Prime

aBi Finance releases Shs120b to fund green projects

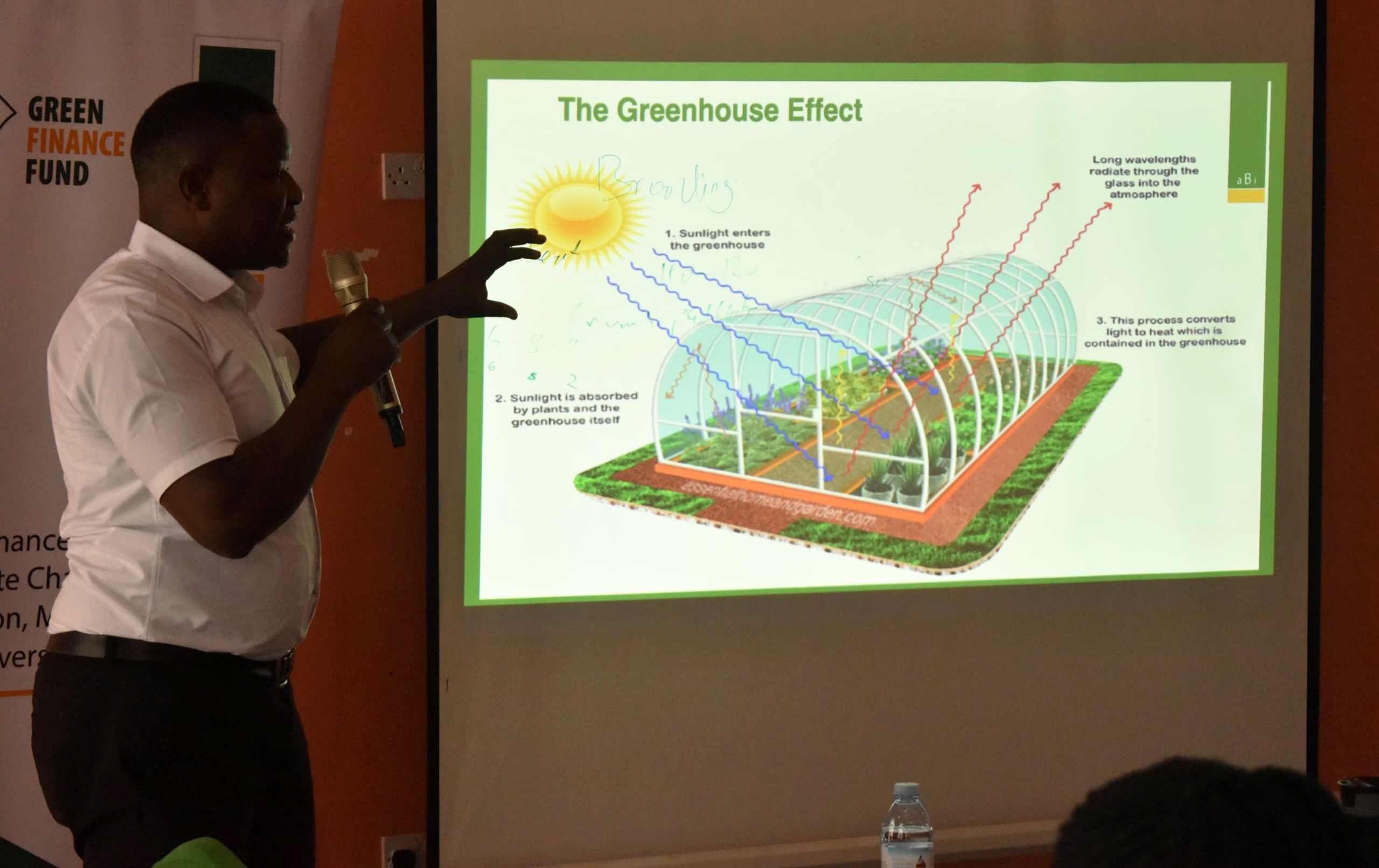

Mr Noah Owomugisha, Head of green growth and business development services, aBi finance limited, makes a presentation during the stakeholders’ engagement and green finance capacity building launch on July 18. Photo/Dorothy Nagitta

What you need to know:

- Mr. Owomugisha explained that the one-month engagement, which is expected to attract about 40 financial institutions nationwide, aims to enhance the capacities of these institutions and provide knowledge and information to enable them to offer environmentally sustainable, inclusive, and well-governed financing.

aBi Finance Limited released Shs120 billion to over 30 financial institutions to support environment-friendly projects aimed at mitigating environmental degradation and climate change.

aBi Finance Limited, a social enterprise dedicated to fostering agribusiness expansion through lending financial institutions, released the funds last year with the objective of not only financing agribusinesses but also strengthening the capacity building of financial institutions.

Mr. Noah Owomugisha, Head of Green Growth and Business Development Services at aBi Finance Limited, said that supporting agribusinesses can play a crucial role in alleviating poverty by generating more income.

“Climate change leads to poverty. But when agribusinesses are supported to thrive, more money is made and poverty is eliminated,” he said during the aBi Finance stakeholders' engagement and green finance capacity-building launch in Wakiso on July 18.

Mr. Owomugisha explained that the one-month engagement, which is expected to attract about 40 financial institutions nationwide, aims to enhance the capacities of these institutions and provide knowledge and information to enable them to offer environmentally sustainable, inclusive, and well-governed financing.

Mr. Moses Bwire, the Investments Manager of Green Growth and Business Development Services at aBi Finance, said supporting green projects will help financial institutions develop their Environmental Social and Governance (ESG) policies.

“We do believe that financial institutions have Environment Social and Governance (ESG) policies, but they are strong on governance and social aspects. However, when it comes to environmental aspects, some are weak. So, these projects will help them to enhance their environment policies,” he added.

Ms. Jane Aik, an Associate Consultant of the Uganda Institute of Banking and Financial Services, a body mandated to provide capacity building for the financial sector, supported the initiative and urged all financial institutions to participate and explore how they can become environmentally sensitive.

“We are telling banks to think beyond just the figures we have been looking at previously. Yes, when we are analyzing these businesses, they have their figures, but what makes them sustainable is the environment around us, and how does it impact the businesses that they work with?” she said.

She further emphasised, “If we focus and look at how to protect the environment in such a way that it gives us those basics of life, then we will be able to progress. But if we cannot meet our basics of life, then we really don’t know where we are going.”