Prime

Top 100 Mid-Sized companies tipped on bankable projects

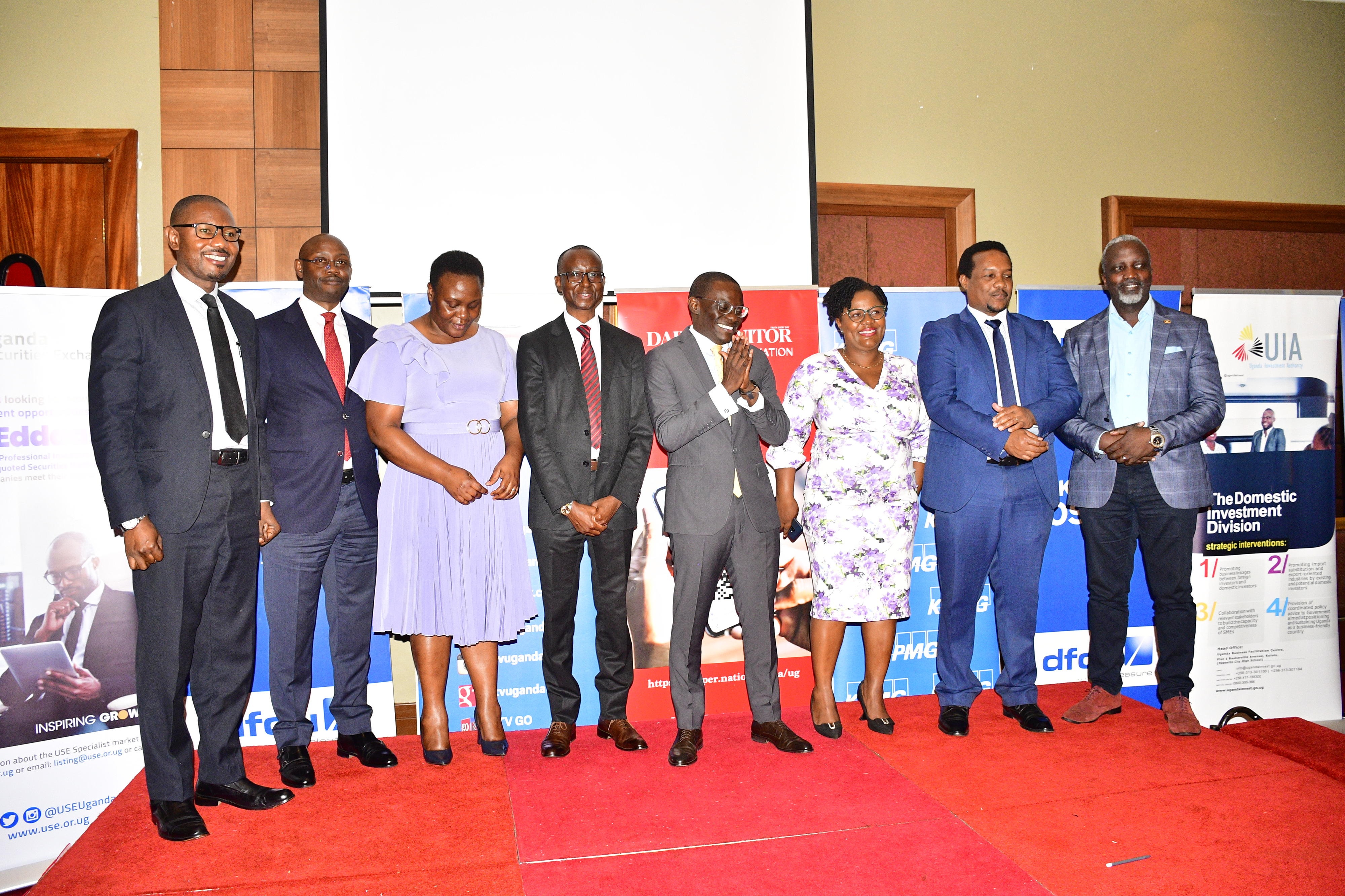

Representatives of companies sponsoring the 2023 Top 100 Mid-sized companies survey (Left to Right:) Ronald Kasasa, Head of Business Banking at dfcu Bank; Sam Barata, General Manager Commercial NMG Uganda; Salome Sseruyange, Manager at KPMG; Peter Kyambadde, Managing Partner KPMG; Paul Mbuga, partner at S & L Advocates; Elizabeth Namaganda, NMG Head of Marketing; Paul Bwiso, CEO Uganda Securities Exchange; and Fred Kakooza, the head of IT at Uganda Investment Authority, at the forum yesterday. PHOTO | STEPHEN OTAGE

What you need to know:

- At an alternative financing forum held in Kampala yesterday, representatives of companies, which participated in last year’s annual mid-sized company survey, were also tasked to put their books of accounts in order and also incorporate certain modern business practices.

Top 100 mid-sized companies in the country have been urged to build strong corporate governance structures if they are to attract funders and investors.

At an alternative financing forum held in Kampala yesterday, representatives of companies, which participated in last year’s annual mid-sized company survey, were also tasked to put their books of accounts in order and also incorporate certain modern business practices.

“SMEs fail to access funding because they think only about balance sheet balances. Investors have a wide matrix they look at,” Mr Paul Mbuga, a partner at S & L Advocates, said.

“In addition to the balance sheet, they need to have corporate governance, incorporate certain elements of doing business, which are considered modern and progressive,” he added.

Mr Paul Bwiso, the chief executive officer of Uganda Securities Exchange (USE), said investors look at companies with boards that are accountable to the public and have a growth story where they can attract long-term capital, and are transparent.

“Without disclosures, investors cannot give you money and yet this is public capital. Uganda Securities Exchange has the USE Eddaala, which is an incubator where SMEs are assessed so that they can attract capital like the large companies listed on the exchange,” he said.

Mr Bwiso added that the company should be able to disclose the different aspects of the business and the ability to provide the growth and sustainability.

Mr Ronald Kasasa, the head of business banking at dfcu Bank, said they organised the forum, sponsored by USE, to tell the SMEs how to access the products the bank is offering based on their credit capacity, collateral conditions and character.

“They show how a customer is positioned to get financing. In preparing customer indexation, the customer should come with well documented, audited accounts, business plan, the unique selling proposition how they are managing risk and remain growing,” he said.

Mr Kasasa added that the customer should demonstrate how the business is separate from ownership and they should have good corporate governance structures.

Mr Peter Kyambadde, the managing partner at KPMG, said the forum was a build up to the Top 100 Mid-sized companies’ survey and then the conference where the top 100 SMEs in Uganda will be recognised and awarded.

He informed the participants that this year’s theme for the survey – ‘Inclusive access to business information services, technology and financing for SMEs’ entail organising a number of information sharing forums and yesterday’s was one of them.

Mr Kyambadde explained that in the forums, they provide the participants with solutions to some of the challenges that they pointed out in last year’s survey.

Justification

He noted that at the beginning of the year, the participants were given information regarding opportunities available in the oil and gas sector and tourism. He added that they have also been trained on how to manage taxation and yesterday’s conference was on leveraging on capital markets for public financing to address the challenge of financing.

According to Mr Kyambadde, this year’s survey ends in October and the winners will be unveiled at a gala dinner in the first week of December.

Mr Sam Barata, the general manager- commercial at Nation Media Group Uganda, said for the last 15 years, the media company together with KPMG have been partnering with institutions such as Uganda Investment Authority, dfcu Bank, Innovations Village, Uganda Securities Exchange, Ministry of Tourism, UNDP, and the Ministry of Science, Innovations and Technology, to grow SMEs and help them to attract capital.

“Our role is to bring them together and help them with growth. Technology is the major backbone for growth. SMEs should adopt technology to innovate and increase efficiencies because we have a young population involved in technology,” he said.

background

Monitor Publications and KPMG annual mid-sized company survey is an initiative by the two companies to identify the fasted growing medium sized companies in the country to show business excellence and also high light some of the country’s most successful entrepreneurial stories. To participate, the company must have an annual turnover of between Shs360m and Shs25b, with the exception of banks, listed companies, insurance companies, listed companies and accounting consulting companies.