Why EACOP project must go on

Avolla Kennedy

What you need to know:

I am quite confident that Uganda will benefit from this oil production if we have the right social license

EACOP

Ever since the European Parliament adopted the resolution condemning the East African Crude Oil Pipeline (EACOP) Project, public discourse has been awash with quite a number of opinions about the project.

There has been renewed interest in this project. However, this European resolution isn’t the only move that has been taken against the EACOP project.

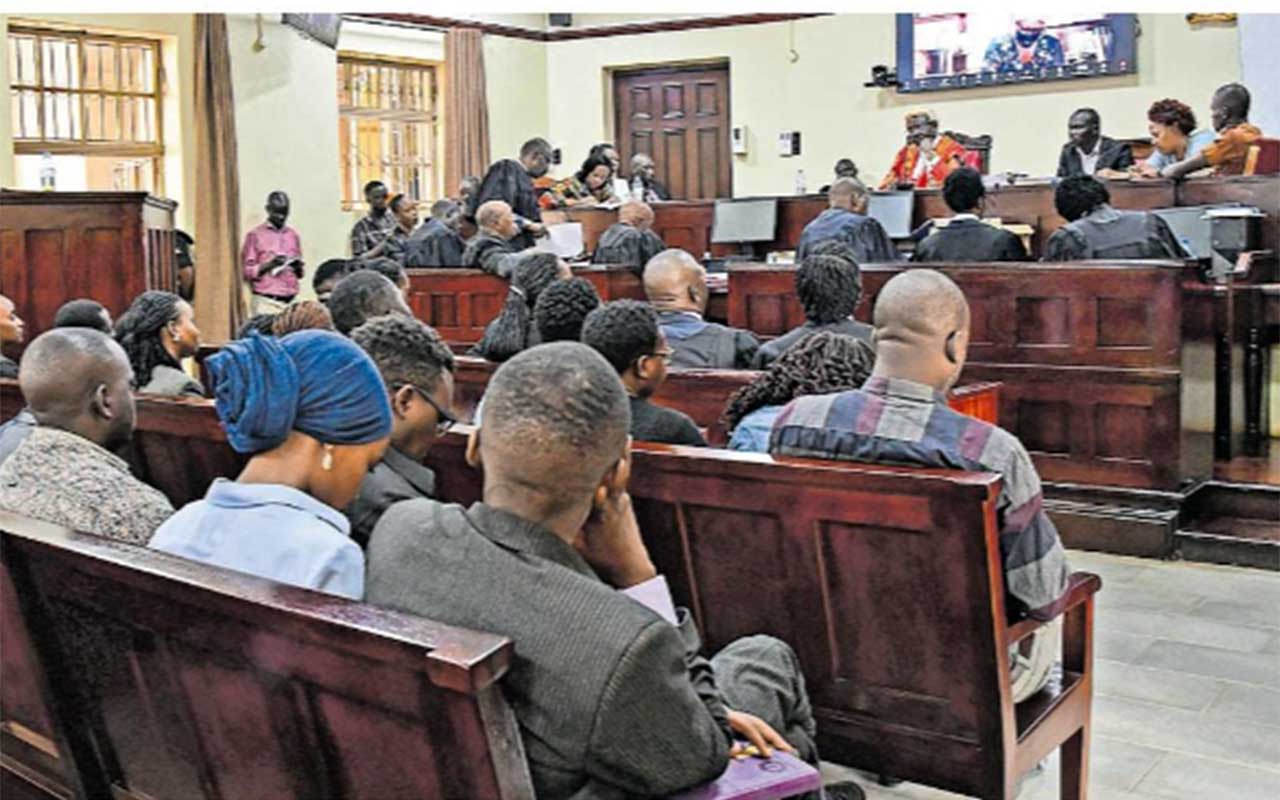

In 2019, Friends of the Earth France and four Ugandan NGOs filed a lawsuit against Total, concerning the serious human rights violations and risks of irreversible environmental damages associated with Tilenga and EACOP projects.

After a two year-long procedural battle, the case should be heard on the merits on October 12, this year, before the Paris civil court.

The EACOP project has been “reflexively denounced” as an undertaking with gross environmental abuses. However, I don’t know if many people are informed that not only did National Environment Management Authority (NEMA) scrutinise the environmental and social impact assessment but also solicited the help of the Norwegian environment agency as a second pair of eyes on this project. This is why I would be particularly interested in scrutinizing the technical notes that informed this resolution and whether they found gaps in this particular impact assessment report.

Because the oil that the pipeline will transport is thick, the pipeline will be heated and lined with fiber optics and valves. So that in case of a leakage, the data will be sent to a computer system and the values subsequently turned off.

We have lost a substantial forest cover because of cutting down trees for charcoal. Uganda’s oil project can generate up to 300,000 tons of cheap Liquefied Petroleum Gas for use in place of charcoal and firewood, a substantial emitter of greenhouse gases in Uganda.

The country can maximise economies of scale of the gas, to reduce the number of trees cut down in a bid to do cooking. Uganda’s oil project is part of the country’s energy transition plan. Therefore, we can’t afford to delay the pipeline.

A substantial number of people questioned why the EACOP company was incorporated in England and Wales. I would like to state that anyone who has done structured financing on projects would understand that this was done for strategic reasons.

Most technology startups in Uganda that raised venture capital above $1 million are advised to incorporate offshore structures. Therefore, the EACOP company certainly isn’t the first Ugandan entity to do this.

We should understand that EACOP project, according to the Shareholders Agreement (SHA), which defines the rights and responsibilities of the shareholders in the EACOP Company has three shareholders from four different jurisdictions who are; Uganda National Oil Company (UNOC) with 15 percent, the Joint Venture Partners (Total Holdings International B.V. with 62 percent and CNOOC Uganda Limited with 8 percent and the Tanzania Petroleum Development Corporation (TPDC). TPDC will take shareholding of up to 15 percent.

It was, therefore, important to cure the conflict of laws arising from different players coming from different countries by choosing a neutral jurisdiction with a strong rule of law record for arbitration purposes.

Uganda has a Bilateral Investment Treaty with the UK. I don’t think this move was meant to deny the government tax through “financial engineering and offshoring tactics, the kind exposed by the paradise and Panama papers leaks.

To allay fears that this move was principally intended to deny government tax, it was agreed that the head office of the EACOP company is in Uganda so that for tax purposes the project company is tax resident in Uganda despite incorporation in the UK. This can visibly be seen in the EACOP (special provision) Act, 2021.

I am quite confident that Uganda will benefit from this oil production if we have the right social license (public support). The “break-even oil price” for Uganda to benefit from this oil is $40 per barrel. The current price of oil on the Brent Crude futures market is $86. Anything below $40 spells disaster for us. Like any commodity, the oil price is subject to speculation in the financial markets.

Avolla Kennedy is the District Staff Surveyor, Gomba District.

(MS Urban Planning and Design)