Prime

Only 30% of Ugandans can build a good house- report

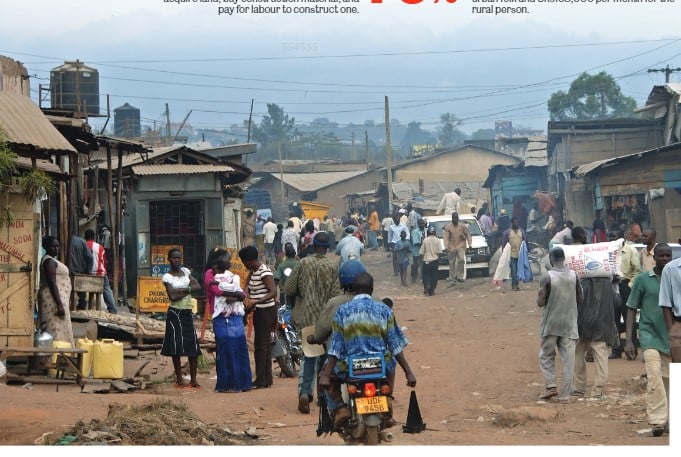

A settlement in Banda, Kampala. Inset is an aerial view of some of the houses found in Acholi quarters and Kiganda zone in Kampala. PHOTOS/SAMILU BUSEIN

What you need to know:

- Reports show only three in 10 Ugandans can build a good house, with experts calling for urgent action to address the housing deficit.

Ugandans are too broke to build a decent house, with only three in 10 able to acquire land, buy construction materials, and pay for labour to construct one.

Ms Judith Nabakooba, the Minister of Lands, Housing, and Urban Development, said the low income earned by Ugandans both in urban and rural areas does not enable them to construct a decent starting house that costs about Shs183m.

Ms Nabakooba, who was officiating at the World Habitat Day at Naguru, a Kampala City suburb, on Monday, said: “A median-income of Ugandans is Shs220,000 per month for the urban folk and Shs168,000 per month for the rural person. Majority, [about] 76 percent, of Ugandans can only afford a housing unit costing in the range of Shs12m to Shs24m, meaning that Shs183m is on a higher end.”

“Such very low-cost unit can only be delivered if there are innovative ways of neutralising the cost of labour in the construction, which currently stands at $78 (about Shs286,778) per square metre in Uganda,” she added.

Ms Nabakooba’s remarks come only days after the Uganda Bureau of Statistics (Ubos) released the main report of the 2024 National Population and Housing Census (NPHC), which revealed that 42 percent of households in the country’s urban centres are staying in rented premises.

The minister also unveiled the government's current and planned interventions aimed at ensuring that the majority of the population, especially in urban areas, at least own a house.

Industrial players yesterday said the Shs286,778 per square metre cost is not realistic because it cannot even construct a square metre in villages where the cost of building is relatively cheap compared to urban areas.

Lands minister Judith Nabakooba speaks during the World Habitat Day celebrations in Kampala on October 7, 2024

Housing deficit

The 2023 Africa Housing Finance (AHF) Report, indicated that Uganda has a housing deficit of 2.4 million housing units. Of these, the report says 210,000 units are in urban areas and 1.395 million in villages.

This deficit is up from the 1.6 million housing units reported by the Financial Sector Development Strategy in 2021.

The AHF report estimated that 900,000 available housing units were simple rentals commonly known as mizigos and needed to be replaced or upgraded.

Twenty-two of every 100 households captured by the AHF survey in Kampala were being occupied by the owners while the rest are renting with the majority living in a one-bedroom house.

Ms Nabakooba explained that the 2.4 million unit deficit has created an annual housing deficit of 284,000 units, which arises from an average annual urban and rural demand for housing at 150,000 for urban and 143,000 for rural areas, against an annual supply of 60,000 housing units.

“The few supplies are largely informal and the few formal ones are exclusively for the high-end dwellers. This is because of a shortage of qualified professional human capital in the housing and construction sector,” she explained.

Speaking at the construction symposium organised by the Uganda Society of Architects (USA) in Kampala on September 20, Mr Kenneth Kaijuka, the chief executive officer of the National Housing and Construction Company (NHCC), said Uganda needs five million permanent houses worth a $150b (about Shs550 trillion) investment, three million semi-permanent units worth $75b (about Shs275 trillion), and two million temporary residential units $20b ( about Shs73.2 trillion).

The main report of the 2024 NHPC, released last week, indicated that seven million dwelling units (residential houses) were occupied by actual owners while 2.7 million units were rented.

In terms of ownership, Teso Sub-region led with the highest percentage of 83, followed by Bukedi, Karamoja and Kigezi sub-regions with 82 percent while Buganda region trailed with 45 percent.

The report notes that 77 percent of the houses found in rural areas were owned by the occupants as compared to 49 percent in urban areas.

The biggest households in urban areas lived in rented premises as compared to their rural counterparts. Majority of households, the report added, live in single-rooms, especially in urban areas.

A 2023 World Bank Report indicated that 41.7 percent of Uganda’s urban population is currently living in slums. This statistic gives an alarming picture: while global urban population trends, especially in slum areas, are projected to reach 75 percent by 2050.

This suggests that in the next 10 to 20 years, Uganda may face significant challenges related to urbanisation and housing. The level of urbanisation is increasing every day and in Uganda, the urban population growth rate is 5.2 percent higher than the 2.7 percent national population growth rate.

The 2024 NHPC report indicated that 5.5 million Ugandans are living in the 11 cities, with Kampala leading with a day population of 2.7 million people, followed by Arua City with 440,000 people.

Mr Aldo Olwoch, the national coordinator at Habitat for Humanity, linked this increment to the rural-urban migration by the largely unemployed youths, creating an inevitable population pressure.

“Youth migrate from the rural areas and come to the city to settle but they do not have jobs. They in turn end up staying within the informal settlements and slums,” he said.

Solution

As a solution to the increasing housing deficit, the government, Ms Nabakooba said, is implementing the national housing policy plan and attainment investment plan to operationalise the National Housing Policy of 2016.

This policy, she said, would among others, compel urban centres and cities to adopt high density construction designs as a strategy to optimise housing land under the condominium arrangement.

Ms Nabakooba encouraged low-income earners, the majority being youths, to join and participate in housing development schemes through special purpose saving schemes such as Savings and Credit Co-operatives (Saccos).

“We are considering a policy reversal for the NHCC and refocus it towards its original intention of provision of affordable housing. Activities involving land infrastructure and construction on the supply side and on a corresponding set of demand side inputs related to housing finance among others. We need to note that the housing ecosystem is a totality of markets, laws, finances, actors and inventories of material that play in constant supply to deliver housing,” she said.

Mr Olwoch said 65 percent of the urban population are largely young people living within informal settlements.

“Making these basic essential services cheaper will lessen the burden of acquiring them and help spare some little money which they can use for housing,” he said.

Ms Nabakooba further linked the high cost of labour being one of the drivers of high housing units, which she said can be contained by encouraging participation of youth in innovation and also execution of housing development strategies, among other initiatives.

“If there are sufficient arguments in the current circumstances, the concept of affordable housing must be re-engineered and ensure we do things differently. This, we must handle based on the definition of affordable housing, which relates to decent housing that can be afforded by majority youth who earn the median income and below and whose acquisition does not deny the acquiring household their right to other basic needs, including adequate knowledge, clothing, and education,” she said.

Ms Nabakooba revealed that the government is currently working on reviewing the housing policy to bridge this gap. In this new arrangement, the government will support financial housing institutions to make rates affordable to young people and establish a mortgage refinancing company to address the unfavourable terms of housing finance debt.

“We are working on the other modalities to increase access to non-bank housing financing by facilitating the creation of housing cooperatives,” she stressed.

Mr Ronald Asiimwe, a site engineer and the executive director of Sandbolt Construction Ltd, said it costs between Shs500,000 and Shs1m to construct a square metre in the villages and between Shs1m and Shs2m to construct the same square metre in urban areas.

“A decent two-bedroom house will take about 100 metres and starting with the village, a low income earner will spend Shs50m, a middle income earner-Shs75m, and Shs100m for a high-end earner. For those constructing in towns, a low-income earner will spend Shs100m, middle income earner-Shs150m and a high end earner Shs200m, to have the house fully completed,” he said.

Mr Asiimwe said unlike items such as cement, nails, iron sheets and other building materials sold almost at the same prices in villages and towns, some materials like sand, bricks differ in prices.

For example, the prices of most iron sheets in majority of hardware shops range between Shs35,000 and Shs85,000, cement prices fall between Shs31,000 and Shs35,000, nails range from Shs4,000 to Shs10,000 a kilogramme. A medium truck of sand in urban areas costs between Shs350,000 and Shs400,000, compared to between Shs150,000 and Shs250,000 in villages. The same applies to bricks where one in town costs between Shs250 and Shs300 while in villages it ranges from Shs180 to Shs250.

“In villages, one may decide to make their own bricks and buy other materials. You may also find that water is fetched from a well unlike in towns where everything is bought. This also apply to labour in the village, with the workers living near the site but in town someone may be staying in Najjera (a Kampala suburb) and working at City Square (Central Business District) and they incur costs in transport, and feeding, making the cost high,” Mr Asiimwe said.

However, Ms Cissy Namaganda, a condominium developers and consultant and the founder of Cinam Investments Ltd, said the cheapest house one can construct in the village will cost at least Shs35m.

“Which type of house can Shs12m the minister is talking about construct? Even when we look at the village setting where it is a bit cheap, that money is little because if we take a family of 5 people a house that can accommodate such people would at least have more than one bed room,” she said.

Lands minister Judith Nabakooba speaks during the World Habitat Day celebrations in Kampala on Monday.