Makerere gives staff 11% interest on pension savings

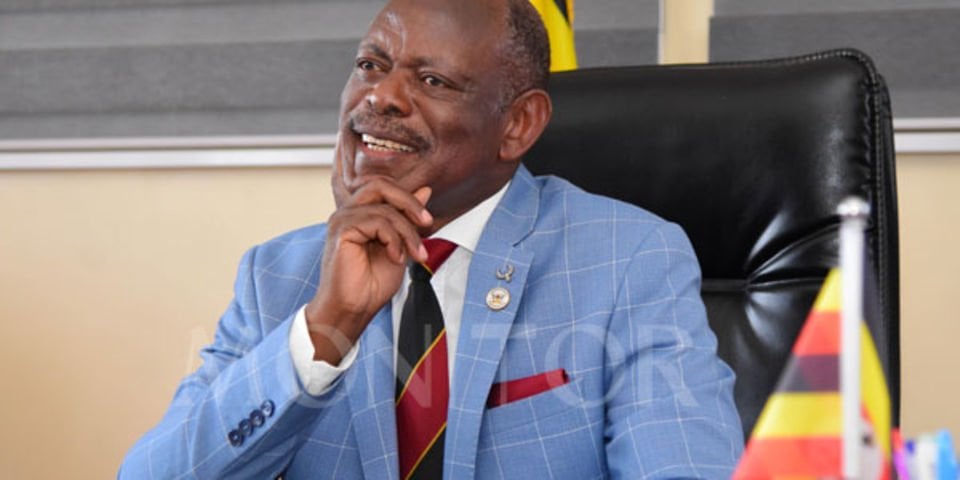

Makerere University Vice Chancellor Prof Barnabas Nawangwe in a recent interview with the Monitor. PHOTO | FRANK BAGUMA

More than 7,000 Makerere University staff who save with the University Retirement Benefit Scheme (MURBS) are to be paid 11.05 percent interest for this financial year.

During the presentation of the scheme’s performance to the university top managers yesterday, the MURBs board chairperson, Dr Godwin Kakuba, said the investments during the year resulted in a net return of Shs32b.

He said the fund grew from Shs255b at the start of the 2021/2022 financial year to Shs299b at the end of this financial year.

“The growth was supported by an increase in contributions and positive returns from our investments. During the year, the trustees approved investment in unit trusts which created an avenue for the scheme to maximise opportunities for daily cash contributions,”Mr Kakube said. “As a result, the trustees were able to achieve their target of declaring an annual interest of not less than 10 percent,” he added.

However, some members expressed dissatisfaction, saying if the scheme was able to give 13 percent last financial year, it was not right to reduce it this year.

But the secretary board of trustees, Mr Wilber Grace Naigambi, asked the staff to appreciate the return, saying it is higher than the inflation rate in the country and on the international market.

The chairperson of the University Council, Ms Lorna Magara, whose statement was read by Mr Frank Mwine, also concurred with Mr Naigambi, saying they considered the economic and market conditions .

The interest rate is slated to be announced to the Makerere staff next week during the annual general meeting. Since inception in 2010, MURBS had been engaged in battles with the National Social Security Fund (NSSF) over retaining the staff on its scheme.

In 2018, NSSF sued the university over non-remittance of monthly staff social security contributions.

The Worker’s Fund argued then that MURBS — to which the university made the mandatory 15 percent remittance for the vast bulk of its staff — was illegal.

Although the case is still in court, the Finance ministry officials approved MURBS as a superannuation scheme last year .Nealry 1,000 Makerere staff who were saving with NSSF were shifted to MURBS.

The scheme’s membership also grew to 7.162 this year up from 5,984 in 2021.

On shs25b debt with scheme

The university management owes MURBS Shs25.4b from the in-house contributions for the period of 2005-2009. According to Mr Kakube, the university has since cleared Shs13b with the balance which is expected to come through soon.

The university Vice Chancellor, Prof Barnabas Nawangwe, said he negotiated with the government to take over the debt and it (government) has been remitting the money annually.

According to Prof Nawangwe, the government has promised to remit the balance in less than two years to ensure that the staff scheme and money is intact.