Prime

Government unveils Shs165b poverty eradication scheme

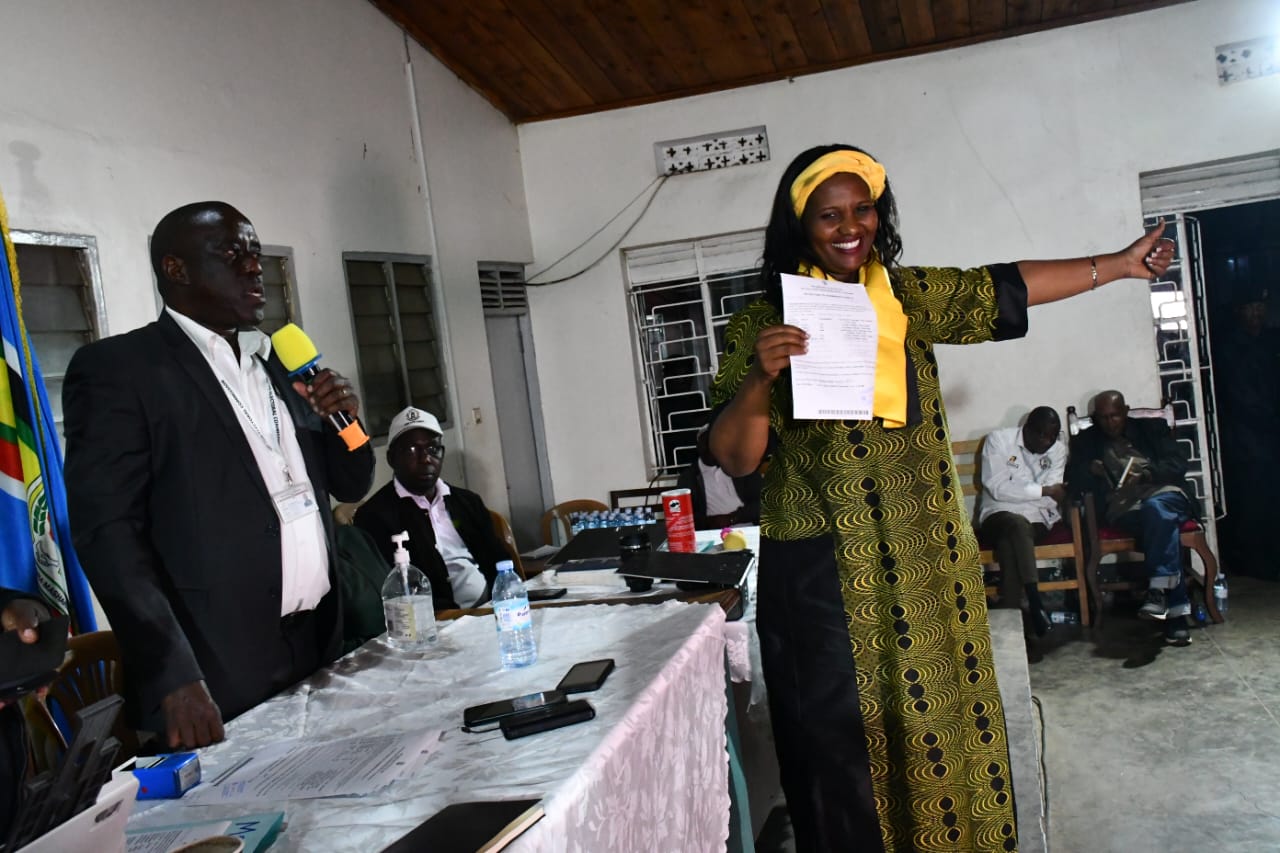

Minister of State for Microfinance Haruna Kasolo (left) looks on as the Presidential adviser of Youth Empowerment, Mr Hillary Musoke, signs a placard at the launch of the presidential initiative scheme in Entebbe July 9, 2020. PHOTO ABUBAKER LUBOWA

What you need to know:

- Mr Abdul Bisaso, a technical personnel on the Emyooga committee, said if a manager steals people’s money, government will compensate that Sacco and deal with the defaulter.

Government has unveiled a Shs165.7b poverty eradication plan slated to alleviate Ugandans from poverty.

The new scheme dubbed ‘Emyooga’ targets Ugandans in the informal sector clustered in 18 groups.

The money that is slated to be managed by Microfinance Support Centre under the coordination of the Ministry of Finance, will be shared among beneficiaries in all sub-regions, when they meet the requirements.

Each constituency, apart from Wakiso, is entitled to Shs560m.Wakiso will be given Shs4.4b because it has eight constituencies.

Launching the scheme yesterday at the Entebbe Municipal Council offices, the Minister of State for Microfinance, Mr Haruna Kasolo, said government had already availed the funds to run for the next six months.

“Government has prepared programmes and the money is readily available as long as you are also ready and have fulfilled the necessary demands. It is to be used as seed capital within the formed Saccos,” Mr Kasolo said.

He said the scheme will create jobs through specialised categories at constituency levels where each Sacco is entitled to money between Shs5m and Shs30 million.

Mr Kasolo said government is targeting the informal sector such as boda boda riders, carpenters, tailors, welders, fishermen, taxis, vendors and salon operators.

Others are journalists, market vendors, veterans, produce dealers and Persons with Disabilities (PWDs).

Mr Kasolo said before money is issued, beneficiaries are supposed to form a Sacco of between seven and 30 members, register through District Community Development Officer (DCDO) and thereafter open up bank accounts on which the money shall be deposited.

In an interview with Daily Monitor, Mr Godfrey Mangeni, the senior zonal manager in-charge of Kampala Zone, said the fund is not to be returned to government.

“This fund is going to be disbursed to the Saccos. That fund is not to be paid back to Microfinance support centre, no, It is going to remain within the Saccos. It is meant to benefit the members of the association,” Mr Mangeni said.

He added: “Why we call it revolving fund is because money lending will be done at a small interest rate, which will benefit the Saccos themselves. The leadership of the Sacco should be well vetted from parish level. We are also going to do training and among the training, we shall train leaders on governance.”

Mr Abdul Bisaso, a technical personnel on the Emyooga committee, said if a manager steals people’s money, government will compensate that Sacco and deal with the defaulter.

“There is a statutory body called UMRA (Uganda Microfinance Regulatory Authority) that is aimed at regulating all Saccos in Uganda. We shall use this law to handle all those who will mismanage the money,” Mr Bisaso said.

The State Minister for Primary Education, Ms Rosemary Seninde, advised that all targeted beneficiaries be subjected to thorough induction before issuance of the funds is done.

“As govt we have not given up and that is why we now have Emyooga. You should first attend training and induction, before money is issued,” she said.

Similar schemes

The National Agricultural Advisory Services (Naads) was created in 2001 to improve livelihoods of people in rural areas by increasing agricultural productivity . It was, however, faulted for only targeting individuals instead of groups.

In February 2007, President Museveni launched the Prosperity For All programme dubbed ‘Bona Bagagawale’ and he said government would through it establish Savings and Credit Organisations in at least 1,000 sub-counties.

Later, Operation Wealth Creation was created with the objective to improve people’s household incomes.

In 2013, government through the Ministry of Gender, Labour and Social Development and the Youth Livelihood Funds which by mid last year generated about 100,000 jobs.

Reason for failure: Minister of State for Micro Finance, Mr Haruna Kasolo, says some schemes failed because leaders directed the funds for private initiatives.