Buyers often have the opportunity to select certain features, finishes, or even layout options when purchasing off-plan. Photos/Tony Mushoborozi.

An off-plan purchase refers to buying a property that has not yet been completed or constructed. In real estate terms, it typically involves purchasing a property directly from a developer before it is built or during the construction phase. Buyers often make off-plan purchases based on architectural plans, and designs, and sometimes show units or model homes provided by the developer. Off-plan purchasing is popular with property buyers because of many factors.

One of the major attractions of off-plan purchases is the potential for significant appreciation in property value by the time construction is completed, typically three to four years after purchase. Early buyers often find themselves with prime properties, allowing them to earn substantial profits if they sell. This increase in value over the construction period makes the initial risks of buying off-plan worthwhile.

Another compelling reason for the popularity of pre-construction purchases is the advantage of securing the best choices early in the process. By contacting the property developer early, buyers increase their chances of selecting a condominium with preferred features such as desired floor levels, optimal views, and favourable pricing. This proactive approach ensures that buyers can secure the most desirable properties available.

Best payment terms

Annet Babigamba, a realtor and condominium salesperson at Universal Properties, emphasizes that the primary allure of purchasing a condominium off-plan lies in the favorable payment terms.

She explains, “The biggest advantage of buying a condominium off-plan is the flexible payment terms. With a pre-construction purchase, you can reserve a unit with as little as five or Shs10m, which often amounts to less than five percent of the total condo price. Additionally, you have the option to pay the remaining balance in installments over the construction period, typically spanning about three years. This payment structure is highly appealing to many prospective buyers.”

Babigamba highlights that for most Ugandans, raising the substantial sums required to purchase properties in prime areas like Nakasero, Kololo, or Mbuya is challenging.

“Buying off-plan allows individuals to spread out their payments over several years, making it feasible for more people to afford these condominiums,” she adds.

She contrasts this with purchasing a condominium after construction is completed, where the initial payment required can often be daunting.

“When buying a fully constructed unit, the buyer’s first installment typically amounts to at least 50 percent of the total condo price. Not everyone can readily come up with Shs150m as a down payment,” she notes.

The flexible and manageable payment terms offered through off-plan purchases enable more accessibility and affordability for potential homeowners in Uganda’s competitive real estate market.

Preferences

The distinction in buyer preference highlights the varying priorities of investors and homeowners in Uganda’s real estate market. Top-floor units are prized for their panoramic views and rental potential, while lower-floor units are favored for their convenience and family-friendly appeal.

“We have observed that one-bedroom apartments on the top floors are particularly attractive to investors interested in rental properties,” Babigamba explains. “On the other hand, three-bedroom units tend to sell better on the ground and first floors. Buyers of these units often have young children or are planning to start a family.”

Demographics

The off-plan market in Uganda is evolving, driven by varying age groups with distinct financial priorities and investment goals. The demographic most actively purchasing off-plan consists primarily of individuals in their 30s. This age group is often financially stable, currently renting but looking to make property investments.

“Young people in their 20s are still navigating their financial paths, while those in their 40s are typically managing mortgages or settled in homes they have built,” Babigamba explains. “In contrast, those in their 30s are in a position to invest in property.”

She notes that this trend is expanding, with some individuals in their 20s also opting for condominiums due to favourable payment terms and desirable locations.

“Buyers over 50 years-old often view condominiums as a sound investment strategy,” Babigamba continues.

“Having fulfilled major financial obligations such as education costs, they now have surplus funds to secure their retirement through property investments.”

She adds that approximately 30 percent of condominium sales are attributed to diaspora buyers, reflecting a growing trust in the market among this demographic.

Cons of off-plan purchasing

While purchasing property pre-construction offers several advantages such as low initial deposits, a wide array of unit choices, and the lowest early-bird prices, there are also drawbacks to consider, according to property expert Cissy Namaganda.

Namaganda highlights that opting for a property before it is built can lead to unforeseen changes in the building’s details due to various factors.

Additionally, selecting an unreliable developer may result in the project never being completed as promised. Even if the developer refunds the money, the inconvenience caused can be considerable. Furthermore, there is risk of construction delays, with projects often taking longer than initially estimated.

Precautions

Steven Opolot, a Ugandan realtor based in Dubai, emphasizes the importance of conducting thorough due diligence before any purchase. Here are steps you can take to ensure you do your due diligence before buying a pre-construction condo, according to Opolot:

Research the developer

Not every developer can be trusted, so the first step is to investigate the history and track record of the developer. Reach out to previous buyers from the company and gather their feedback. If possible, meet them in person. Additionally, conduct online research by checking reviews and news articles about the developer’s past projects, financial stability, and reputation in the industry. This thorough examination will empower you to make a well-informed decision before purchasing a pre-construction property.

Check the location

Simply looking at computer-generated images of the prospective building or knowing the general area where construction is planned is insufficient. It’s crucial to thoroughly investigate the neighborhood and location of the project to determine if it suits your needs.

Assess factors such as proximity to amenities like supermarkets, main roads, restaurants, public transportation, hospitals, and schools, whatever you deem essential. This thorough exploration ensures that the location aligns with your lifestyle and preferences before committing to purchasing a pre-construction condo.

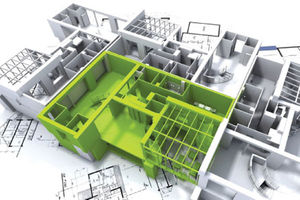

Review the floor plans

Examine the floor plans to determine if the layout suits your needs. In the Ugandan market, purchasing off-plan often allows for minor adjustments to the condominium’s floor plan. However, you need to thoroughly study the floor plan beforehand to identify any changes you may want to make.

Additionally, this phase reveals details such as the unit size and room dimensions. If these aspects do not meet your requirements, you can decide not to proceed with payments. This ensures that you are satisfied with the layout and specifications before committing to buying the property.

Review the building features

It is widely understood that condominiums offer amenities such as security and parking. However, these should not be assumed. Take the time to carefully inspect each feature and understand how they align with your needs.

Ask detailed questions about shared spaces to ensure they meet your expectations and preferences. This thorough assessment helps you determine if the condominium’s features and amenities are suitable for your lifestyle before making a decision.

Review the contract

Carefully read the contract and ensure you comprehend all its terms and conditions. It is advisable to consider hiring a lawyer or real estate agent to assist in reviewing the contract with you. In many cases, the construction of the building exceeds the stipulated timeframe in the contract.

Inquire about the estimated completion date, potential delays, and understand the developer’s protocols for handling delays or cancellations. This proactive approach will help you navigate potential issues that may arise during the construction process.

Market value

Even if the property price seems appealing due to its location, it is important not to rush into payment. Visit the location and compare the price of the off-plan you intend to purchase with similar properties in the area. This comparison will help you determine whether you are overpaying or securing a favorable deal.

Why take the risk of buying off-plan when you could potentially purchase a finished property for the same amount in the same area? Conducting this assessment ensures that you make an informed decision about the value and investment potential of the property before committing to a pre-construction purchase.

Deposit structure

Ensure you fully grasp the deposit structure and payment timeline, which can span over several months or even years. Inquire about any penalties you may incur if you fail to complete payments within the developer’s specified timeframe. Understanding these details will help you navigate the financial obligations associated with your purchase effectively.

Consult several real estate professionals

Real estate experts possess insights about the market that you may not even realise you need to know. In addition to providing valuable information about the developer’s track record, they can offer superior alternatives and valuable advice. Relying on just one professional may result in bias, so consulting with multiple experts is advisable for making informed decisions.

General prices for popular off-plans

The pricing for the apartments varies based on their configurations: a single-bedroom unit, complete with a living room, kitchen, toilet, and bathroom, is priced at Shs168m. If you prefer a larger space, a two-bedroom duplex apartment is available for Shs295m, offering a unique layout spread over two floors where utility spaces are on the lower level and bedrooms are situated upstairs.

For those looking for more space, the three-bedroom duplex apartment, priced at Shs353m, provides ample room across its two floors, similarly dividing living areas and bedrooms.

Warranty

Most off-plan purchases come with guarantees and warranties from the developer. These can cover structural defects and ensure that any issues arising during construction or immediately after completion are addressed by the developer.

Opportunity to Influence Development: By buying off-plan, buyers can sometimes have a say in the development process. Developers may seek feedback or offer options that allow buyers to influence certain aspects of the property’s design or features.