Prime

Why UTL search for investor is still elusive

Debt-ridden. The Uganda Telecom business centre in Kampala. FILE PHOTO

What you need to know:

- Ms Annet Nyakecho (Tororo North, Independent), the chairperson of the Parliament Committee on ICT, said UTL’s search for an investor will not end until government puts the company under supervision of the right sector.

- A Shs200b debt UTL owed to government was also written off and turned into shares under Uganda Development Corporation (UDC).

Kampala. For more than two years, Uganda Telecom (UTL) has been placed under administration and there is no clear signal suggesting that the status quo is about to change.

In early 2017, UTL was in debts of more than Shs700b when the Libyans, who held 69 per cent shares, left.

At that time, government had to liquidate the firm or save its collapse by putting it under provisional administration to allow a search process for competent investors to take it over.

The company was handling most official government telecommunication businesses, especially the official telephone lines.

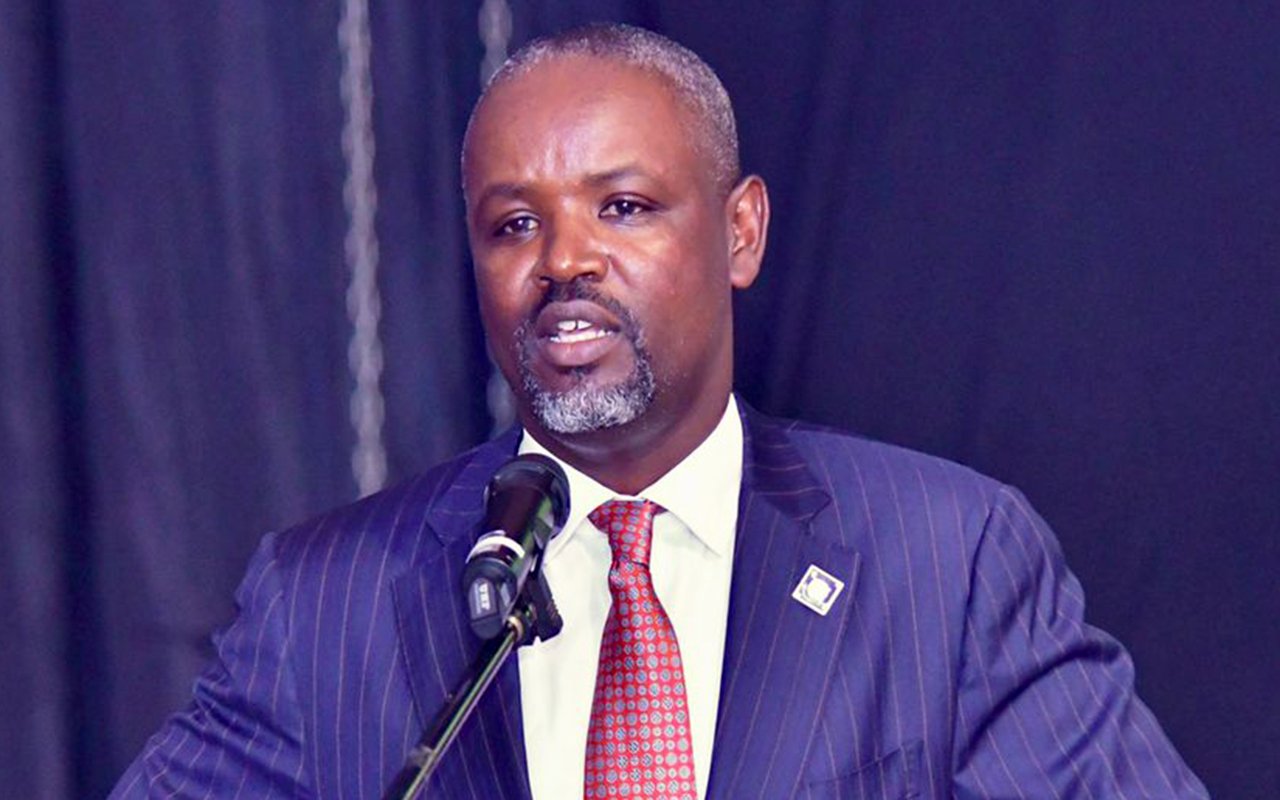

In May 2017, UTL went under Administration Deed and government appointed the Registrar General of Uganda Registration Services Bureau (URSB), Mr Twebaze Bemanya, as the provisional administrator.

One of his tasks was to find an investor to buy UTL within six months. Others were to clear liabilities to all creditors.

However, the company did not attract a new investor and Mr Bemanya’s provisional administration was extended twice.

Efforts to get a new investor have been futile, triggering speculation that UTL will be under administration for a long time or be declared insolvent and liquidated.

In May 2018, President Museveni ordered that all government ministries, departments and agencies (MDAs) sign up UTL as their sole provider for internet services as part of efforts to make the company more attractive to a prospective investor.

The National Backbone Infrastructure (NBI) would also be surrendered to UTL by the National Information and Technology Authority (NITA) to ensure fiber network connectivity across the country.

Debts

A Shs200b debt UTL owed to government was also written off and turned into shares under Uganda Development Corporation (UDC).

In April last year, Cabinet extended UTL’s operational licence for 20 more years. This also included a directive that Uganda Communications Commission (UCC) expands the UTL reach to cover the whole country.

However, to-date, the search for the right investor continues and the company remains indebted to the tune of Shs536b, according to a bi-annual progress report for November 22, 2018 to May 22 this year that the administrator sent to the Commercial Court, all creditors and shareholders indicated.

Besides that, more than 1,000 pensioners have since petitioned the Speaker of Parliament, Ms Rebecca Kadaga, seeking their Shs1.5b that court awarded to them but the company has not yet cleared it.

The relationship between UTL and UCC is also on the rocks.

In an April 29 letter, Mr Godfrey Mutabazi, the regulator’s executive director, wrote to Mr Bemanya, saying it may not renew the UTL licence in June 2020 because the latter had not met the application process requirements under the law.

He also stated that UTL owes UCC Shs49.8b in pre-administration debt and Shs10.2b as part of the administration.

Mr Mutabazi also accused the company of failing to comply with the Uganda Communications Act 2013 which requires an installation of an Intelligence Network Monitoring System (INMS) to enable state agencies monitor telephone calls for security purposes.

“UCC is concerned that whereas all private telecom companies fully complied with this requirement, UTL is to date not connected to INMS. This made UTL become the potential conduit for all fraudulent calls and transactions in the sector, thereby rendering government efforts to improve revenue assurance in the telecoms sector ineffective,” Mr Mutabazi stated.

“By not being connected to this system, UTL could expose the country to security risks since traffic through the UTL network is not effectively monitored by the security agencies,” he added.

Mr Mutabazi urged government to expedite the process of finding an investor.

He faulted UTL for underutilising assigned mobile and fixed phone numbers, not complying with the directive on implementing Location Based Services (LBS), not submitting any of its networks and end-user device/terminals to UCC for approval; poor quality of service, using networks that no longer have manufacturer’s support services and failure to seek UCC approval prior to using short codes used by other network services.

Finance, UTL woes

There has also been a protracted fight between Mr Bemanya and the Ministry of Finance.

Early this year, the ministry failed to have UTL audited on two occassions. The first was when Finance minister Matia Kasaija requested the Auditor General, Mr John Muwanga, to audit UTL.

In April, Mr Muwanga wrote back to the ministry, saying he could not audit the company because “it is being supervised by court.”

The second attempt was by State Minister for Privatisation and Investment, Ms Evelyn Anite, who asked Mr Bemanya to allow the ministry audit the company.

Mr Bemanya declined, saying such an exercise can only be conducted after the lapse of the Administration Deed in November.

After a week of confrontation through letters between Ms Anite and Attorney General, Mr William Byaruhanga, and his deputy Mwesigwa Rukutana, President Museveni last Thursday ordered Justice and Constitutional Affairs minister Kahinda Otafiire to ensure UTL issues are presented before Cabinet before any further action is taken. The President insists efforts to revamp UTL through getting another investor must be explored first and Cabinet must take a decision on that.

“As I have guided on several occasions, given the strategic importance of UTL to the economy, government has been in the process of identifying a suitable investor/s to partner with to revamp UTL as opposed to diverting it,” Mr Museveni wrote on July 3.

“The above position was also taken by Cabinet. Therefore, no actions contrary to Cabinet’s position should be taken. Further, Cabinet must always be consulted on any investment or related decisions concerning UTL before they are taken,” he added.

The following day, Mr Otafiire wrote to Mr Bemanya to expedite the process of finding an investor before the company is liquidated.

“As the administrator of the company, you are requested to expedite the process of sourcing a strategic investor. You are required to continuously update me on the progress to enable me report to Cabinet accordingly,” Mr Otafiire stated.

There are also other limitations that undermine the successful search for an investor for UTL as listed in the 2017 audit report of PricewaterhouseCoopers Uganda.

Limitations

It noted that there was need for a restructuring plan that would include conversion of the Shs224b debt UTL owes to Ucom, a company owned by the Libyans, into equity.

The firm also recommended that the Uganda Posts and Telecommunications Corporation pension liability of Shs206b be taken over by government and converting the combined debt of Shs134b owed to government entities such as Uganda Revenue Authority, National Social Security Fund and UCC into equity.

The auditors argued that this would reduce the debt to Shs145b. However, this has not been done.

Ms Annet Nyakecho (Tororo North, Independent), the chairperson of the Parliament Committee on ICT, said UTL’s search for an investor will not end until government puts the company under supervision of the right sector.

However, Mr Otaremwa Otuhumurize, UTL technical consultant, yesterday dismissed the outstanding debts, failure to comply with UCC regulations and lack of a business plan as reasons for the company’s failure to secure an investor.

He blamed the delay on the friction between government agencies that scare away prospective investors.

He said outstanding debts cannot be a problem to the investors since the administrator is supposed to pay off the creditors from what will be paid for the company.

“The investor will not buy the debt and that cannot be mentioned in negotiations. For the issue of a business plan, the administrator’s role is simply to find investors who will together with the government institute a board that can plan for business,” he added.

Mr Otuhumurize also said by the time Mr Mutabazi wrote to UTL, the company had already installed the INMS.

Earlier attempt

Nigerian firm: In October 2018, Cabinet handed UTL to a Nigerian firm, Taleology Holdings GIB Ltd, ending a year of controversy and competition by seven bidders. The decision followed a September 24, 2018, presentation to Cabinet of a financial capability report by an ad hoc committee after Ms Anite claimed that Taleology had no technical expertise or financial muscle to run telecom business. Her choice, the State-founded Mauritius Telecom, was ranked second best in a pack of competitors such as Safaricom, Kenya’s subsidiary, Afrinet, and Hamilton dropped out prematurely.

Opt out: However, Taleology later failed to meet its obligation to pay up a sale fee of $71m (Shs268b) which it had offered to knock out Mauritius Telecom’s $45m (Shs167b) bid. They had three months within which to have completed the payment but failed and Cabinet deemed the deal a “white elephant.”

Efforts: Government has been seeking to repossess UTL assets worth $375m (about Shs1.4 trillion), mainly in the telecommunications, banking, hotel and oil sectors from the Libyans. Sources close to the negotiations said government believes that after reposing the assets, it will gain full control of UTL hence making a “big statement” in the quest to attract a serious investor. It is not clear whether government has subjected the new bidders to due diligence assessment by the Financial Intelligence Authority (FIA) as it was mid last year when seven bidders were investigated.

In the report, FIA found that none of the seven companies including front runners Taleology, and, Mauritius Telecom, met the requirements. Nevertheless Cabinet proceeded to award Taleology the UTL takeover, which has since fallen apart.