BRICS Project mBridge could be a game changer for payments

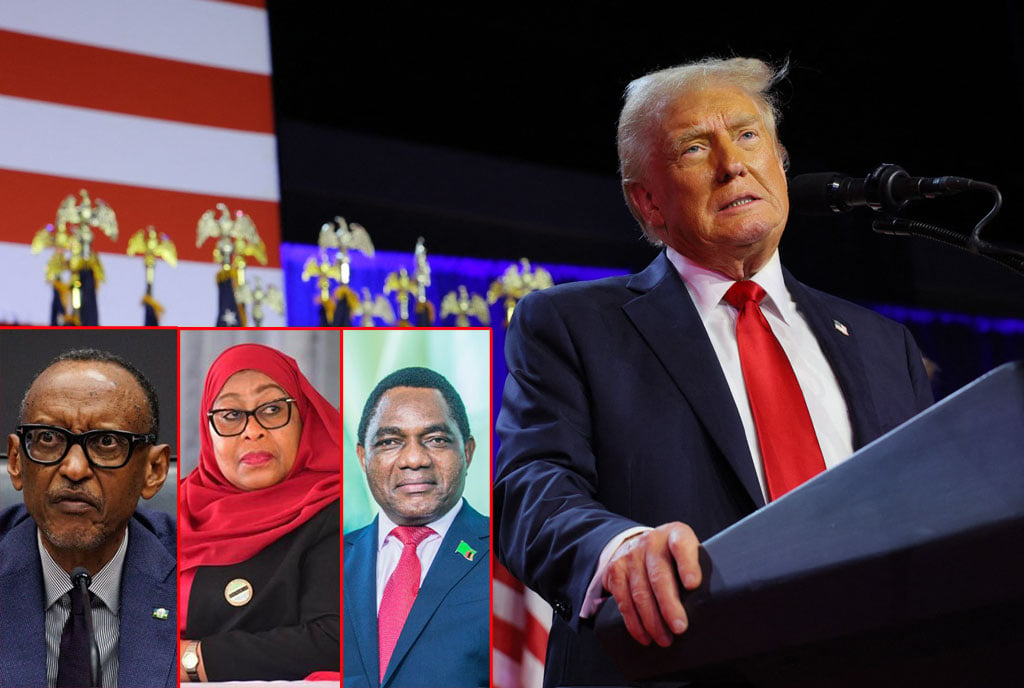

Samuel Obedgiu says the main purpose of mBridge is to allow users to bypass the existing US-centric monetary system. PHOTO/COURTESY

What you need to know:

- The new BRICS payment system aims to bypass the US-centric SWIFT network and the need for USD in cross-border transactions, writes Samuel Obedgiu.

The Ugandan media paid no attention to a worldwide development that occurred in the last few months that had local ramifications.

The introduction of a new payment system by the BRICS (Brazil, Russia, India, China, South Africa) nations via the Bank for International Settlements' (BIS) innovation hub. The name of the recently released payment system is Project mBridge. This payment system has been in development for years; it is based on the Ethereum blockchain.

The Ethereum blockchain is the foundation of mBridge. It's just a replica of Ethereum that makes use of the MBL blockchain, which is written in solidity and employs the EVM for smart contracts.

In 2022, African Union (AU) launched the Pan-African Payment and Settlement System (PAPSS) which sends credit or debit settlement instruction to the Central Bank of the originator and the Central Bank of the beneficiary.

The Central Banks settle the transaction in hard currency, using Afreximbank as the settlement agent.

But mBridge does away with “settlement agents” and need for “hard currencies”.

MBL and Ethereum are not the same. MBL is permissioned and private, which means that you must be a commercial bank or central bank to use MBL.

Needless to say, these commercial banks and central banks run nodes on MBL, with participating commercial banks running de facto relay nodes and participating central banks running de facto validator nodes.

Another difference between mBridge and Ethereum is that the former appears to be significantly faster than the latter.

This is due to mBridge's unique consensus process, "dashing." Chinese researchers developed a hash that validates blocks by inspecting parts of them instead of the whole block.

To be clear, BRICS currencies and the BRICS payment system are completely different. A theoretical BRICS would be a real currency like the US Dollar or the Euro, while the BRICS payment system is a payment rail for any currency.

This Central Bank Digital Currency (CBDC) system has been built by the central banks of Thailand, Hong Kong, China and the United Arab Emirates with the assistance of the BIS. For context, CBDC is a digital currency issued and controlled by a central bank.

Frankly, the US dollar alone, doesn't matter for countries whose interests are not aligned with those of the West; it's the payment channel it runs on, namely the SWIFT network. SWIFT is the largest payment system in the world.

Clearly, SWIFT is aligned with Western interests and is increasingly being used as a financial weapon by blocking payments to certain parties.

Simply put, the SWIFT payment system is a much bigger problem for non-western nations than the US Dollar. This is why the BRICS are working on an alternative to SWIFT.

Technically, there are two types of CBDCs, each with their own characteristics: Retail CBDCs, used by individuals like you and me, and Wholesale CBDCs, used by selected individuals and institutions. As you may have already guessed, mBridge is a large-scale CBDC system intended for institutional use only.

The main purpose of mBridge is to allow users to bypass the existing US-centric monetary system.

This includes not only bypassing SWIFT, but also bypassing all intermediary banks in cross-border transactions, and bypassing the US Dollar in Forex transactions.

For you information, the US Dollar is essentially a bridge currency, especially for larger transactions.

For example, if you want to exchange a large amount of Ugandan Shillings to Nigerian Naira, you will need to exchange the Ugandan Shillings to US Dollars and then exchange the US Dollars to Nigerian Naira.

This is simply because you cannot always exchange a large amount of Ugandan Shillings directly to Nigerian Naira.

With mBridge, you would exchange Ugandan Shillings to Nigerian Naira directly from a Ugandan bank to a Nigerian bank, but only if these banks are part of the mBridge system.

his eliminates the US Dollar as a bridge currency, removes intermediary banks from payments, and removes SWIFT from the equation and lowers transaction costs. The number of central and commercial banks willing to join the bridge has increased to 26.

Mr Samuel Obedgiu is an agricultural biotechnologist and activist. [email protected]