Prime

Population growth hastens sugar scarcity

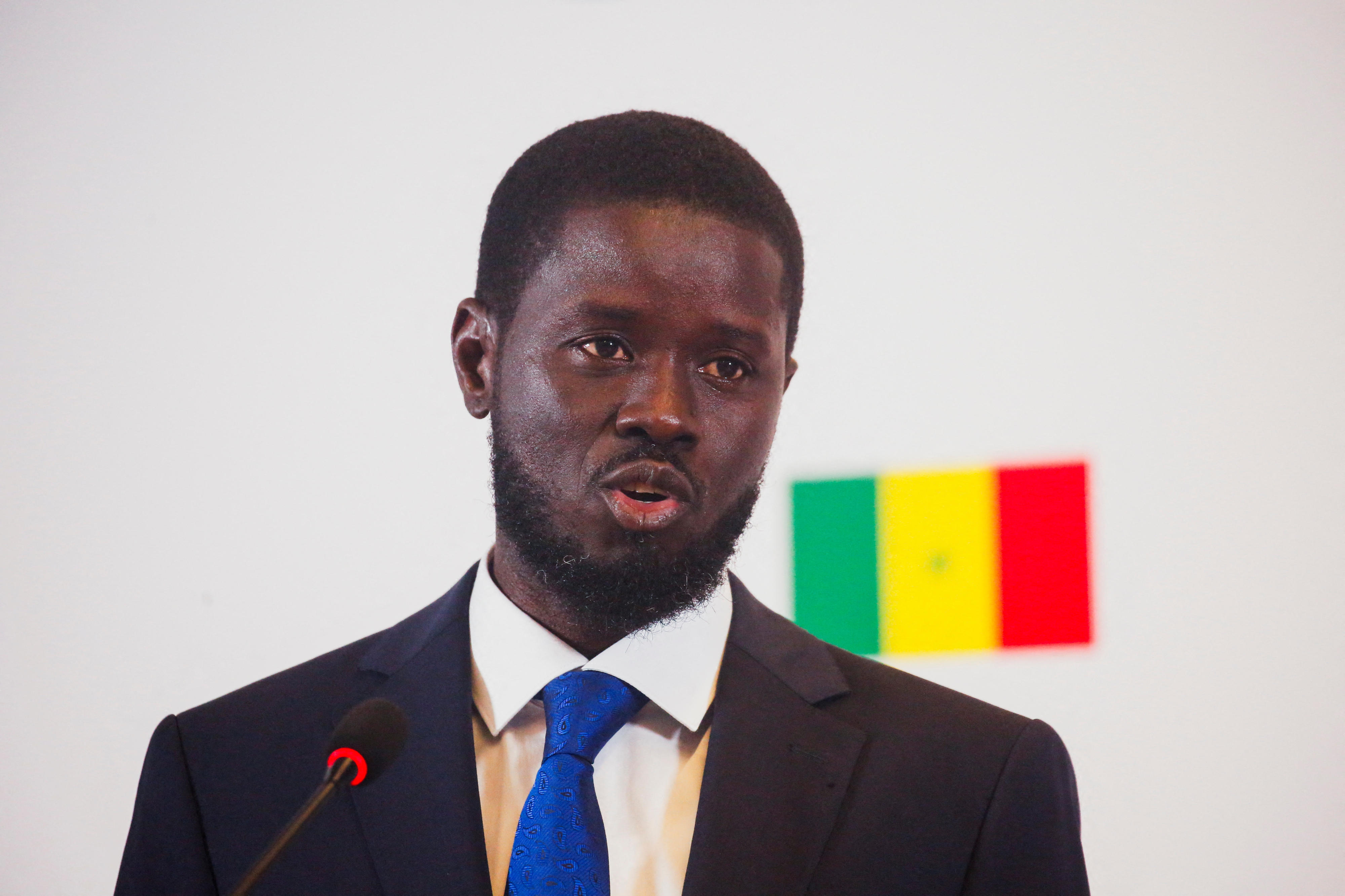

Mr Badagawa

The demand for sugar in Uganda is growing rapidly due to a high population growth rate, which currently stands at 3.25 per cent annually. “The per capita consumption is expected to rise as the economy improves,” a private sector platform for action report on sugar reads in part.

In mid 2009, the population of Uganda was 32.7 million and by 2030, the population is expected to be above 50 million, even by factoring in a reduced population growth rate of 2 per cent. Per capita consumption, which today is 9 kilogrammes, could rise to 16 kilogrammes by 2030.

The net effect of these two forecasts is an increase of sugar consumption from 290,000 tonnes today to 830,000 tonnes of sugar in 2030, an increase of almost 200 per cent.

Mr Gideon Badagawa, the executive director of Private Sector Foundation Uganda says: “This presents an opportunity for Uganda to grow more sugar cane and process it into more sugar for domestic needs, rather than importing foreign produced sugar to the detriment of the economy in terms of foreign exchange cost and lost employment opportunities.”

The sugarcane growers, in their submission to the ‘Private Sector Platform for Action report’ said the volume of cane that millers are purchasing from farmers has trebled in eight years to over 1.3 million tonnes per annum.

This has created an expanding economy of Shs52 billion into the out grower areas immediately surrounding the mills. A sugar mill is a catalyst for rural development.

Nevertheless, Uganda is restricted from importing sugar and whoever does so will have to pay the100 per cent import duty, unlike in Kenya and Tanzania where sugar can be imported from the Comesa countries - Free Trade Union, to boost their stock.

The Spokesperson Kampala City Traders Association, Mr Issa Sekitto, said: “We have no much alternative now because you cannot tell a trader who has imported sugar at 100 per cent tax to put it up for sale at your price”.

The price of sugar on the world market is distorted and does not reflect the true cost of production. Many countries provide input subsidies of one kind or another or sell sugar at incremental cost of production, which creates this distortion. However, this past year, the global production / consumption shortfall has caused prices to rise to levels not seen for over 30 years.

The report says Uganda, and East Africa, will never be among the least cost producers of sugar mainly because of the terrain. The East African sugar industry is currently so important economically and politically that it must safeguard measures in place.

Apparently, these are being threatened by the Kenyan treatment of Common Market for East and Southern Africa (Comesa) sugar. “The issue of Comesa sugar is a serious one. Kenya has a special agreement with Comesa that was accepted when the EAC Customs Union was entered into. This agreement permitted Kenya to initially import 200,000 tonnes of duty free sugar as “gap” sugar,” the report reads on. All other Comesa sugar is to be taxed at the Common External Tariff (CET) rate of 100 per cent.

The details of this agreement, the import volume and residual duty rate were to be relaxed in steps until any amount of Comesa sugar can enter Kenya at 0 per cent rate of duty in 2012.

Imminent repercussions

The only reason why the problem is not being acutely felt today is that the high international price is more attractive for the Comesa producing countries to sell their sugar elsewhere other than in Kenya at this moment.

“This situation is likely to end thus it is important that the Uganda government understands its likely repercussions on Uganda’s economy,” Mr Badagawa warns. The sugar sector has made a remarkable recovery following a near collapse in the 1980s.

In 2009, Uganda produced a record amount of centrifugal sugar with a combined production of 281,000 tonnes from the three main sugar mills and two small new ones. These are mainly Kakira Sugar Works, Kinyara and Sugar Corporation of Uganda.

This was a 20 per cent year on year increase for the second year running and predictions for 2011 indicate that a further increase of 10 per cent to 320,000 tonnes is achievable.

Collectively the sugar industry is one of the largest employers in the country, providing both direct and indirect employment.