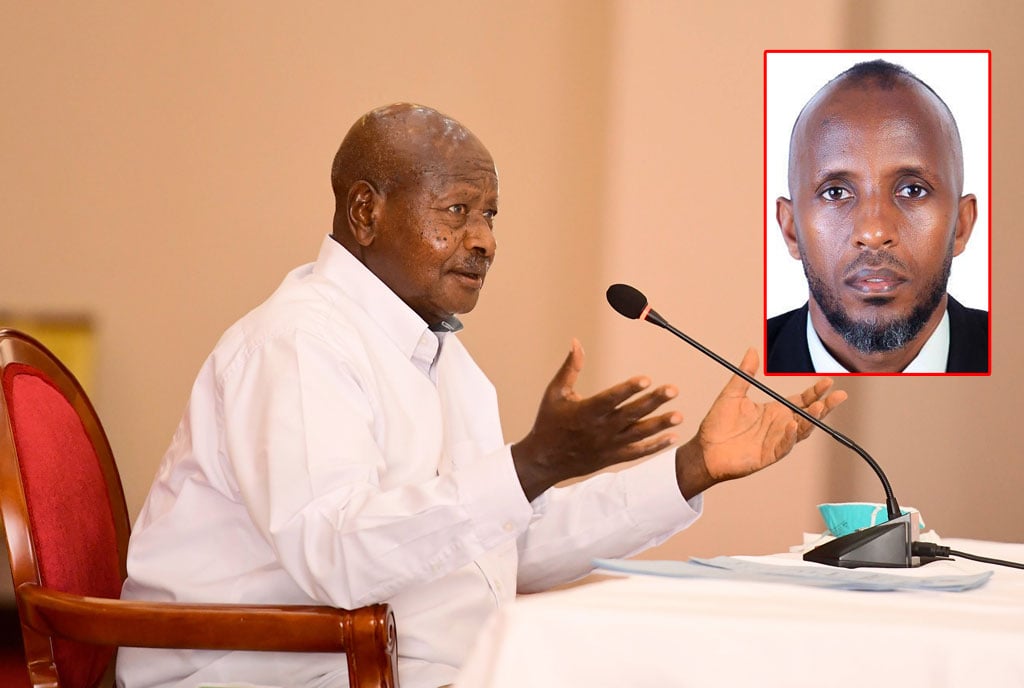

Mr David Kalemera, the head of State House Revenue Intelligence and Strategic Operations Unit. Photo | Courtesy of his X-handle

President Museveni has appointed Mr David Kalemera, a corruption convict, to oversee the operations of the newly-created State House Revenue Intelligence and Strategic Operations Unit.

Mr Kalemera was on April 21, 2022, found guilty by the Anti-Corruption Court Judge Lawrence Gidudu of the offence of conspiracy to commit a felony contrary to Section 390 of the Penal Code Act, and also using falsified customs documents contrary to Section 203 (h) of the East African Community Customs Management Act, 2004 (EACCMA).

Justice Gidudu, in his verdict, stated that Mr Kalemera and his co-accused, Mr Ian Paul Ssemanda and Mr Ronald Kazibwe, worked in conspiracy to cheat taxes of the taxman.

“It does not require rocket science to see that A1 (Mr Kalemera) and A3 (Mr Kazibwe) were working in a conspiracy to cheat taxes. There is no other explanation on any reasonable hypothesis than to conclude the three persons were acting in a conspiracy,” held Justice Gidudu.

He added: “Both lady assessors did not find a conspiracy and advised me to find not guilty on count five. With respect, I am unable to accept that advice for the reasons I have discussed were acting innocently and independently. Circumstantial evidence is so strong against the accused that there are no other co-existing circumstances that would weaken or destroy the inference of guilt. I find each guilty and convict them accordingly.”

It remained unclear what punishment the judge handed Mr Kalemera and co-convicts, but the maximum punishment of conspiracy to commit a felony is seven years.

The court also found Mr Kalemera and Mr Kazibwe guilty of using falsified customs documents contrary to Section 203 (h) of the East African Community Customs Management Act, 2004 (EACCMA).

According to the charge sheet, the trio was charged with four counts of knowingly using customs documents contrary to the EACCA in counts one to four and one count of conspiracy to commit a felony.

Mr Sandor Walusimbi, the senior Press Secretary to President Museveni, didn’t respond to our inquiry whether the President didn’t do a background check before tapping Mr Kalemera. It also remained unclear whether Mr Kalemera had appealed against the conviction before the Court of Appeal and whether the same had been set aside or not.

Past episodes

This is not the first time the head of State has tapped a corruption convict to serve in his government. In July 2021, Mr Museveni controversially appointed Ms Alice Kaboyo as the Luweero Triangle minister despite being convicted on her plea of guilty before the Anti-Corruption Court in 2012. Ms Kaboyo pleaded guilty to the charges of abuse of office in connection with the corruption scandal of the Global Alliance for Vaccines and Immunisation (Gavi). She was at the time jointly charged with the current Security Minister, Jim Muhwezi, and his deputies, Mike Mukula and Dr Alex Kamugisha.

For pleading guilty to the charges, Ms Kaboyo was sentenced to a fine of Shs20m or in default be jailed for eight years. She chose to pay the fine and escaped jail.

When Mr Kalemera was appointed head of a unit tasked to “do oversight on Uganda Revenue Authority (URA) operation and fight corruption within tax administration”, Faruk Kirunda, the deputy Press Secretary to the President, took to X (formerly Twitter) to extend his congratulations. Mr Kirunda also requested Mr Kalemera to “serve with distinction and make the appointing authority and general public proud.”

Very little is known about Mr Kalemera, but Devex, a media platform for social development, described him as a “governance and planning expert with (more than) five years’ experience, having worked for both public and private sector organisation[s] in Uganda”.

Surprise appointment

The creation of the new unit has, however, come as a bit of a surprise given that it was only in March that the President handed the Commissioner General, Mr John Musinguzi Rujoki, a new five-year contract at URA. Sources within URA told the Monitor back then that the renewal of his contract was based on achievements in the area of growing revenue collections.

Mr Rujoki’s appointment on March 29, 2020, as Ms Doris Akol’s replacement came against a backdrop of revenue collection shortfalls and failed collection targets. Half-year performance figures for the fiscal year (FY) 2019/2020 revealed a shortfall of nearly Shs700 billion against a target of Shs9.7 trillion.

Matters were not helped by the outbreak of the Covid-19 pandemic and the government’s decision to place Uganda under a lockdown as a containment measure. That affected collections. URA only managed to collect Shs16.75 trillion against a set target of Shs20.33 trillion that fiscal year.

Figures from the Ministry of Finance indicate that the tax body collected Shs19.26 trillion during FY2020/2021, rising to Shs21.65 trillion in FY2021/2022 and Shs25.2 trillion in FY2022/2023. Most notably, though, for the first time, the taxman in FY 2022/2023 beat the revenue collection target of Shs25.1 trillion.

Over the years, the tax-to-GDP ratio has consistently ranged between 10 and 14 percent, with the highest tax to GDP of 14 percent, the highest in 33 years, achieved in FY2022/2023. The sub-Saharan average is 18 percent.

Speaking through an intermediary, Mr Musinguzi told this publication at the beginning of his new term in office that he aimed to grow Uganda’s tax-to-GDP ratio from 13 percent to at least 18 percent by the end of FY2024/2025.

A member of the Board of URA, who preferred not to be named, told Sunday Monitor that the decision to appoint an overseer amounted to a vote of no confidence in the leadership at URA.

“It seems the collections made over the years and Mr Musinguzi’s vision of URA’s future performance had not convinced the powers that be,” the board member said.

In the press statement announcing Mr Kalemera’s appointment, President Museveni made clear that “the unit will help the government to close revenue leakages and boost tax collection.”

The court process

A lot has, however, been made of Mr Kalemera’s past conviction. According to the charge sheet, the trio was charged with four counts of knowingly using customs documents contrary to the EACCA in counts one to four and one count of conspiracy to commit a felony.

At the close of the prosecution’s case, the court found that Mr Kalemera and Mr Kazibwe had a case to answer for counts one to four and was put on the defence. Mr Ssemanda, on the other hand, was found not to have a case to answer for counts one to four. All three of them, however, had a case to answer for count five, of conspiracy to cheat the tax body, leading to their conviction at the end of the trial by Justice Gidudu.

The prosecution had in counts one to four claimed that Mr Kalemera and group had knowingly used falsified commercial invoices and packing lists while forwarding and clearing goods in four containers in the URA ASCUDA system purporting they were issued by Guangzhou Sen Development Ltd whereas not.

In count five, where court put all the accused persons on defence, it was the prosecution’s case that the accused used falsified invoices and packing lists with intent to defraud while forwarding and clearing goods from Mombasa and in the URA tax system in respect of containers namely PCIU 8634233, PCIU 8822143, PCIU 8656187 and PCIU 9090345, purporting they were issued by Guangzhou Sen Mao Development Ltd, whereas not.

The gist of the prosecution’s case was that in October 2016, XIE XILIANGA, alias HAPPY, and XIE HANMING, alias LUCKY, both employees of Choice International Forwarding Company, reached an agreement with Mr Kalemera to arrange transportation of their containers from Mombasa to Uganda, handle all documentation, pay taxes and return empty containers to Mombasa.

Court documents further show that they (employees of Choice International Forwarding Company) had a business relationship with Mr Kalemera until March 2018 when eight containers were seized by URA.

Two employees of Choice International Forwarding Company were arrested and charged with using falsified documents in an attempt to clear goods.

Denial

Ms XILIANGA came to Uganda and availed documents like loading lists and bills of lading to the tax body, which revealed, among others, that the invoices used in the URA ASCUDA system had omitted some goods and were purported to be issued by Guangzhou Sen Mao Development Company Ltd, a parent company to Choice International Ltd, whereas not.

Guangzhou Sen Mao Development Company Ltd is a shipping company that does not issue commercial invoices because it is not a supplier of goods, according to the court documents.

“Further, the invoice declared in the ASCUDA system by A3 (Mr Kazibwe), who was the clearing agent, were false because they purported to originate from a company that does shipping and not the sale of goods. Furthermore, the goods in the container were more than those declared for purposes of tax,” reads in part the court documents seen by this publication.

It adds: “Investigations revealed according to evidence of PW2, Alfred Okoya, PW3, Milton Sabiiti, PW5, D/SP Dorothy Kyobutungi, that A1 (Mr Kalemera) was the source of the documents used in an attempt to clear goods in the URA ASCUDA system, which were false. Evidence of PW1 is that A1 (Mr Kalemera) availed A2’s (Mr Ssemanda) bank account into which Choice International Forwarding Company made payments in dollars for A1’s services. A1 also provided names of consignees and other addresses used in generating the bills of lading and packing lists. Consignments such as Allan Kiwanuka turned out to be a fraud/ ghost.”

The prosecution contended that Mr Kalemera knew the documents were false because when the containers were opened, it was clear that there was non-declaration, mis-declaration, and under valuation and the taxes to be paid were far more than those declared.

Mr Kalemera, who had denied the said charges, claimed he was not an importer, forwarder, or a clearing agent and that he was surprised that he was charged with charges related to forwarding and clearing of goods.

He also denied working for Choice International Forwarding Company as a clearing agent.

Mr Kalemera had worked at URA from 2007 to 2016 when he was charged in court before being terminated in March 2017.

He claimed his troubles stemmed from stepping on the toes of the top URA bosses in the course of his duty of plugging revenue leakages in the tax body.

We reached out to Mr Kalemera for a comment, but he didn’t respond to us by press time. In an X post on Friday, Mr Kalemera said he was “deeply hono[u]red to have been appointed” to head the unit. He also noted that the “new role comes with great responsibility.”

The law

According to the Anti-Corruption Act of 2009, once one is convicted, he/she is banned from holding public office for the next 10 years. But the Attorney General, in his legal opinion, advised that one is eligible again to work in government office once the 10-year ban is done.

For Mr Kalemera’s case, despite him being charged before the Anti-Corruption Court, the offence of conspiracy to commit a felony is under the Penal Code Act (PCA) and not the Anti-Corruption Act, hence the 10-year ban not to serve in public office doesn’t apply to him