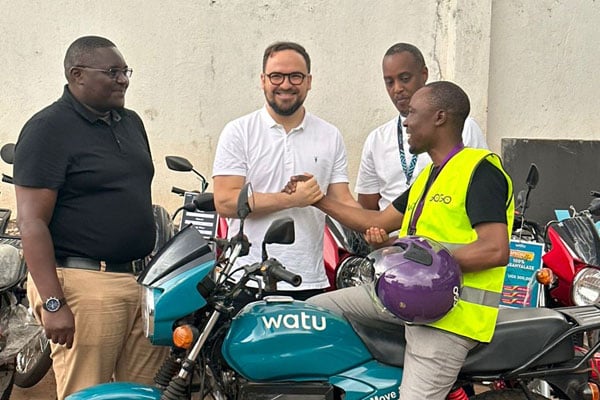

Mr Paul Bwiso, the Uganda Securities Exchange chief executive officer

In the high-stakes game of capital markets, fear often sits at the table, whispering caution into the ears of potential investors, especially in developing countries like Uganda. Picture this: A world where the bold and daring dance with wealth, while the cautious huddle together, sharing stories of market crashes and lost fortunes. It’s no surprise that the number of investors in our countries remain low.

But here’s the twist—technology is poised to be the superhero in this narrative, swooping in to demystify the complexities of investing and to bridge the gap between fear and fortune. Consider the titans of industry we all admire: Elon Musk, Jeff Bezos, and Bill Gates. These moguls didn’t just dabble in innovation; they catapulted their visions onto the stock market, transforming their companies into cash-generating machines that have boosted their wealth by margins most of us can only dream of.

In fact, pundits are now speculating that Musk could soon wear the crown of the world’s first trillionaire in 2027, depending on how quickly his wealth multiplies, as reported by Bloomberg. This staggering growth is primarily attributed to the stock he holds in his game-changing companies that are listed on the stock market.

Mr Paul Bwiso, the chief executive officer of the Uganda Securities Exchange, and I met at Kampala Serena Hotel last week on Friday. We were intent on unpacking how technology can turn fear into fortune by enhancing financial inclusion, simplifying the investing process, and ultimately closing the knowledge gap in this space.

The money folks have a point: with the right tools and platforms, we can flip the script on capital markets, transforming them from daunting giants into welcoming allies. This shift could encourage more people to dip their toes into investing and seize control of their financial futures.

A new era of awareness

I am with Mr Bwiso and he is looking as composed as a seasoned captain in his dark blue suit. He is the gentleman behind Uganda’s stock market, which is teeming with untapped potential. Sadly, the majority of local investors remain blissfully unaware, and for those who do know, understanding is often a distant dream.

Mr Bwiso gets it; and he’s on a mission to change that. He and Ms Josephine Okui Ossiya, the chief executive officer of the Capital Markets Authority (CMA), recognised the vast chasm of knowledge surrounding Uganda’s stock market. With a determined glint in their eyes, they hatched a plan: let’s educate the masses! Their approach? Think big—television, radio, public lectures, conferences with stakeholders, and direct outreach to students and everyday citizens about all things in capital markets: stock trading, collective investment schemes,bond markets, equities, and beyond under the World Investor Week campaign.

Harnessing technology

When I applaud his efforts, he responds with a humble sigh, acknowledging the progress made this year. Mr Bwiso has been a champion for financial inclusion, especially through the magic of technology particularly in the financial markets. And it’s hard not to be captivated by this idea: technology is fast becoming our greatest enabler, making even the process of reading this article more accessible. The more we harness it, the better our outcomes. This is particularly crucial for Uganda, where investment by the population could see a serious boost. “Capital markets seem to be a strange topic, and many people fear investing. But when you delve into the nitty-gritty, you’ll find that a lot of people are already investing within this space.

Currently, we have about 251,000 investors registered in the exchange’s Central Securities Depository system, but only 46,000 of them are active investors holding shares in these companies,” he explains. The UN Conference on Trade and Development’s 2021 report delivers a vital message: digital platforms and financial solutions are game-changers for improving investment access, among small businesses and entrepreneurs. They enhance transparency, slash transaction costs, and widen the capital net to include underserved markets.

CMA is convinced that by embracing technology, we can significantly amp up participation in capital markets, paving the way for government’s ambitious plan to elevate the country’s savings to gross domestic product (GDP) from the current 20 percent to a lofty 40 percent. This isn’t just a pipe dream; it dovetails perfectly with the government’s ten-fold growth strategy.

Sobering statistics

When we focus on promoting investor education and awareness, we empower individuals to make savvy investment decisions, fostering the overall health and stability of our capital markets. And get this: according to the Uganda Communications Commission, there are 37.8 million telephone subscribers in Uganda. Given that the latest census pegs the population at 45.9 million, that means about 82 percent of the population has access to mobile technology—assuming each line belongs to an individual. “This impressive coverage offers us a golden opportunity to leverage mobile technology for financial inclusion, reaching those who have often been left out of the formal financial system. Let’s seize this moment and connect with the underserved,” Ms Ossiya said at a recent conference on financial inclusion.

However, it’s disheartening to see that, despite this considerable population and widespread access to mobile services, we only have 253,000 Central Securities Depository accounts—essentially the sole participants in our capital markets. Even more sobering, there are just 92,000 funded collective investment accounts. This glaring gap highlights the monumental work still required to engage more individuals in investing and participating in our capital markets.

When the penny drops

But those who know have reaped big. Several companies have successfully raised an impressive Shs2.3 trillion through shares. CMA’s records show that assets under management in collective investment schemes now total Shs3.2 trillion—surpassing our initial target of Shs1.8 trillion—while Uganda’s market capitalisation has soared to Shs10.7 trillion. This progress underscores the significant potential in this space, especially when you consider the relatively low number of participants compared to the possible market size. But both the USE and CMA are diving into tech to shake things up and boost market activity by smashing barriers to financial inclusion. “We’re reaching out to folks in remote areas and those left out of the financial system,” says Mr Bwiso.

And guess what? Good news is on the horizon. Recent initial public offerings (IPOs) and transactions on Uganda’s stock market show more Ugandans jumping in, signalling a shift toward greater investment activity. We’ve gone from 26,000 investors in 2020 to a whopping 253,000 today—proof that our capital markets are evolving fast, Mr Bwiso beams! To keep this momentum going, USE and CMA have rolled out user-friendly tools like the Easy Portal, launched in 2018, which lets investors monitor stocks, check balances, and trade—all from their phones. Gone are the days of long lines and paper forms! This boost in accessibility is paying off.

The MTN IPO in 2021 attracted more than 21,000 investors—92 percent of whom were Ugandans— who collectively staked more than Shs54 billion. It’s clear: retail investment is thriving alongside institutional support. A game-changer is USE’s partnership with telecom giants Airtel and MTN, allowing seamless access for investors to manage their holdings. More than 24 million shares have already traded, thanks to this connection. But wait, there’s more! USE is also joining the African Exchanges Linkage Project, linking us to eight other exchanges. By June next year, Uganda’s brokers will be able to trade across Africa, potentially buying stocks from Casablanca to Johannesburg, all from the comfort of home.

Liquidity challenges

This initiative aims to pump up liquidity in Uganda’s stock exchange, which currently struggles with daily volumes under $5,000—pale in comparison to Kenya’s $1.5 million. The National Social Security Fund (NSSF), Uganda’s largest institutional investor, has also been a bit of a bottleneck, limiting share trading when it buys up issued shares which are mostly the majority when offered by companies. NSSF’s Deputy Managing Director, Gerald Paul Kasaato, is in talks with USE to explore market-making roles for pension funds if the regulations allow, plus they’re eyeing securities lending to revitalise market activity to a more vibrant securities exchange, especially as transaction volumes have bounced back post-pandemic.

Last year, Bank of Baroda showed us how to hit the jackpot with a bonus issuance that raked in Shs125 billion, proving that our market isn’t just a pretty face—it’s got growth potential and can help companies snag the capital they need. Meanwhile, the ACW 3 a private equity fund made waves by scooping up 51 percent of Cipla Uganda, giving exchange activity a hearty boost to Shs155 billion. This year, MTN decided to join the party, raising over Shs220 billion in a secondary market offer, which catapulted total turnover on the exchange to Shs268 billion—a jaw-dropping 72 percent jump. And talk about a growth spurt; the number of active investors skyrocketed from about 3,000 to more than 12,000.

Regulatory move

To keep the momentum rolling, CMA is stepping up with a shiny new toolkit of regulatory initiatives, including a regulatory sandbox. Think of it as a playground where investors can test new financial toys without the usual bureaucratic swings and slides. The aim? To spark innovation and meet the financial needs of those who’ve been left in the dust. “We’re also cooking up a brand-new asset class: commodities trading. We’ve been busy behind the scenes and hope to wrap up our pilot by the end of November. With the first harvest hitting the market in February, we’re expecting to see some lively trading on the exchange,” says Mr Bwiso.