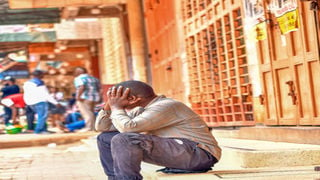

A puzzled trader sits outside the closed shops city traders went for a sit-down strike challenging Uganda Revenue Authority’s Electronic Fiscal Reporting and Invoicing System. Many small traders have or could lose their source of livelihood. PHOTO / MICHAEL KAKUMIRIZI

|What if you lose your job today?

What you need to know:

Experts advise on what you can do if the hard news hits you unexpectedly.

You may have lost your employment already or may be worried about losing your job. Either way, your financial, physical and mental health would be impacted in one way or the other.

According to human resource professionals, psychologists, professional counsellors and financial coaches that Prosper Magazine spoke to for this article, all seem to concur that the loss of a source of income will always take a toll on you even subconsciously.

Responses from Nation Media Group (NMG) Uganda online poll seeking to understand what you would do if you were to unexpectedly lose your job, corroborate the aforementioned fears expressed by the various experts.

Many responses were somewhat chilling, several others blunt and many more deeply personal.

One unemployed respondent described the situation as difficult to get used to, revealing that sometimes it is even difficult to catch some sleep.

Another respondent didn’t even like the idea and sound of the poll question, saying: “Just don’t talk about it.” In the same breath, another responded said: “Man, this is a wrong topic to discuss in these times!”

Other were upbeat, recommending a stint in agriculture after disclosing that they were part of the nearly half a million jobs that Covid-19 pandemic wiped away.

Some respondents were cynical. One particular one said “wendi,” meaning life goes on amidst unemployment, adding this is not a new phenomenon in this part of the world.

Another simply said: Start a business. Jobs are just that.

It does not solve the problem. You are better off being self-reliant, arguing that when you have a job, you are not only comfortable but your chances to grow are slim.

Coping mechanism

Losing a job is not and should not be the end of the world, even though it may feel that way. The issue is, that you should not remain out of work longer than usual. It is for this reason that surviving a job loss requires planning, something that is easier said than done for many people.

However, for an economy like the one of Uganda where half of between 15 to 20 million labour force earns a monthly payment of about Shs200,000 or less, according to findings contained in the National Labour Force Survey (NLFS) 2021, it is difficult even after taking stock of your income and cutting your expenses, to save consistently.

A woman packs her belongings from the office. PHOTO/FILE

Experts recommend having three to six months of living expenses in savings to cover your ongoing costs including “surprise” bills if you are out of work.

In the wake of meagre income, Ms Daphne Kakonge, a human resource expert, recommends you try saving at least 30 per cent of your monthly earnings. Don’t stop at that. Go ahead to invest it in investment clubs, unit trusts, Saccos et al where guaranteed returns are certain for a rainy day.

“It is hard to know for how long you will be out of work,” says Ms Kakonge, adding: “To be on the safe side, prepare for at least six months of unemployment. Depending on your age and experience, you might find a job sooner, but still, you need to prepare in case this situation drags a little longer.

But, with proper capability, Ms Kakonge believes between three and six months or slightly more, a highly competent person would have found a job or another way to have an alternative source of income.

Take it on the chin

Ms Kakonge who is also the managing partner Human Capital Business Solutions (HCBS) Limited - Uganda and Tanzania, told Prosper Magazine in an interview last week that your inability to live in denial rather than adapt to your situation after losing your job could quickly see you degenerate into a place that affects your head space.

A man displays a placard seeking a job. The news of a job loss can be devastating but it should not be the end of the world. PHOTO/MICHAEL KAKUMIRIZI

“You must accept that you no longer have a job and this is when the support system from your family, relatives and friends and even counselling comes in handy to help you adjust quickly.

“It is time to reflect and for some people, it is a reality check. When they bounce back, they tend to be stronger and in a better mindset than before. But that happens if you are able to stay positive.

“Meanwhile you should be prepared to volunteer your services, network more, learn a new skill and make a budget to minimise unnecessary expenditure. Also update your profile, make use of referrals, read to understand what is happening in the job market and skills required with a view to benchmark yourself,” Ms Kakonge says.

Calculations to consider

If you are unemployed now, you already know that life never stops irrespective of your status. Expenses to be incurred are still part of the fixture. So, for example, essential expenses roughly add up to Shs3 million per month which would mean having at least Shs9 million to Shs18 million set aside in savings to see you through rainy unemployment days over three to six months which is deemed as an average for unemployed workers to find a new job.

Now that you have an idea of what it is like to lose a job or survive without generating an income for a while, your exit strategy, if any, should be to stay at your current job to keep a steady income flow until you have either gotten a new offer from another employer or until when you are ready to kick start your own business.

Experts weigh in

While in that state, the executive director of Enterprise Uganda, Mr Charles Ocici, an acknowledged financial mentor and coach, notes that in times like this – when you are out of work, cutting your spending down to the bare minimum—covering only the most basic, necessary expenses—with minimal to no discretionary spending, is the right approach to pursue.

“The first thing you experience when you lose your job is loss of income and as your income continues to drain, the stress levels also become visible, sometimes resulting into depression, affecting your family and people around,” says Mr Ocici.

He continues: “You must adjust your cash flow to reflect your current reality and remain positive because you have no source of income. Accept that you have lost your job and avoid blaming others for your situation instead consolidate the gains you have registered thus far and see how it can help you move forward.”

For example, he says that if you were able to create some kind of income-generating activities to supplement your earnings while employed, this is the time to dedicate your efforts to that venture. Make yourself busy. You should collect your debts and ensure you keep busy – all the progress you make will lift you up.”

Just like Ms Kakonge, Mr Ocici also a veteran motivational speaker, notes that you should deploy your experience probono (free services/volunteer), saying this is proven way of not only making yourself useful but also getting yourself noticed by way of freely advertising your professional skills and capability.

Plan your exit on day one!

As for Mr Moses Ssesanga, an experienced human resource management professional, don’t be stunned or act surprised when you are rendered unemployed.

He says: “When you get an appointment letter and pen an acceptance in a new organisation, start thinking and planning for your exit!”

He continues: “You must remember that unless you are a shareholder in the business, time will come when you have to exit and it is best to put up a contingency exit plan!”

Mr Ssesanga advises employees to start putting aside a portion of their salary in a saving/investment which they will not easily access, and allow it to grow to a point that it can cover their living expenses for between three and six months when they lose the job.

“This money is not for emergencies but for that time when you unexpectedly happen to be without a job. That time will always come so your failure to plan for it won’t stop it from happening.

“Never get caught flatfooted irrespective of what you are earning. Remember, it is all about financial resilience. Never gobble up all your salary without planning for that time when your job is gone!

“Try as much as possible to plan for another source of income from your salary. The point here is don’t depend on salary alone! Even people who earn less can succeed in growing their income streams. How do they do it? Sacrifice!” Mr Ssesanga concludes.