Prime

Valuers must include sustainability in reports

ESG has a valuation aspect where the values of properties must be in-tandem with the realities countries are dealing with such as climate.

What you need to know:

- Environmental, social and governance aspects that were often skipped by valuers in their property reports will now be mandatory.

- In six months the Ugandan property valuation industry will have new standards that match those at the international level.

KAMPALA. Property developers will have to incorporate Environmental, Social and Governance (ESG) aspects into their valuation assessments.

In six months the Ugandan property valuation industry will have new standards that match those at the international level.

As climate change becomes a major concern with demand for green buildings rising, valuers should keep tabs on sustainability matters and develop inspection checklists that incorporate ESG aspects.

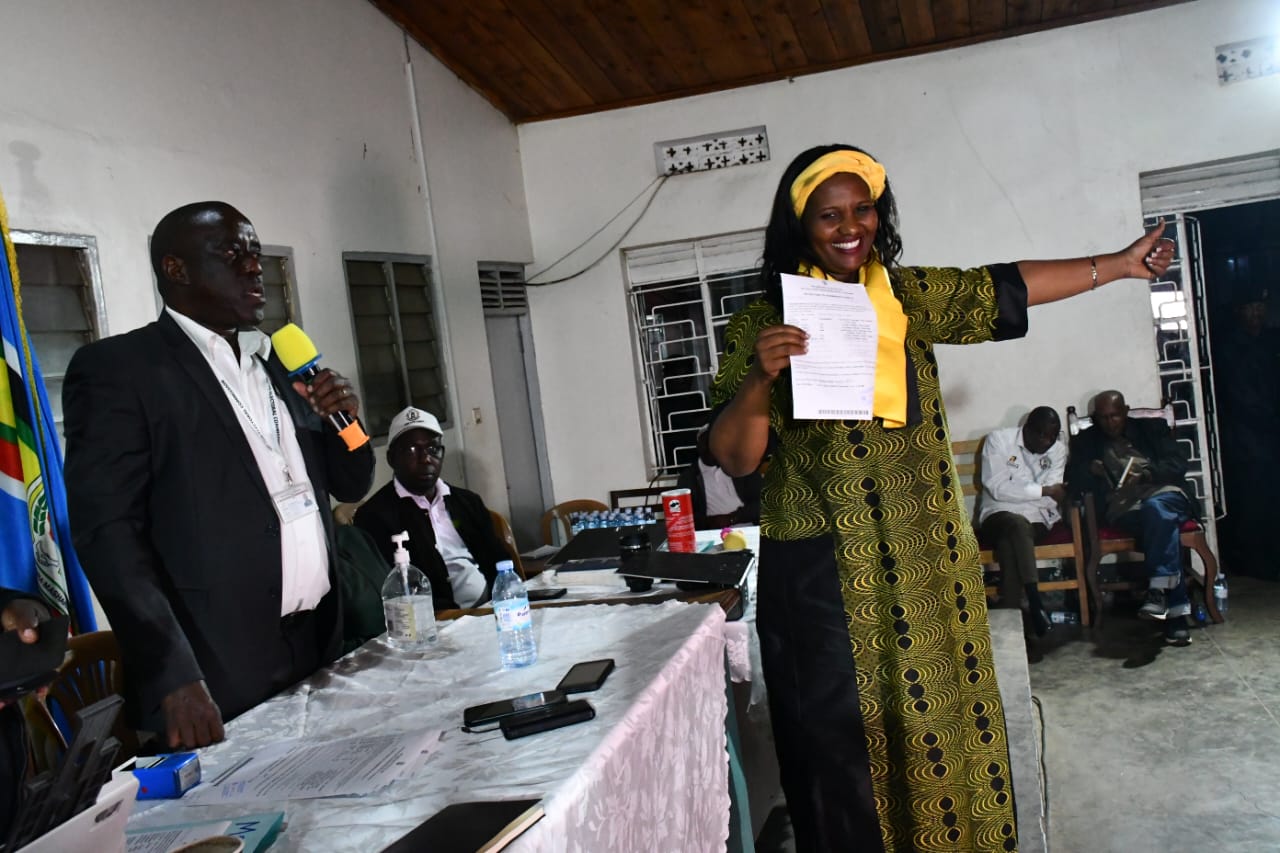

Aloysius Gonza, the Vice President of the Institute of Surveyors of Uganda, says ESG has a valuation aspect where the values of properties must be in-tandem with the realities countries are dealing with such as climate.

“If a property is affected by flooding, that has a direct impact on its value as well as how it is perceived by the market,” he says.

Mr Herbert Okello, the head of valuation and advisory at Knight Frank, says the Royal Institute for charter surveyors produced a guidance note concerning commercial market valuation.

The note provides guidelines on how valuers should value buildings.

Impact on data collection

“That will affect the kind of data collected during inspections as we will be looking at the building’s source of energy say for lighting. There is also the quality of air which affects the social aspect,” he says.

Counsel Richard Masereje, the team leader of the development of national valuation standards of Uganda, in charge of crafting guidelines that valuers will follow says apart from impacting assets and liabilities, ESG also brings in the issues of social value determination which covers several aspects.

“For instance, when doing compensation where people must be shifed, there is a value that comes with disruptions. That is why there is need for a social impact assessment to capture the social impact of the resettlement,” he says.

In regards to environment, Counsel Maserejje says decisions are crucial for one to make money out of their business investment. Therefore, being able to capture the impact of the environmental factors before one takes on an investment decision impacts the value of the whole investment process.

Even in governance, a couple of years ago, several issues were not considered such as planning regulations, regarding valuations. For instance, around the air strip, in Kololo, a planning regulator may tell you that you cannot put up more than four stories.

“That alone has a fundamental factor on valuation because you may be dealing with a comparable site which can allow for as many as 20 stories yet this prime land is limiting your desires,” he explains.

But there is still a skills and awareness gap since it is a new concept.