Prime

Inside Bank of Uganda fight

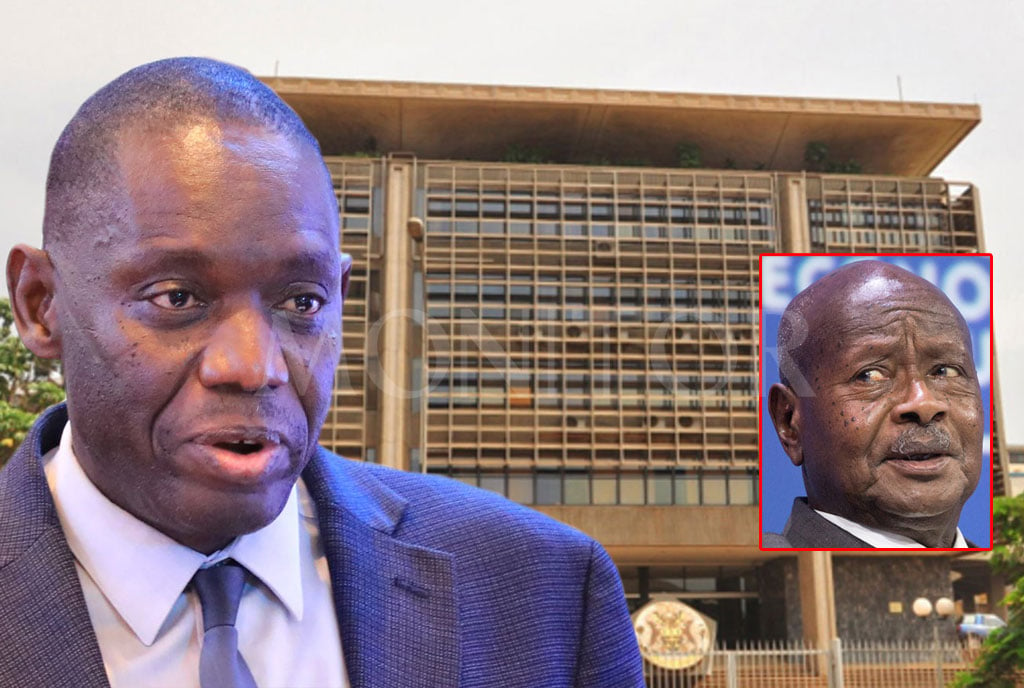

The Bank of Uganda offices in Kampala. An infighting at the central bank over restructuring has snowballed, prompting aggrieved staff to petition President Museveni (inset), followed by a pause of the exercise. PHOTO/FILE

What you need to know:

- The petitioners say a restructuring blueprint excluded input of bank executives and upended good practices of corporate governance.

An infighting at the central bank over restructuring has snowballed, prompting aggrieved staff to petition President Museveni followed by a pause of the exercise.

The overhaul was due to start on August 1, but its implementation has now been stayed for several months, pending a resolution of the sticking issues.

Dr Michael Atingi-Ego, the deputy governor of Bank of Uganda (BoU), whose administration midwifed the planned wide-ranging changes, told this newspaper last night that “the exercise has been halted [and] the new Board is looking into the concerns”.

He declined to discuss a litany of claims raised, many of them against him and his style of administration, in the undated petition to the President - his appointing authority.

The petitioners noted that the restructuring blueprint based on recommendations by KPMG, a consulting and audit firm hired at Shs1.4b to conduct the reorganisation, excluded input of bank executives and upended good practices of corporate governance.

They alleged that the overhaul appeared calculated to purge the Old Guard – many considered loyalists of late Governor Emmanuel Tumusiime-Mutebile – whose jobs, they noted, had been merged, eliminated or downgraded.

President Museveni signs on a portrait of Bank of Uganda Governor Emmanuel Tumusiime-Mutebile during his funeral service at Kololo Ceremonial Grounds on January 28, 2022. PHOTO/ ABUBAKER LUBOWA

None of the claims is true, the bank’s Communications Director Kenneth Egesa said in response to our earlier email inquiry, noting that the process was all-inclusive, followed the rules and internal systems are in place to address evolving staff complaints.

Officially, the overhaul baptised Organisational Structure Review (OSR) was to meet demands of legislations and goals in the bank’s new strategy, and align its staff workload and administrative structures to a modernising financial sector regulator.

It was initiated under Mutebile, but actual execution happened from June 20, 2022 and February 10, when KPMG returned its findings and recommendations for consideration by central bank’s Board whose tenure was expiring.

Through job evaluation and workload analyses, the consultant concluded that there was significant duplications in roles, some positions were redundant while a number of directorates had been created without business justification.

KPMG reported that a number of staff had been promoted every couple of years in line with BoU policy when they continued to do similar assignment, contrary to the principle that promotion places a job holder to leverage experience and expertise to tackle more complex tasks.

There are about 250 senior principal banking officers in this category at the central bank and questions about their fate was reportedly the immediate trigger of protests to the overhaul plan, despite Board assurances that the exercise should minimise job losses.

Highly-placed sources said the new Board, instituted only last month after a four-month hiatus, has directed the management to ensure that staff without requisite skills in the role realignments be supported to upgrade or re-skill instead of being shown the exit.

Our investigations reveal that the restructuring underlines a shift in BoU’s strategy; from principally maintaining financial stability to focusing on socio-economic transformation by pursuing policies that lift majority citizens out of subsistence into the money economy.

In that regard, the financial sector regulator has instructed commercial banks to substitute their principle of creating value for shareholders with engineering value for stakeholders – the society in which they operate.

BoU has also asked commercial banks, for instance, to invest in irrigation for sustainable agriculture and food security or climate change reversals by loaning to facilitate the making and buying of solar panels and energy-saving stoves in order to save the environment.

The new catchphrase for the sector is ‘Environmental, Social and Governance Standards’ under which financial institutions gauge their performance by evaluating their contribution in lifting up the lower income category.

The central bank wants them to lend more, either directly or through Financial Technology players, to those with the least means instead of targeting blue-chip firms and other lucrative sectors such as oil and gas.

Individuals familiar with the process said the changes have been necessitated by realisation that price and economic stability requires improved productivity of Uganda’s larger agrarian population after drought last year pushed up food inflation by up to 30 percent, which accelerated other inflation pressures.

These strategic objectives, coupled by a desire to foolproof BoU amid evolving cybercrime and anti-money laundering risks, prompted proponents to seek a new institutional structure talent and repositioning that has kicked up an uproar.

In an interview with this publication in March, officials said the exercise involved reorganising the organogram of the central bank and aligning it to its strategy, and rationalising staffing and costs to drive up productivity and operational efficiency.

The outcome, however, left a bitter taste for sections of the employees, leading to their call for President Museveni to intervene by immediately appointing a substantive Governor to replace Mutebile who died 18 months ago.

“Your Excellency, we hope you can promptly see how to intervene and make the necessary appointment. We shall be very happy and you will have saved the bank …The (central) bank can’t provide confidence and stability in the sector if it isn’t stable. Give us a Governor, sir,” the petitioners wrote.

We were unable to speak directly with President Museveni on his apparent inordinate delay in naming a new Governor, but Deputy Presidential Press Secretary, Mr Faruk Kirunda, said there is no leadership vacuum at the institution.

Deputy Presidential Press Secretary, Faruk Kirunda. PHOTO/COURTESY

He said he was not aware whether or not the petition had been delivered to the Head of State, “but one thing you should know is that … the President cannot be blamed for those fights”.

“How can you blame those internal wrangles on the President when there is a deputy governor with full authority to manage the bank? … if he has committed any crime, then, the aggrieved staff at Bank of Uganda should either petition the Inspector General of Government or State House Anti-Corruption Unit,” he noted.

“All issues will be investigated because the Deputy Governor is not above the law.”

An accomplished economist with vast international experience, Dr Atingi-Ego was named BoU Deputy Governor in March 2020, but the death of long-serving Governor Mutebile on January 23, 2022 placed him to simultaneously occupy the two top executive posts at the gigantic institution.

For part of this year, the tenure of members of BoU Board by law chaired by the Governor expired, theoretically leaving Dr Atingi-Ego to perform the core functions of a Governor, Deputy Governor and the Board.

Such concentration of power, according to the petitioners, was leveraged to target them during a restructuring exercise contracted out to KPMG, an external consulting and audit firm.

Dr Atingi-Ego last night declined to comment on the allegations, but Bank Spokesman Kenneth Egesa said there was no cause for alarm as the institutional was functioning normally and delivering on its mandate.

“The consultant conducted an organisational structural re-engineering exercise, resulting in proposals for a new structure,” he said, “In February 2023, the [new BoU] board of directors received and approved the consultant’s report. They subsequently instructed management to implement the new structure.”

On July 7, Dr Atingi-Ego informed the staff of the bank that the rollout of the new organisational structure would proceed as planned on August 1, before it was paused.

He had noted that during the transitional period, which would last for the next six months, the central bank would necessitate special assignments and technical backstopping including policy review, skills transfer, training, mentorship, and resolution of residual concerns, many raised by staff during a February 27 townhall meeting.

The bank subsequently instituted a Complaints Handling Committee (CHC) and the Executive Committee considered the concerns raised, leading to the Excom members recusing themselves and assigning a Human Resource-led Job Matching Committee to decide which staff to place where.

After a three-week retreat in Kigo, outside Kampala, the latter committee reported its recommendations on job placements that the ExCom validated based on evaluated qualifications, experience and skills of staff.

The Executive Committee members reportedly also authorised Deputy Governor Atingi-Ego, in the period when the bank had no Board, to create positions of directors based on internal controls and identified financial risks, subject to a future ratification by the Borad.

Subsequently, 38 such positions were created. New positions carved out for some of the affected 250-plus senior principal banking officers are 67 manger slots and other assistant manager positions.

However, affected employees said the system was rigged, with Dr Atingi-Ego usurping all executive powers and gagging dissenters while the members of committees, including one on Appeals, put in place to resolve grievances were lacked power for independent decision-making.

The petitioners, for instance, alleged that the creation of temporary departmental units on some micro-structures, have resulted in juniors being installed above seniors, with some of the lower-rung staff reporting directly to the Deputy Governor.

Calling the placements “haphazard”, the petitioners noted that they were “not against restructuring, [but] we are against blatant disregard to corporate governance principles and the law”.

“We believe that if the bank had a Governor, he/she would follow the law and listen to reason. More so he/she would help the current Deputy Governor (Atingi-Ego) who is overwhelmed with this and many other loads,” they noted.

Dr Michael Atingi-Ego, the deputy governor of Bank of Uganda. PHOTO/HANDOUT

They told the President that rather than conform to the bank’s 2022-27 strategic plan, the reorganisation is polarising and detached from improving performance of the institution despite a modernising ambition.

They questioned the manner and motive, claiming that out-of-favour executives were sidelined during the process and displaced or demoted in the final outcome.

Jobs of hundreds of staff were reportedly scrapped or downgraded in the name of alignment, with some dropped to positions three levels lower than their current posting.

“In the new structure, a deputy director 3 levels below an executive director would report to the executive director, in some cases report directly to the deputy governor. This had never happened in any modern organisation,” the petitioner told President Museveni.

The new structure removed directors for Legal, Audit, Board Affairs and the Office of the Chief Accountant. It changed administrative assistants to Officer III Cadres, which is entry-level for fresh graduates.

Some of demotions mean the job holders would require a decade or longer to climb back to an equivalent of their current positions, according to the petitioners, and that members of the new Board erred in approving the restructuring without internalising its impact.

“The macro-structure disregarded professional requirements for practice for certain specialized professions such as lawyers. The proposals in the new structure were totally divorced from common sense or any known standard of corporate governance of employment and labour relations practices,” the petitioners added.

For example, according to the petition, a holder of First Class degree specially trained in counter-terrorism, a skill essential in detecting terrorism financing and illicit financial flow, was demoted without an explanation.

A lawyer who had worked with the bank for 24 years, credited for legal wins and successful corporate social responsibility (CSR) projects, has been moved to an ineffectual risk role while a non-accountant was posted to do reconciliation for the bank, a role requiring a Certified Public Accountant qualification.

In other questionable staff movements, an employee with a doctorate degree in Public Administration was reportedly demoted and shifted to Security department handling to, among other things, handle safety of cash-in-transit.

BoU Communications Director Egesa, however, said such accusations directed at the Deputy Governor were unfounded because the Board approved the new structure and tasked the management to implement, and that executive directors at the bank collectively validated recommendations for new placements of staff.

“In so doing, management set up various committees to identify possible operational challenges, and placement of staff based on identified skills set, experience, and knowledge expertise. The recommendations of these committees were considered and approved by management…,” he said.

Bank of Uganda headquarters in Kampala, Uganda. PHOTO/FILE

According to other sources, the changes were to enable BoU focus on its core tasks, among them issuance of currency, financial and economy stability and being banker to the government, explaining why the bank and Currency Directorate has been split into three: financial markets, banking payment systems and currency.

A Financial Stability Department has also been created out of the Banking Supervision directorate such that the supervisor of commercial banks is not always the on wielding the powers to dissolve them.

Responsibilities such as communications and board resolutions considered sensitive have in the interim been moved under the Deputy Government, pending a redistribution of the tasks once a new Governor is named.

The central bank is a critical institution in the country and its mandates under the law include, among others, maintaining price and monetary stability, playing financial and economic advisor to the government, manager of external debt, being a banker to the government, regulator of financial institutions and issuer of currency notes and coins.

In the main petition to the president, the staff accused Dr Atingi-Ego of introducing through Human Resource, a staff performance rating calibrating system that they said inhibited staff performance. They said the system limited only a tiny fraction of staff in each department to score above a certain mark.

“The rest should then automatically be mediocre. Institutionalising mediocrity was now official. This also meant that team work was no longer necessary as there was only a tiny fraction of staff who would, by policy, be considered stars in their departments,” the petition reads in part.

The Banks Administration Manual provides for restructuring and sets down the process from beginning to end. According to the manual, the human resources directorate with the business units determine staffing needs, gaps, and skills sets required against the strategic outlook.

A task force is then composed and tasked to make informed analyses based on fact which are then transmitted to the Excom and onwards for Board approval.

The petitioners, however, allege that the Deputy Governor circumvented this process and forced decisions on staff.

“This will likely affect enterprise-wide outputs,” they told the President, adding, “The disruption caused cannot be [quantified].”

Claiming that affected staff compensation will cost upwards of Shs70b, they added that “unless Your Excellency pays attention to the central bank, one day you will wake up and find a broken-down edifice whose repair will be costly in terms of time and costs.”

President Museveni arrives for the Emmanuel Tumusiime-Mutebile Memorial Lecture at the Kampala Serena Hotel on January 27, 2023. PHOTO/STEPHEN OTAGE

However, Mr Egesa told Monitor that the structural review will enable BoU to effectively deliver its mission of promoting price stability and a sound financial system supporting socio-economic transformation in Uganda.

“Operating in a developing economy context compels the BoU to support national socio-economic transformation by encouraging investment and working with other stakeholders to develop and implement innovative solutions to development challenges,” he noted.

He added: “The review is central to implementing the strategic initiatives covering several emerging issues that the BoU must address, such as climate change, cyber security, anti-money laundering, financial technology, supervisory and regulatory technology, big data analytics, as well as institutionalising an environmental, social and governance sustainability framework in supervised financial institutions.”

A highly placed source said most of the current staff lack skills for these new tasks, requiring their redeployment or retooling.

Separately, Mr Egesa said the review will align the BoU’s operations with legislative developments, including the National Payment Systems Act, 2020 and amendments to the laws governing the regulation and supervision of non-bank financial institutions, including large Savings and Credit Cooperative Organisations .