Judge blocks Bitature’s attempt to bypass South African lenders

Businessman Patrick Bitature. PHOTO/FILE

What you need to know:

- Justice Ocaya also stopped the Uganda Registration Services Bureau from registering resolutions passed by Bitature’s companies which sought to dilute the influence of the South African lenders.

A judge in the Commercial Division of the High Court in Kampala has blocked attempts by businessman Patrick Bitature to side-step his South African creditors and take back shares and properties he mortgaged to them.

In the latest instalment of a long-running legal dispute, Justice Ocaya Thomas on November 17 issued an injunction stopping the Commissioner Land Registration from cancelling mortgages and land titles issued by the businessman and his companies as security for the loan he took from Vantage Mezzanine Fund II Partnership/Vantage Mezzanine Fund II Proprietary Limited.

In the same orders, Justice Ocaya also stopped the Uganda Registration Services Bureau from registering resolutions passed by Bitature’s companies which sought to dilute the influence of the South African lenders.

It is the latest episode in a long-running legal drama that saw Bitature’s properties put up for auction last year after he defaulted on a $10,000,000 mezzanine loan from the South African firm. Lawyers representing the businessman went to court and argued that the loan was illegal because the South African firm was not registered in Uganda.

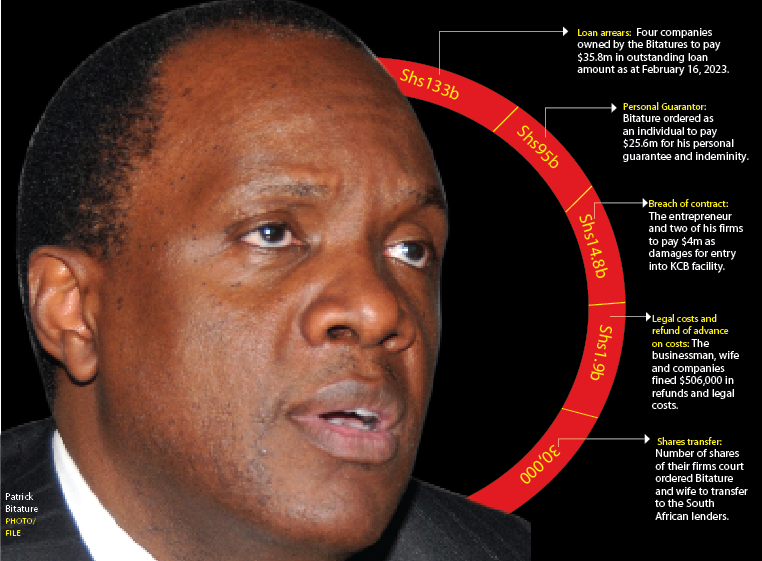

The matter eventually went to an arbitrator appointed by the International Chamber of Commerce who in August ordered Bitature, his wife, and their companies to pay Shs244 billion in principal, interest and penalties.

The Bitatures are understood to have filed a lawsuit in the civil courts in England to challenge the arbitration award. Lawyers for the South African lenders have also applied to have the award recognised by Ugandan courts so that they can start the process of recovering against the security pledged against the loan.

The latest court process was triggered by an October 13, 2023, letter from the Commissioner Land Registration (CLR) to Vantage inviting the lender to be examined on the various properties that the Bitatures mortgaged as security for the loan.

The Commissioner asked Vantage to appear and produce copies of the certificates of title and mortgage instruments in respect of the properties on October 27, 2023, following what they said were complaints filed with the Lands office about the titles and mortgages.

Although the complaint has not been made public, the court heard during the just-concluded application, that the CLR was establishing whether Vantage could be registered on the titles as a partnership, or whether it should have been the individual partners. The CLR has the authority to cancel titles without recourse to court proceedings.

This threat of having their securities cancelled compelled Vantage’s lawyers, Kirunda and Company Advocates, to apply for interim measures of protection against the CLR tampering with the titles and mortgages.

URSB, which is the Uganda company registry, was enjoined in the application after the South African lenders learned that the Bitatures have been taking various actions and filed with the URSB documents that alter the records of companies in which the lenders have an interest arising from their loan to the businessman’s companies.

Background

In December 2014 the South African firm lent Bitature $10m against corporate guarantees from the businessman’s companies: Simba Telecom Limited, Elgon Terrace Hotel Limited, and Linda Properties Limited. In addition, Mr Bitature provided a personal guarantee.

As part of the transaction, Mr Bitature, his wife Carol and another of their companies, Simba Properties Investment Company Limited, in addition to the three companies above, also provided mortgages over various pieces of land around the city to secure the loan.

The mortgaged properties included land comprised in Freehold Register 331 Folio 31, Plot 32, Elizabeth Avenue Kololo, LRV 3908 Folio 13, Plot 32, Elizabeth Avenue, Kololo, LRV 3435 Folio 12, LRV 3895 Folio 4, Plot 3, Water Lane, Naguru, LRV 3891 Folio 18, Plot 1, Water Lane, Naguru and LRV 4525 Folio 18, Plot 11 Summit View Close. The borrowers also provided share pledges and executed various documents in respect of the shares in the various companies.

After defaulting on the loan and attempting to have it struck off as illegal, the Commercial Court ruled in June 2021 that there was a valid, binding and enforceable arbitration agreement between the parties, which opened the way to the London arbitration process.

On July 31, 2023, the sole arbitrator constituting the arbitral tribunal that the International Chamber of Commerce appointed rendered an arbitral award in favour of Vantage.