Prime

Uganda’s coffee boom: A case for sustainable use of proceeds

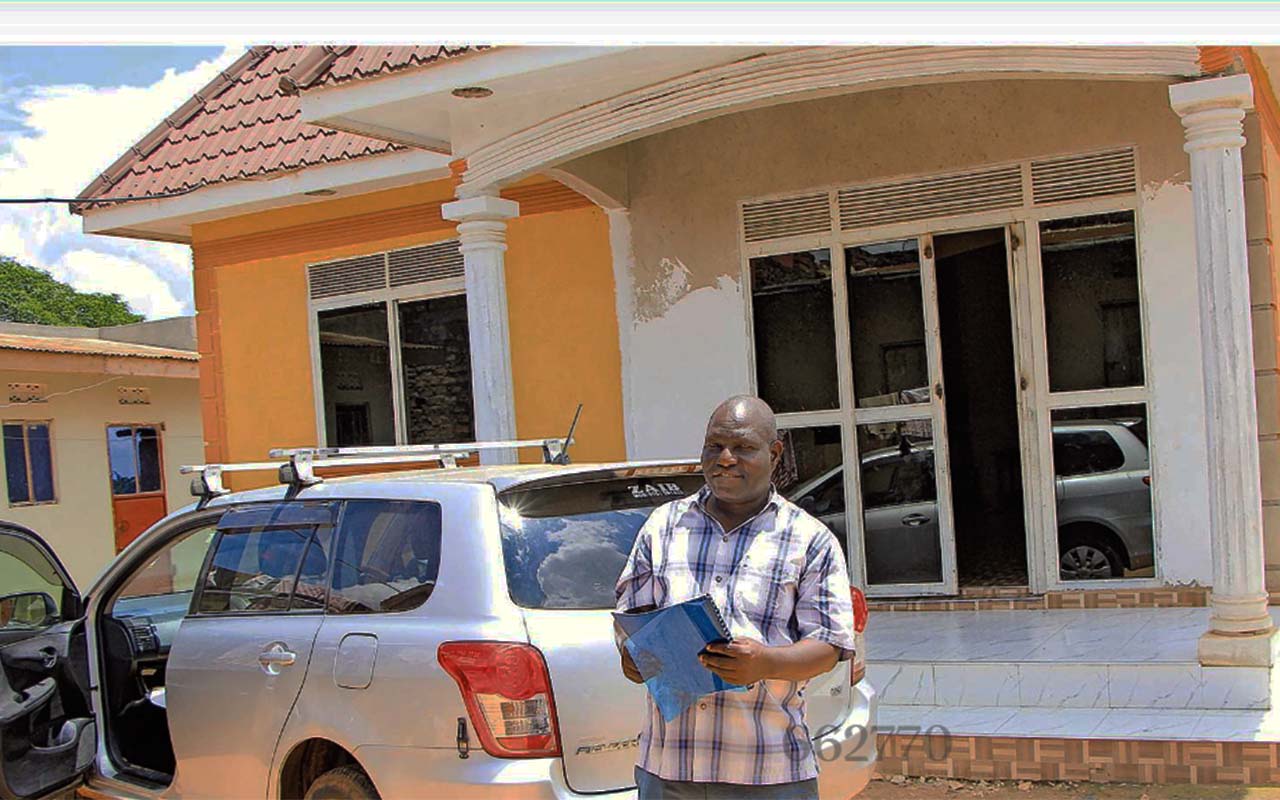

Mr Joseph Lwevuze in his coffee garden in Ntangala Village, Luweero District. Mr Lwevuze counts himself among the beneficiaries of the coffee boom after harvesting and selling more than 50 bags and earning more than Shs50 million this year. PHOTOS/DAN WANDERA

What you need to know:

- Uganda’s coffee industry is crucial for economic growth, contributing significantly to exports and supporting millions of livelihoods. With targeted investments in value addition, infrastructure, and farmer support, Uganda can maximize coffee’s impact beyond raw exports, write Mr Daudi Migereko and Prof Ibrahim Mike Okumu.

Uganda’s coffee industry is a vital engine of socio-economic transformation, particularly amid recent global market growth. From 2013 to 2023, coffee consistently contributed 14.4 percent to Uganda’s total merchandise export earnings, reinforcing its foundational role in our

economy. Over this period, coffee export revenues reached an estimated $1.15 billion annually, underscoring its substantial impact on national income.

Beyond economic value, coffee sustains more than 1.8 million smallholder households—benefiting approximately 12.5 million people across the coffee value chain and providing essential livelihoods for a significant portion of the population.

Its contribution to GDP further emphasizes its integration within the national economy, positioning Uganda’s coffee sector as a uniquely powerful lever for social stability and economic resilience.

The government has demonstrated a strong commitment to the coffee sector, implementing strategic interventions and programmes through key agencies like the Ministry of Agriculture, Uganda Coffee Development Authority (UCDA), National Agricultural Research Organisation (NARO),National Agricultural Advisory Services (Naads), and Operation Wealth Creation (OWC).

These targeted efforts have yielded positive results, with Uganda emerging as a reliable producer of high-quality coffee, able to meet global demand even as other major exporters like Brazil and Vietnam face production setbacks due to natural disasters.

As discussions continue regarding the mainstreaming of UCDA into the Ministry of Agriculture, decision-makers have a timely opportunity to address an essential priority: harnessing current gains in coffee export revenue to fuel immediate, medium, and longterm socio-economic transformation.

This strategic approach could cement Uganda’s coffee sector as a cornerstone of both economic stability and resilience in global markets.

While the debate over UCDA’s re-alignment is important, the current momentum in Uganda’s coffee sector calls for a united approach to maximise its benefits.

Rather than limiting our focus to governance structures, a strategic agenda should target the entire coffee value chain—pursuing value addition, farmer support, and market expansion to enhance productivity, generate jobs, increase incomes and maximise the impact of coffee earnings on the entire Ugandan economy The opportunity to channel coffee revenues into value-added industries is essential for driving sustainable, broad-based growth.

Uganda’s coffee-producing regions are already benefiting from the current boom, with many farmers enjoying significantly improved earnings. However, much of this newfound wealth often flows into status-driven expenditures, such as new homes, boda bodas, cars, constructing shops and shopping malls, or expensive social gatherings.

While these investments uplift individual prosperity/ status they typically yield limited economic spillovers. By redirecting a portion of coffee profits into import-substitution industries within regional industrial parks, Uganda could unlock broader benefits—generating jobs, diversifying the production base, and building resilience against external economic shocks.

Such reinvestment in value-adding sectors would amplify the coffee industry’s impact, transforming it into a powerful regional and national economic development driver.

To maintain Uganda's economic stability and address structural challenges like poverty and unemployment, part of the coffee proceeds could support a national “coffee fund”. This fund could finance critical infrastructure projects, bolstering our country’s business competitiveness, or support initiatives targeting productive sectors, agri-business development, coffee/agro-tourism, education and healthcare.

Such strategic reinvestment would allow Uganda to avoid the missed opportunities experienced during previous commodity booms, such as the cotton boom of the 1950s and the fish boom of the 1990s. Both of these booms focused heavily on raw exports, leaving the country vulnerable to price fluctuations and limiting long-term economic benefits.

The experience of previous coffee booms in Uganda, like the one in the 1970s, provides a clear lesson: enhanced primary commodity production and exports alone do not generate sustainable growth. The local “Kasee coffee millionaires” could not consider investing in productive long-term projects because it was not safe to do so during the Idi Amin regime.

The National Resistance Movement (NRM) leadership in Uganda today, is mainstreaming investment and wealth creation programmes; the coffee farmers and processors can readily be guided on how to invest the proceeds to yield sustainable benefits.

Indeed, to maximise returns from coffee, Uganda must capture higher value through local processing, packaging, branding, and sustainable investments.

Ethiopia’s success in promoting branded speciality coffee, which commands premium prices in global markets, demonstrates the potential of African nations to enter high-value markets. By investing in infrastructure that supports processing, Uganda can increase its export earnings and create thousands of jobs while ensuring that more of the economic benefits from coffee remain within the country.

Central to any strategy for sustainable growth is investment in coffee farmers. Increased farmer productivity directly translates into higher household incomes, enhanced capacity to spend and a more robust national economy.

This includes providing farmers with access to well-trained extension staff, affordable irrigation, and value-addition equipment / facilities. Initiatives aimed at empowering model farmers, largescale commercial farms, cooperatives, and farmer associations which can play a crucial role in scaling up training programs and ensuring that farmers have access to high-quality inputs.

Additionally, exploring niche markets—such as organic, fair-trade, speciality coffee supported by investment in local coffee tourism —can help protect Uganda’s coffee sector from global price fluctuations, as these markets and the tourism angle are less affected by price

swings.

Efficient trade infrastructure, from post-harvest storage to transportation, is essential for maximizing the benefits of Uganda’s coffee exports. Investments in storage facilities and digital platforms can reduce post-harvest losses, open up to new lucrative markets and

improve trade efficiency.

With robust trade partnerships and targeted market expansion, Uganda’s coffee can reach more lucrative markets, ensuring that the coffee boom yields benefits locally and nationally. Establishing a robust digital marketplace for coffee will also help farmers access more competitive markets, secure higher prices and better manage supply chain logistics.

As Uganda evaluates the administrative re-alignment and mainstreaming of UCDA’s roles and functions into the parent ministry, maintaining a primary focus on the broader coffee sector’s potential is vital. The current coffee boom offers a unique opportunity for Uganda to secure critical immediate, medium and long-term economic gains that benefit not only smallholder farmers but also the national economy.

To ensure sustained impact, a strategic plan should emphasize increased value addition, market diversification, and targeted investment in infrastructure, coffee / agro tourism and human capital.

In summary, Uganda’s coffee boom is more than a momentary economic lift; it is a potential pillar for sustainable economic growth and development. By moving beyond the focus on increased raw exports and emphasizing the full coffee value chain, Uganda can capture significant economic gains and foster resilience.

Through strategic reinvestment in local industries, import-substitution industries, enhanced infrastructure, and market expansion, Uganda’s coffee industry can support far-reaching economic transformation and become a central pillar of the nation’s economic future.

Mr Daudi Migereko is a former minister and a farmer.

Prof Ibrahim Mike Okumu is the Dean at the College of Economics, Makerere