Between January 1971 and January 1986, Uganda experienced several regimes changes: with four of them being turbulent. But did you know that as most citizens ran for cover, there is one particular office holder that could never hide successfully? Regardless of where he sought refuge, he had to be found; at all costs.

That person sat in the saddle as Bank of Uganda governor. Why? He had to meet demands for foreign exchange by the fleeing group and accountability to incoming leaders of government. If the incumbent governor refused the demands, especially from fleeing leaders, he risked losing his own life.

He always had to satisfactorily explain to new regime honchos why he had dispensed foreign exchange to the toppled leaders. Secondly, he might be required to attend to unusual demands for foreign currency by the new regime; to help them ‘settle down’ and to facilitate repatriation of their families from exile. Meeting such demands, under the watchful eyes of heavily armed soldiers, could, certainly be challenging.

The foregoing example portrays one of the challenges that a Central Bank Governor, in several countries across the world, faces. Although the job comes with fine perks, such as chauffer driven limousines, body guards, furnished residential houses, free medical care for self and family, trips abroad, etc., it is replete with lots of challenges.

An office holder must keep a very cool, calm and above all prayerful stance to ensure a plausible way forward and yet not to unduly step on toes of vital regime heads.

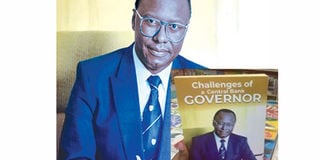

It is against this and other backgrounds that governor BOU Emeritus, Leo Kibirango has written an autobiography, titled ‘The Challenges of a Central Bank Governor, My Journey and Reflections”. His story shines light on tension that one has to endure as he or she balances financial systems, economic development and politics, especially during dangerous times.

The author first takes the reader through his formative years. He was born in Kisoga, Kyaggwe, central Uganda, in 1939, to an enterprising farmer. While barely four years of age, his mother packs her bags and leaves him in the custody of his paternal grandma and father. Under the old woman, he falls in love with his Ganda culture and the Catholic religion. Likewise he gets a stint of about a year at his paternal aunt for character formation and development of work stamina.

Years of schooling see him through rural schools, Jinja College, Namilyango College and Makerere University. He graduates with a B.A degree in Economics. In 1967, a few months after graduation, he gets employed at Bank of Uganda, after a stint at NYTIL as a Research Economist. Through hard work and God’s grace, he rises through the ranks. As Gen. Idi Amin’s regime comes to an end, in 1979, Kibirango is a General Manager; following two years as Director, Bank Supervision. In 1980, he acts as Deputy Governor. And a year later, he becomes Acting Governor following a sudden departure of the previous Governor due to the disputed 1980 General Election results.

At the end of October 1981, the new President, Dr Apollo Milton Obote, appoints him Governor. Over the previous years, five Governors had sat in that chair. Three of them had quit in strange circumstances. While one lost his life, others had been forced into exile for the sake of saving dear lives. . Another Governor had been imprisoned in Luzira, after failing to honour demands for most probably, forex from new regime leaders!

Although scared about the immediate past, Kibirango gets down to work; to midwife the economy back to normalcy through a Reciprocal Credit Arrangement with Kenya to address dire commodity scarcities; Bretton wood institutional vital assistance to Uganda; Paris Club Uganda debt cancellation; and the introduction of the innovative Dual Window Forex Management Regime to address the huge disparity between the official and the black market exchange rates for foreign currency.

He endures tumultuous challenges to put the economy back on a sound footing, upon which subsequent Governors and Governments added bricks, to make Uganda a better place for all of us. In this book, you will find out how he and his team of professionals and the Presidential Economic Committee managed to achieve that feat.

After leaving the Bank, mid 1986, he joins the private sector and helps herald diverse structures that supported the changing corporate world and Uganda’s financial architecture. Among these were the Kampala Stock Exchange, now the Uganda Securities Exchange; the Capital Markets Authority; the Institute of Bankers; the Institute of Corporate Governance of Uganda; and the Financial Intelligence Authority. In two of these, he served as the pioneer Chairman.

After all this contribution to national service, he veered into financial, economic and corporate governance consultancy on the local, regional and international scene; where he is up to today.

He sums up his book by taking a holistic peep into the current and immediate future; how can Uganda be more competitive on the international scene?

Grab a copy of this book, which is currently available at Aristoc, Mukono and Uganda Bookshops and at his LK Consultancy. You will be challenged about the path of Uganda’s financial and economic journey thus far; and how it can be made better.

Title: The Challenges of a Central Bank Governor, My Journey and Reflections

Author: Leo Kibirango

Pages: 276

Price: Shs70,000

Availability: Aristoc and Uganda Bookshops

Published: 2024

Leo Kibirango, the former governor of the Central Bank of Uganda.