Prime

EACOP financing deal set for this month, refinery on course, says govt

Government says it has already completed the process of securing land for the project and compensated all project-affected persons. Photo / File

What you need to know:

- In total, nine lenders have promised to finance the project on a 60:40 percent debt-equity ratio

Developers of the East African Crude Oil Pipeline (Eacop) say they are optimistic that they will conclude a syndicated debt financing deal of the project with two Chinese and seven European Banks this month.

Energy Minister Ruth Nankabirwa, in April, went to Beijing to negotiate for debt financing on the invitation of Chinese President Xi Jinping, where she also met officials of Sinosure, a lead investor that requested Uganda to also interest European lenders to bankroll the project

The project is currently facing a financing gap after the $2b injected by shareholders was exhausted.

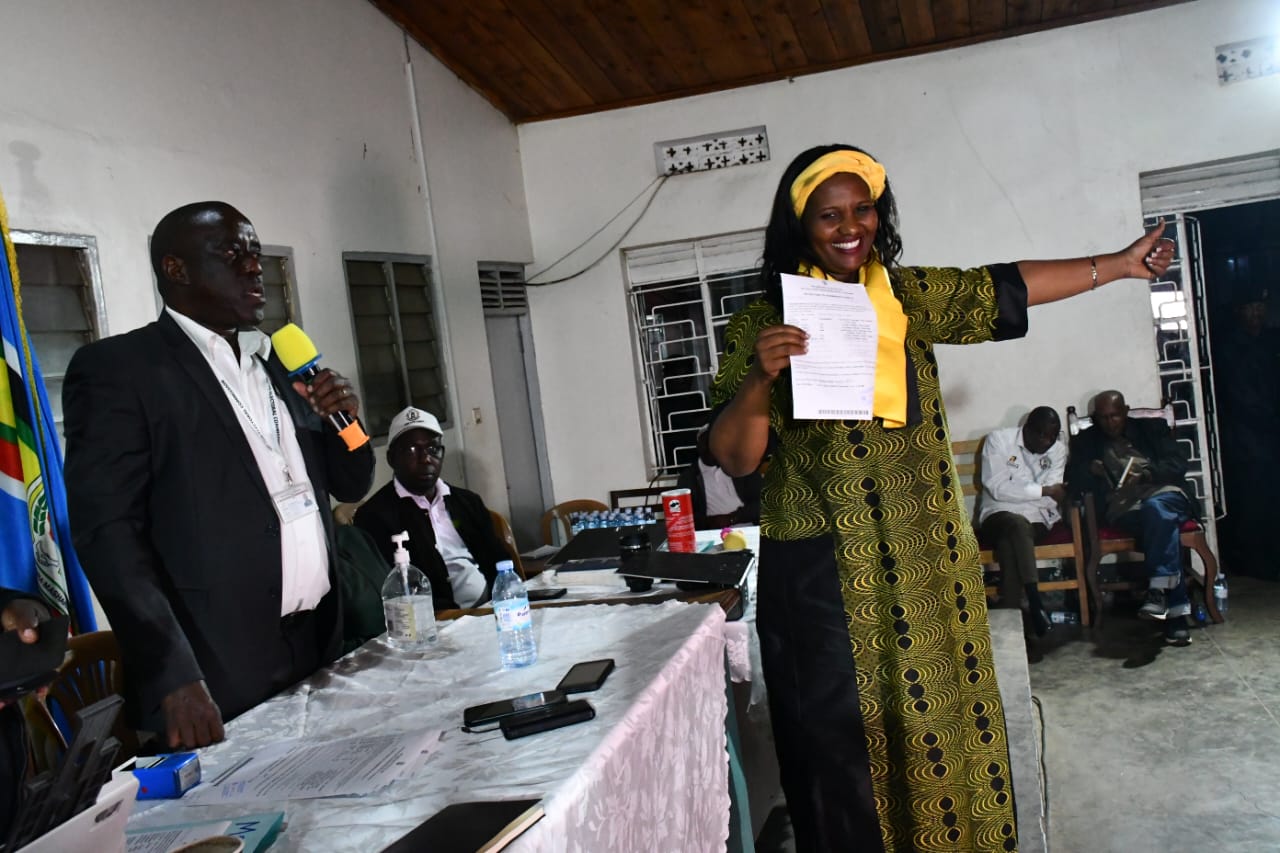

In total, nine lenders have promised to finance the project on a 60:40 percent debt-equity ratio, but Ms Nankabirwa, who announced the new financing developments in Kampala last week, did not name the European financers, saying anti-pipeline lobbyists could sabotage the plan.

Ms Nankabirwa last week noted that they had reached a sensitive period, saying: “The project is still viable. Uganda is expanding exploration and this midstream infrastructure will be used even after 25 years.”

Significant progress has been made on the pipeline after the construction license was granted in June 2023, allowing civil works to commence at the main camps and pipe yards in Hoima and Sembabule districts.

The Energy Ministry indicates that engineering, procurement, construction management, and commissioning activities are ongoing in London and Dar es Salaam, with Worley, a construction firm, undertaking the works in partnership with ICS Engineering in Uganda and Norplan in Tanzania, as subcontractors.

“The overall progress [is] at 39.2 percent. The engineering phase is at 81.1 percent, procurement at 54.5 percent, and construction and commissioning at 15.4 percent. Detailed engineering, being carried out by Worley is at 89.1 percent, surpassing the planned 88.3,” Ms Nankabirwa said.

Construction of the thermal insulation plant in Nzega District, Tabora region in Tanzania was completed and commissioned on March 24, while seven batches of line pipe, totaling 500 kilometres have so far been delivered to Tanzania of which five have been delivered to the Thermal Insulation System plant in Nzega.

China Petroleum Pipeline Engineering, the pipeline construction contractor, has begun civil works at pump stations and main camp and pipe yard sites in both Uganda and Tanzania.

In Uganda, work has been completed at three of the five main camp and pipe yards in Hoima, Kakumiro, and Sembabule districts, while work continues at other sites in Mubende and Kyotera districts.

Other works underway include works on an oil terminal and loading jetty at Tanga, in Tanzania, above-ground installations, which include pumping stations and main camps and production yards in Uganda and Tanzania, while installation of the pipeline started in June, with four batches of 100 kilometre of line pipes already delivered in Dar es Salaam.

Ms Nankabirwa also said government is negotiating with Alpha MBM Investment, a United Arab Emirates firm, which is described as a consortium with money needed after the Albertine Graben Energy Consortium failed to raise capital for the project, to construct the oil refinery.

Uganda is trying to fast-track and synchronise the programme so that several things are handled simultaneously to beat the 2025 first oil deadline.

Government expects to sign key commercial agreements before the final investment decision, encompassing the host government agreement, crude supplier’s agreement, and shareholders’ agreement.

The host government agreement, like Eacop, will be executed between the government and the refinery company, yet to be established, outlining commitments such as security and land ownership and issues related to national content and health safety and environment by the refinery company.

The crude suppliers' agreement secures the necessary feedstock of 60,000 barrels of crude oil per day required for the refinery and will be signed between the crude oil owners and the refinery company.