Prime

What the future looks like for NSSF savers

Finance Minister Matia Kasaija (left) and NSSF managing director Richard Byarugaba (right) address savers after declaring the 10.75% interest rate. PHOTO/RACHEL MABALA

What you need to know:

10.75% interest rate. Last week, National Social Security (NSSF) declared a 10.75% interest rate for its savers, down from last year’s 11 per cent and 2018’s 15 per cent. A higher interest rate means higher returns and a lower one, means lower returns.

Last week, National Social Security (NSSF) declared a 10.75% interest rate for its savers, down from last year’s 11 per cent and 2018’s 15 per cent. A higher interest rate means higher returns and a lower one, means lower returns, Martin Luther Oketch writes.

Interest rates affect the decisions you make with money. Rising rates means people who save money in certificates of deposits, money market funds and bank accounts will see higher returns.

A higher interest rate means higher returns and a lower one, means lower returns.

Prosper Magazine analyses NSSF’s interest rate over the past five years and what the future looks like for savers.

Interest rates

Interest rates are one of the most important aspects of the members with the National Social Security (NSSF) and the entire economic system in Uganda and other countries in the different parts of the world because of NSSF being a big institutional investor in the capital market.

The significance of the high interest rates offered to savers influences the cost of borrowing, return on savings, and is an important component of the total return of many investments.

However, certain interest rates provide insight into future economic and financial market activity. Interest rates determine the amount of interest payments savers will receive on their deposits.

An increase in interest rates always makes saving more attractive and should encourage saving, while a cut in interest rate will reduce the rewards of saving and tend to discourage savings from members.

However, in the real world, it is more complicated. Some experts argue that the link between interest rates and savings is not clear because many factors affect saving.

In Uganda, NSSF interest rate movements have fluctuated due to prevailing factors in the economy.

The managing director of National Social Security, Mr Richard Byarugaba, says: “The interest rate we give to our members is a result of several factors. Some are macro – such as the performance of the economy and the performance of the capital markets. Some are micro, such as the investment strategy of the Fund, which determines how we allocate resources to the various asset classes.”

Bearing in mind all what affects the interest rate levels in the country at a particular time, Mr Byarugaba says the Fund’s goal is to achieve the highest possible return for acceptable risk, pointing out that this is different from trying to achieve the highest possible return; which comes with a large downside.

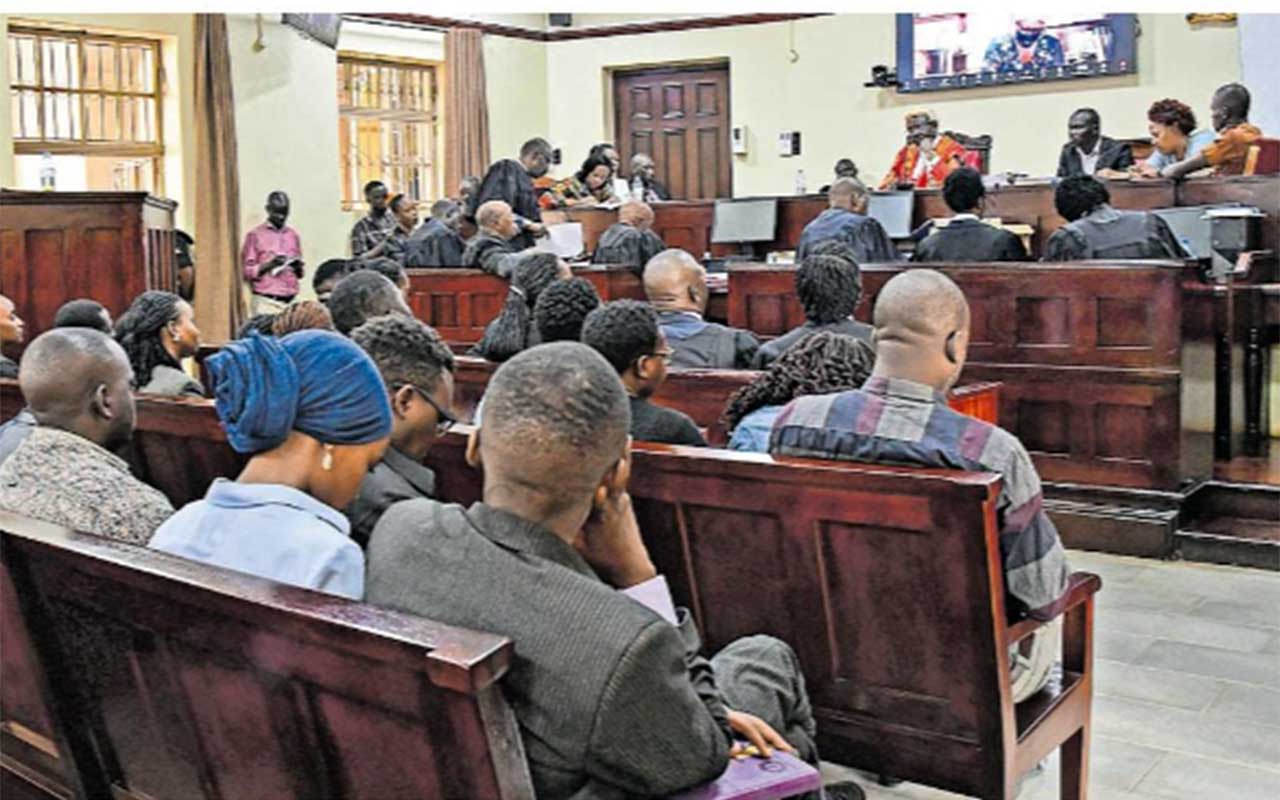

A NSSF members attend an Annual General Meeting in Kampala last year. PHOTO/RACHEL MABALA

“Our investment strategy is to give our members a real rate of return on their savings. We have kept this promise since 2012, which vindicates our investment strategy,” he says.

An investment product is offered to investors based on an underlying security or group of securities that is purchased with the expectation of earning a favourable return. Investment products are based on a wide range of underlying securities and encompass a broad range of investment objectives. Institution investors are always driven by investment products that provide high returns on investment.

Asset classes

NSSF currently invests 78 per cent in Fixed Income, 15 per cent in Equities and 7 per cent in real estate.

Speaking about the most productive in terms of investment returns, Mr Byarugaba says: “We invest in three asset classes: Fixed income, equities, and alternatives (which include real estate). Each asset class serves a unique role in the investment portfolio.

Equities tend to offer growth potential because NSSF is a long term investment but they exhibit high levels of volatility.

Mr Byarugaba added: “When we paid an interest rate of 15 per cent two years ago, this was driven mainly by the great performance of equities in the regional markets that year – particularly in Kenya. But the reverse happened the following year when the equity markets crashed. Fixed Income is not as high performing as equities, but is predictable – hence the term “fixed income”.

“…Because we value safety of the members’ savings above anything else, most of our resources (78 per cent) are invested in fixed income and mostly government bonds-Governments do not default,” Mr Byarugaba says.

He explains that real estate accounts for 6 per cent of the total portfolio. This is uniquely an illiquid asset class. While the returns can be relatively high over the long term, there are much more costs involved in owning these assets.

“So we place resources here to take advantage of unique growth opportunities, but not exposing our members’ savings to too much risk,” he elaborates.

Currently, NSSF is investing in mainly instruments in the East African region and these instruments include fixed income, equities and real estates.

Regulator’s view

Regulators in the industry in the pension industry say as people develop through their lifetime they have an expectation that a time will come when they will be able to retire. For some people, the State pension is sufficient to provide a basic level of income.

Others may have an opportunity to accumulate wealth without using pension schemes - perhaps through their business ventures or other assets. But most people will want to supplement what they have with some form of pension scheme. Many employers also take the view that, while their employees are working, they should be building up an entitlement to a pension when they retire.

The chief executive officer Uganda Retirement Benefits Regulatory Authority (URBRA), Mr Martin A. Nsubuga in an interview said the pension sector in Uganda will continue growing and the savers interest rates will not keep going down. So there is no reason for alarm about a slight reduction in NSSF members’ interest rate.

“The asset class in government security is good and it is above the interest rates that have been declared by NSSF. So the yields coming out of these asset class investment is still better. Going forward, we will see better returns. We expect share prices to go up. This will boost the interest rate given to savers. The pension industry will continue growing and people accumulating from different schemes,” he said.

“Currently, we have 67 fund managers and they are all investing in high yield assets like equities and bonds that provide high income to savers,” he adds.

Covid-19 effects

Mr Nsubuga explains that a slight drop in interest rate and the number of members saving with NSSF declining is because of the Covid-19 which has affected companies especially the informal sectors.

He further explains that following the instruction of Bank of Uganda, banks were advised to pat dividends, Umeme also declared dividend but in future these companies will declare dividends.

The investment managers in the region have the opportunity to invest in instruments in the region of East Africa. Mr Nsubuga said there is liquidity in equities such as Safaricom and they will continue investing in it.

Future of NSSF

About the future of the Fund and the savers in Uganda, Mr Byarugaba says the world is changing at such a fast pace.

“Our model today is a mandatory collection model. We enforce a law that requires employers to remit contributions on behalf of their employees. But data shows that even with this model, members are not putting aside enough savings for retirement and other unforeseen social security risks. The future is going to turn this model upside down,” he says.

Widening saving options

However, he did point out that members will need to take more responsibility for their savings and not fully depend on their employers.

“But for this to happen, saving must be integrated with life-style. As intuitively as one pays an electricity bill, or school fees, so must they be compelled to put money aside for retirement, projects, and the occasional rainy day. The Fund’s new purpose is to facilitate this integration of savings into the life-style of our members through financial literacy, partners, technology and new customer experiences,” he says.

Member contributions

Statistics at NSSF show that member contributions increased by only 5 per cent from Shs1.22 trillion to Shs1.28 trillion. The marginal growth is attributed to the amnesty NSSF offered to businesses that were affected by Covid-19 pandemic. In the result, NSSF deferred a total of about Shs22 billion in collections.

Low savings

While announcing the interest rate, Finance Minister Matia Kasaija said saving in Uganda is still very low. He said the level of saving stood at 21.2 per cent in 2019.