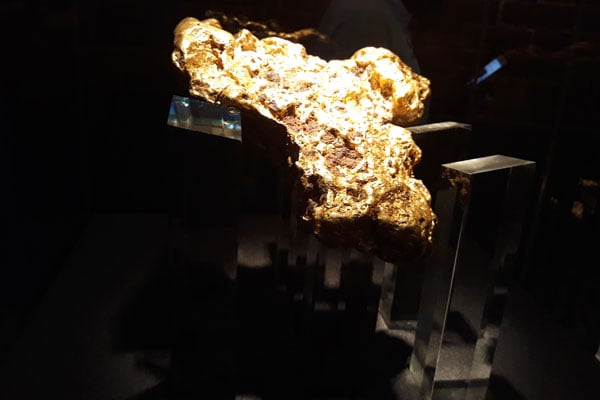

Whereas Uganda’s gold mining industry is not fully developed, the country continues to register massive growth in gold exports that are believed to be re-exports from DR Congo, Zimbabwe and Tanzania. PHOTO / FILE

In the last 10 years, there is no doubt that gold has become Uganda’s most important export.

In fact, it is now the single-largest export earner, contributing above of 42 percent of Uganda’s export earnings.

In the 10 years to June 2024, gold exports have grown by $3.06b, rising from just $25m in June 2014 to $3.09b in June 2024.

Initially, according to data from Bank of Uganda, between June 2014 and June 2018, gold had been a peripheral export commodity in Uganda’s export matrix, contributing just 0.92 percent to the country’s earnings.

In fact, all other non-coffee exports, including electricity, cotton, tea, tobacco, fish and related products, hides and skins, and simsim, among others, were by 2014, individually contributing much more than gold.

However, the precious metal now almost contributes much more than all non-coffee exports combined, a trend that has continued to build strongly since 2020.

Bank of Uganda data indicates that as of June 2024, Uganda earned $6.22b from non-coffee exports, of which $3.09b, an equivalent of 49.7 percent, was from gold.

Uganda first experienced a surge in gold export incomes in June 2018, when earnings increased from just $343.31m to $1.06b in June 2019.

The earnings have since more than tripled, increasing to $1.11b in June 2020, before doubling to $2.24b in June 2021.

However, a tax dispute between government and exporters in 2022 saw the country register zero exports as dealers challenged government to revise a proposal that had introduced a 5 percent and 10 percent tax on every kilogramme of refined and unrefined gold, respectively.

Government later caved in to the demands after registering massive revenue losses, while at the same time, it feared the dispute could distort an industry that was registering progressive growth in terms of foreign exchange earnings and tax income.

Exports resumed in the subsequent year, earning Uganda $1.13b in June 2023, but this was lower than the last earning of $2.24b in June 2021.

However, in the subsequent export calendar for the year ended June 2024, Bank of Uganda data indicates that gold earnings resumed the growth trend, tripling to $3.09b from $1.13b in June 2023, an increase of 36.71 percent.

Data also indicates that a large percentage of Uganda’s gold is exported to the United Arab Emirates and India, which has seen the two countries become Uganda’s largest sources of export earnings.

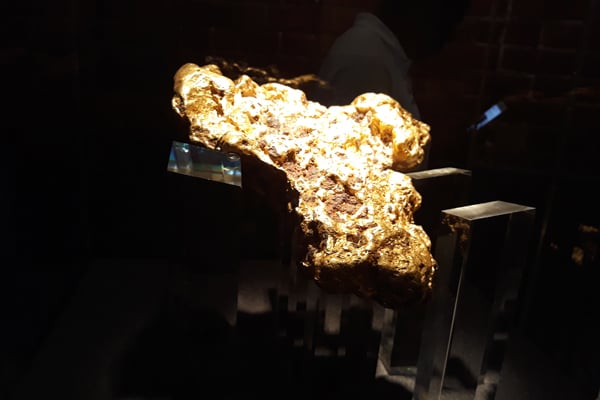

Gold exports have seen United Arab Emirates and India become Uganda's largest sources of export earnings. Photo / File

In the period ended June 2024, data indicates that Uganda earned a combined $2.98b from UAE and India, which was 40.59 percent of the $7.36b receipts from formal exports.

Gold is only rivalled by coffee in terms of export earnings, which in the period registered a 73.9 percent increase in income from $845.41m in June 2023 to $1.14b.

Other high-value exports include base metals and products, which in June 2024, earned Uganda $282.2m, while cocoa beans raked in $215.11m.

Maize earned $172.46m, oil re-exports ($146.26m), and fish and its products ($138.35m).

Bank of Uganda data further indicates that Uganda has in the last five years to June 2024, exported an average of 31,997.8 kilogrammes of gold.

The country first experienced large volumes of gold exports in June 2019, in which 26,711 kilogrammes were exported from 8,553 kilogrammes in June 2018.

The exports doubled in June 2021 to 43,009 kilogramme, but reduced to 19,903 kilogramme in June 2023 after recovering from zero in June 2022 due to a tax dispute.

However, they have since recovered, with the country exporting 48,620 kilogrammes in the year ended June 2024.

Year | Value | Volume |

2013/14 | $25m | 2,118kg |

2014/15 | $23m | 20kg |

2015/16 | $204.26m | 5,423kg |

2016/17 | $433.66m | 11,038kg |

2017/18 | $343.31m | 8,553kg |

2018/19 | $1.06b | 26,711kg |

2019/20 | $1.11b | 21,746kg |

2020/21 | $2.24b | 43,009kg |

2021/22 | 0.00 | 00 |

2022/23 | $1.135b | 19,903kg |

2023/24 | $3.092b | 48,620gk |

Gold continues to be an important commodity in Uganda’s export space, helping the country to increase its foreign exchange receipts, while at the same time, propping up the shilling that continues to face shocks from within and beyond.

However, whereas there has been growth in earnings, Uganda has also registered growth in gold imports from Tanzania, Zimbabwe and DR Congo.

Data from the Central Bank indicates that Uganda’s imports from Tanzania have been growing, grossing $1.77b in June 2024 from $450.46m in June 2023, largely due to an increase in gold and rice imports.

Similarly, in June 2021, Uganda registered a substantial growth in imports from Zimbabwe to $337.4 from $4.19m in June 2020, which according to Bank of Uganda, was due to gold imports from the southern Africa country.

Imports from DR Congo are largely undocumented, but Uganda also sources gold from other countries given that local production cannot support documented export volumes.

Uganda’s gold industry has been growing rapidly, boosted by a government directive, which about two years ago, banned export of unrefined minerals.

But beyond this, the industry is expected to benefit further from a Bank of Uganda initiative, in which, under the Domestic Gold Purchase Programme, the Central Bank will buy gold locally.

In July, Bank of Uganda indicated it would purchase refined gold from the local market to mitigate a decline in foreign reserves.

All this points to a commodity that has become a key pillar in the stability of Uganda’s economy.