Prime

Cooperative Bank to improve teacher’s livelihoods – Minister

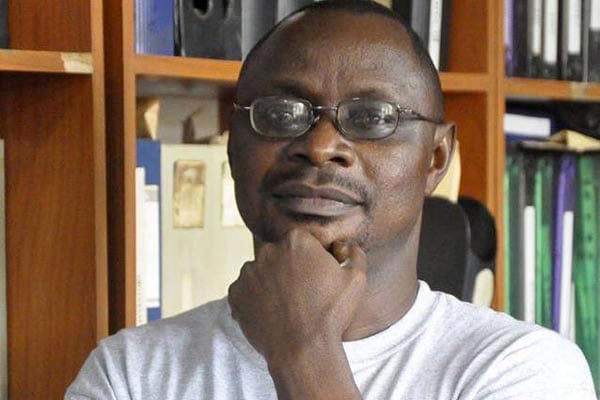

The Walimu Cooperative Union Chairman Mr Steven Nabende addresses teachers as the CEO Wazalendo SACCO Col Joseph Onata (L) listens during the pre-AGM in Kampala on Friday. Photo | Paul Adude

What you need to know:

- Ngobi emphasized that the cooperative bank will be owned and funded by the teachers themselves, allowing them to access loans at affordable interest rates.

The State Minister for Cooperatives, Fredrick Ngobi, has announced plans to reinstate the Uganda Cooperative Bank, aiming to improve teachers' livelihoods through affordable loans and investment opportunities.

"We're carefully analyzing past mistakes to ensure a stronger comeback," Ngobi said at the Walimu SACCO Union Annual General Meeting in Kampala on Friday, adding: "Teachers deserve better loan options, not expensive bank rates."

Ngobi emphasized that the cooperative bank will be owned and funded by the teachers themselves, allowing them to access loans at affordable interest rates.

“Now Walimu has billions of Shillings in an account in one of the banks, he (Chairman) doesn’t know what that money is doing, he is only waiting to withdraw money and give it to teachers, the bank trades that money, so why don’t they do it themselves to trade that money and make their own bank,” he said.

Mr Ngobi said the ministry has consulted with various SACCOs across the country, and the response has been overwhelmingly positive.

“This bank is there legally, we passed a law that changes the cooperatives act, Parliament passed that Bill stating that the Uganda Cooperative Bank has to exist and it was assented to by the President. We have talked for a long time, what we want now is for the Uganda Cooperative alliance to go ahead and present the report to us and I present it to Cabinet,” he said.

Walimu Cooperative Union Chairman, Steven Nabende, echoed Ngobi's sentiments, highlighting the need for teachers to utilize their resources effectively.

“We are realising as teachers we are becoming universal donors, we collect all the resources and just give them out other than utilising them ourselves. All our salaries are being processed through commercial banks and it takes a minimum of Shs20,000 to process for all teachers in this country (about 200,000), meaning we contribute Shs4 billion to these commercial banks,” he said.

The CEO of Wazalendo SACCO, Col Joseph Onata, stressed the importance of a mindset shift towards savings and collective solutions.

"We've seen success in our SACCO, and with the cooperative bank, teachers will have greater financial empowerment," Onata noted.

Mr Onata said people now in the forces are able to access credit where they don’t require putting their land titles as security for salary based loans.

The reinstatement of the Uganda Cooperative Bank is expected to revolutionise teachers' financial lives, providing them with a sense of security and control over their resources.