Prime

Govt working on regulations to operationalise mining law

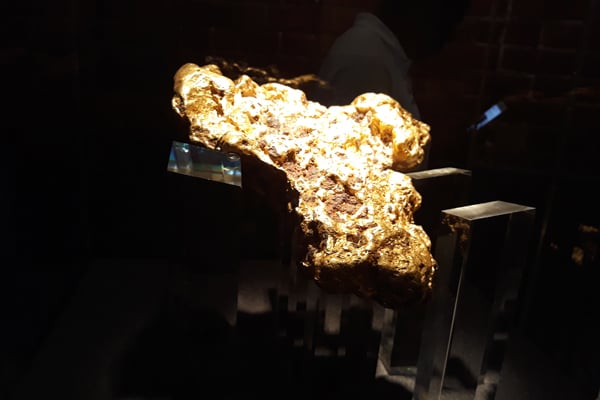

The mining law introduces new types of licenses for large, medium, small-scale, and artisanal miners. Photo / File

What you need to know:

- The Uganda Chamber of Mines & Petroleum says right now there are consultations on regulations to operationalise the 2022 Mining and Minerals Act

Uganda's once-booming gold industry has recently seen a decline, primarily due to strict government regulations on unprocessed exports.

Exports are currently plunging, partly putting the shilling on pressure due to a reduction in export inflows. .

Gold export earnings in June dropped by 23.6 percent to $718.6m from $940.93m in May, according to data from the Finance Ministry due to lower than projected export earnings from mineral products.

Data from the Ministry of Energy indicates that "government policies focused on value addition, which included a ban on the export of unprocessed minerals" were behind the 32.1 percent decline in mineral production in the 2022/23 financial year, leading to a 99 percent decline in mineral export earnings from Shs18.4b to Shs143m.

The most affected were gold, limestone, kaolin and iron ore.

Majority of Uganda’s minerals are extracted by artisanal and small-scale miners who, while they extract gold, extract other minerals such as limestone, granite, tin, tungsten, tantalum, gemstones, among others.

Gold exports have long been a source of contention because they are huge raking in hundreds of millions of dollars yet there are no big ready deposits in Uganda yet.

Bank of Uganda data shows gold generated $3.1b in the year ended June, with an average global price of $63,597.6 per kg .

Data further indicates that a large chunk of Uganda’s gold exports are re-exports from Tanzania, Zimbabwe and DR Congo.

However, Uganda Chamber of Mines & Petroleum says there is potential among artisanal miners, who do most of the mining.

Planet Gold, a small-scale miners’ lobby, estimates small and artisanal miners to be around 400,000, with 60 to 70 percent of those being women and children, whose activities were recognised in 2022 by the Mining and Minerals Act.

However, without proper regulations to back the law, small-scale miners can’t fully benefit from government’s support and good technology, or fight for their rights.

“Right now there are consultations on regulations to operationalise the law,” Mr Aggrey Ashaba, the Uganda Chamber of Mines & Petroleum chairperson of the governing council, said, noting that before the end of the year the regulations will be in place.

The 2022 Mining and Minerals Act addresses previous shortcomings and brings Uganda’s mining regulations in line with global standards by adding value to key minerals and driving industrialisation through their extraction and processing

It introduces new categories of mining licenses including large, medium, small-scale, and artisanal, which will help to formalise unregulated mining sectors, boost government revenue, and improve oversight.

The Act allows various entities, such as companies, partnerships, cooperatives, and associations, to apply for mineral rights, potentially increasing participation in the mining industry, which could lead to more exploration, adoption of technology, better regulations, increased investment, and growth in mineral-based industries.

“We signed an MoU with one of the associations for artisanal miners. We shall use that platform to reach every person and try to amplify some of the partners that are willing to come on board,” Mr Ashaba, said, noting that financing institutions such as banks would want to have conversations on providing technologies and working capital, but could not due to absence of regulations.

Uganda’s gold export earnings are projected to grow by 20.5 percent, driven by the launch of a $200m Wagagai Mining in Busia, which is expected to add 1,000 kg of gold to exports during test runs in 2025, with production expected to ramp up to five million tonnes per day, which could increase total gold exports to 58,620 kg.