Prime

Understanding role of national payment system

A national payment system (NPS) is a set of systems, policies, and infrastructures that enable consumers, businesses and other entities to effect financial transactions, including making payments to one another and using the accounts and payment instruments issued by financial institutions.

The essence of a payment system is that it uses cash-substitutes, such as cheque’s or electronic messages, to create the debits and credits that transfer value.

Well, a payments bank could be a bank operating on a small scale without involving the issuance of credit, but carrying out most bank-like operations and transactions. They operate current and savings accounts, where interest could be paid, and can also issue ATM or debit cards to their customers.

In markets like India, where they have started several payments banks like Airtel and Fino, the beginning was not smooth, but certainly stability was achieved.

With the National Payments System Act 2020 in place in Uganda, there is no turning back. The Act classifies payment systems into systems operated by the Central Bank, payment services provided by commercial banks and private sector payment systems.

Let’s observe that the NPS is a significant part of the financial infrastructure and ensures that payment systems operate in a secure and efficient manner.

The NPS entails a framework of institutions, instruments, procedures and technology used to facilitate the circulation of money within the country and internationally. The ability to make payments easily and safely is important in ensuring the smooth and timely flow of goods and services throughout the economy.

Accordingly, the National Payment Systems Policy seeks to put in place a framework to: facilitate the enactment of a Payment System law, specify the roles and responsibilities of all the payment systems stakeholders, ensure safety of all payment systems in the country, foster consumer protection, enable increased access to electronic payment systems and reduce cash-based payments and promote innovations.

A key provision in the Act is a requirement for a payment service provider, a financial institution or microfinance deposit taking institution that intends to issue electronic money to incorporate a subsidiary legal entity for that purpose.

This requirement is going to affect telecommunication companies which currently provide mobile money services. They will have to set up different entities to continue issuing electronic money, and these are the firms that culminate into payments banks.

Payments banks could come into being, thanks to the Central Bank’s resolute push to ensure that the banking sector delivers a comprehensive set of financial services to the poor and the unbanked.

With full-service banks clearly finding it uneconomical to deliver to low-income and rural Uganda by closing off some of their upcountry branches, a more appropriate solution would be to conceptualise and deliver new models under a differentiated banking system to sustain the banking operations and be in position to serve the hard-to-reach population more efficiently and effectively.

Since the payments banks are an untested model in Uganda, the intent should focus purely on payments and deposits, targeting the bottom of the pyramid and underserved segments.

As we prepare to see the ushering in of payments banks, we should note that this is a great opportunity to rectify the gaps in the current payments models by innovating digital-based solutions.

As the masses wait to enjoy the competition that will come with the payment banks, the players in the financial industry will have to spin operations to remain relevant and maintain or grow their market share.

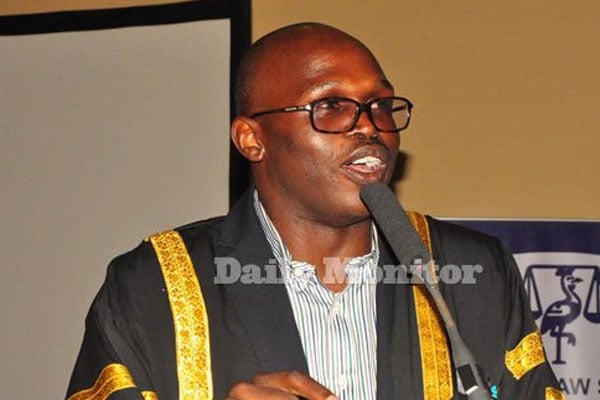

Michael Jjingo is the general manager, Commercial Banking at Centenary Bank and a Fellow of Uganda Institute of Bankers.