Prime

Namayingo residents reap big from Sacco

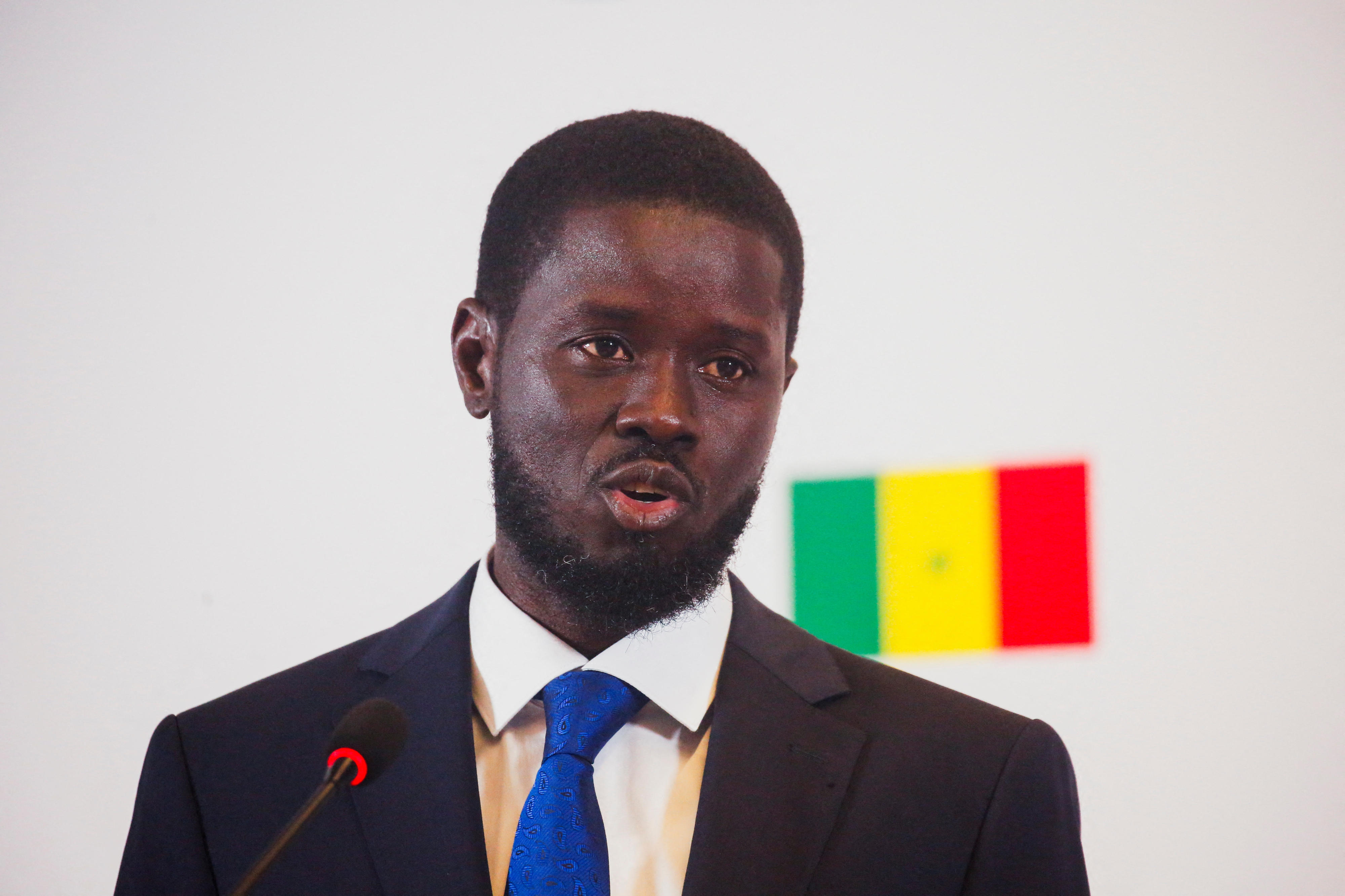

Mr Emmanuel Musanja stands next to the commercial house he completed during the lockdown in Namayingo District on September 23. PHOTO/ PHILIP WAFULA.

Mr Emmanuel Masanja, 42, a teacher at St Philip’s Senior Secondary School, Lwangoshe in Namayingo District, was pondering how to complete a commercial housing unit near his home in Namayunju Village, Namayingo Town Council.

Mr Masanja started construction two years ago, and by the time the Covid-19 pandemic struck in March, he had not roofed, plastered or put up a ceiling until he reached out to Namayingo-Buyinja (NAMAYIBU) Savings and Credit Cooperative Society (Sacco).

“That Sacco gave me Shs3 million and I must say the Covid-19 pandemic was a blessing in disguise because it allowed me to divert my children’s fees to the completion of the house,” the father-of-six, five of whom are of school-going age, said.

Earlier, President Museveni had initiated protocols to curb the spread of the disease, including closing schools and directing an estimated 15 million learners to return home. However, on September 22, he decreed that they will reopen, but for only candidate classes.

A few metres away is Ms Leonid Ajambo, a teacher at Mamba Primary School, Buhemba Sub-county in Namayingo District.

Ms Ajambo, like Mr Masanja, was experiencing financial hardships until she reached out to NAMAYIBU Sacco, which she says has secured her family during the lockdown.

“I approached the Sacco in 2014 for my first loan and was given Shs4 million which I topped up and bought land. I immediately started constructing and was recently added another Shs6m which enabled me to push the house to the top,” Ms Ajambo said.

NAMAYIBU is currently one of the most capitalised Saccos in eastern Uganda, with 4,482 members, share capital of Shs347m, members’ savings of Shs748m and a loan portfolio of Shs953m, according to Mr Godfrey Wanyama, the general manager.

This is in sharp contrast with the 119 membership in 2007 when it was formed to fight poverty through credit and savings in line with the government’s prosperity for all programme.

According to Mr Wanyama, since then, funding to the Sacco has been growing exponentially.

As if the government was aware of the looming threat Covid-19 would pose to the education sector, in February, Microfinance Support Centre (MSC) recapitalised the Sacco with Shs200m, ostensibly for the teachers who form about 30 per cent of the members’ composition, with majority being primary teachers.

In Luuka District, Bukaanga Agaliawamu Sacco in Lukotaine-Busalama Village, in Busalama Town Council was in November last year recapitalised with Shs100m, Shs70m of which was to benefit an estimated 100 teachers, Ms Florence Kitasaala, the Manager, said.

“Our loans from MSC have been Shs10m in 2008, Shs10m in 2009, Shs70m in 2012, Shs50m in 2014, Shs80m in 2017 and Shs100m in 2019 which have enabled us to improve our share capital, improve on teachers’ saving culture and loan portfolio,” she explained.

Mr George Wakabi, the Chairperson, noted that the Sacco started on March 3, 2005, with three members, him inclusive, was registered in 2007 and currently operates two branches: Lukotaine-Busalama and in Bulanga, with a combined membership of about 6,000.

He explained that during the lockdown, teachers have been furnished with salary, agricultural and motorcycle loans.