and a web-based platform, through which customers, even without data, MTN said, would place orders for groceries, appliances, and health and beauty products, among others.

“All our orders [will be] prepaid. As the platform provider, we do an intermediary role. We hold the money until the product is delivered and if the product is not of quality, we shall not pay the dealer until the customer approves that the products [meet] the quality they ordered,” Mr Mutungi said.

Online shopping has in the past been largely impacted by the delivery of substandard goods that do not meet customer standards.

Jumia bets on East Africa operations after closure of two subsidiaries

Meanwhile, Jumia Group has indicated that it will accelerate potential in other markets such as East Africa, after retreating from low-return markets such as South Africa.

Jumia announced on Wednesday it would close its non-strategic operations in South Africa and Tunisia by the end of this year, which would enable it to concentrate its resources on promising markets, of which East Africa – Uganda and Kenya – is part.

South Africa and Tunisia accounted for just 3.5 percent and 2.7 percent of Jumia’s total orders as of December 2023.

“The closure … will allow Jumia to focus resources on its most promising markets that have a stronger growth potential,” the notice said, noting that refocusing resources on its other nine markets will leave the company better positioned to accelerate overall growth and further improve efficiency.

Mr Francis Dufay, the Jumia Group chief executive officer, said the decision was done after a thorough analysis that showed that both businesses accounted for a negligible portion of the company’s overall operations, noting that the closure will improve overall operational efficiency across its business.

Jumia has recently implemented cost-cutting measures, including staff reductions and exiting non-core services such as groceries and food delivery.

In South Africa, Jumia faced tough competition from takealot.com and Amazon, while in Tunisia, the e-commerce space continues to struggle with low consumer trust.

Jumia is now focusing on strategic markets such as Cairo, Nigeria, Morocco, and East Africa, where it has just integrated warehouses to enhance logistics, improve efficiency, cut costs, and reduce delivery times.

These facilities are set to expand storage capacity, meet growing customer demand, and broaden the product range available online.

Jumia bills East Africa, particularly Uganda and Kenya, as a market with high growth potential and in May last year, appointed Mr Vinod Goel as regional chief executive officer.

Mr Goel said after his appointment that there was huge potential, with e-commerce accounting for just 2 to 3 percent of the total retail market, which presented tremendous growth opportunities.

Jumia merged Uganda and Kenya as a single market as a strategic measure to drive growth that would fit into its e-commerce agenda of breaking even.

The e-commerce company last year closed Jumia Food, Mr Goel recently said was a "strategic decision taken at Group level" after a thorough business review, noting: "We need full energy, efforts, and resources on the physical goods business. This is the business where we see huge growth and potential, and the very clear path to profitability, which was not the case with food in all markets."