Michael Atingi-Ego the Deputy Governor of the Bank of Uganda (BoU). PHOTO | FILE

Uganda has joined many other countries in turning to gold to strengthen its international reserves amid increasing volatility in the dollar.

This move is part of a global trend where central banks seek stability in their reserves. The central bank says this strategy, developed with input from key stakeholders (most likely the cabinet, Energy ministry, Finance ministry, and miners) will entail a direct purchase of gold from the country’s artisanal miners.

Dr Michael Atingi-Ego, the Deputy Governor of Bank of Uganda (BoU), explains that due to the increased diversity, frequency, and intensity of economic shocks facing the global financial system, the central bank needed to find ways to address them by diversifying its asset reserves for stability.

Rapid depreciation of a country’s currency against the dollar, like what happened to Uganda’s shilling last year, can deplete its foreign exchange reserves.

Ultimately, the central bank may need to intervene in the forex market to stabilise the currency. In addition, sudden outflows of capital due to loss of investor confidence can put pressure on the shilling. This was noticed recently when Kenya put its infrastructure bond

on the market that had some of the best yields in the region’s financial markets.

Many investors in Uganda’s bond and stock market sold their assets, got shillings, exchanged to dollars and went all up for it. This caused volatility in both the shilling and the dollar in Uganda.

In addition, changes in global interest rates, particularly by major economies like the US, led to capital outflows from emerging markets, impacting their reserves.

“Some of these shocks have resulted in the dwindling down of our reserves because there has been a large buildup of external debt and servicing. There has been a sharp rise in the import of goods and services, a sustained drop in capital flows, and also significant pressures on the exchange rate,” Dr Atingi-Ego told the BBC in an interview on July 16.

And as a result, reserves fell by $149 million to $3.47 billion, covering only 3.2 months of imports insufficient for the country’s needs.

“So what we are trying to do now is to ensure that we hold the decline in our foreign exchange reserves by looking at some of the natural resources that we have to seek the extent at which we can mitigate this decline," he added.

Many African states have tried this to safeguard volatilities of their currencies against the dollar using this magic trick since gold is often considered one of the more stable reserves compared to other assets. For instance, in April, Zimbabwe introduced a new currency called ZiG (Zimbabwe Gold), backed by 2.5 tonnes of gold, to stabilise its local currency.

Elsewhere, Ghana, Africa’s second-largest gold producer, has also instructed major miners to sell 20 percent of their refined gold to the central bank.

Regardless, gold’s stability comes from its role as a tangible, finite resource with intrinsic value. Unlike currencies or bonds, which can be affected by inflation, geopolitical events, or economic policies, gold has historically retained value over the long term. However, it’s not completely risk-free. Gold prices can still be volatile in the short term due to market fluctuations, economic conditions, and investor sentiment.

While it can act as a hedge against inflation and currency devaluation, it’s part of a balanced reserve strategy rather than a guaranteed stable asset.

Local gold options

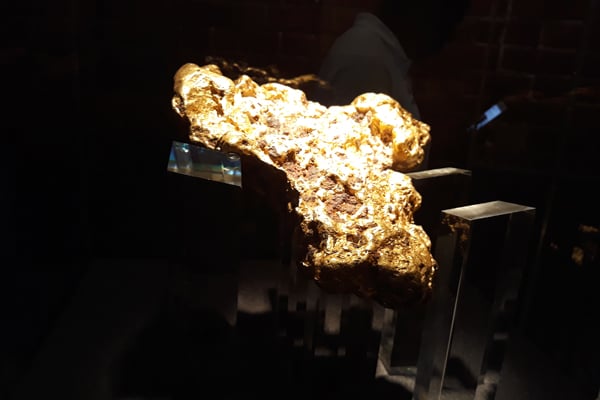

Bank of Uganda data shows that it currently does not hold any gold in its reserves. It, however, plans to locally buy the precious metal from small and medium-scale miners at “fair prices using local currency.” This could, however, be challenging for the central bank be-

cause many gold traders say they don’t buy gold cheaply and exchange it in foreign currency.

Many small and medium miners, whom the apex bank wants to support, sell their gold to middlemen for shillings. These middlemen then sell the gold to traders dealing in euros or dollars. As the gold changes hands and currencies, its price increases, which could lead to losses when converted back to the depreciating local currency, as indeed the central bank envisions.

Mr Collins Tugumisirize, the chairperson of the Precious Minerals Traders Association, argues that the central bank shouldn’t buy the domestic gold in shillings because this precious metal is a form of currency itself.

The challenge with this is that if the central bank were to buy this gold using dollars instead of shillings, many financial markets experts argue that it could immediately push the exchange rate up from the current Shs3,730.41 of selling to around Shs4,000.

This would happen because of the increased demand of the dollar from the central bank to buy gold with a relatively limited supply of the greenback. Additionally, some players in the forex market might exploit this situation by hoarding dollars and selling them when the price rises.

Conditions

Many gold miners have previously suggested that the Finance ministry establish a gold exchange authority to regulate traders, oversee trading methods, license brokers, and control gold pricing, something that’s believed to be in the pipeline.

The central bank, meanwhile, plans to buy gold based on several factors, mainly its purity, and will determine the price on the day of delivery when the supplier provides the gold quantity.

“The price shall be priced using reputable international gold trading platforms such as Bloomberg. For example, on the day of trade, the prevailing Bloomberg rates in US-dollars to Uganda shillings will be used, and that’s the price that will be paid to the gold suppliers, and that price will be strictly translated to Uganda shillings on the same day of the notification,” Dr Atingi-Ego revealed.

And upon delivery, the supplier may be given a leeway to choose any price between the locking date and the delivery date to compensate for any price valuation movements.

”One unanswered question is who BoU will buy gold from, especially since artisanal miners lack an association, potentially leading to business inequalities.

If market scarcity arises because traders fear losses from selling gold to the central bank in shillings (having bought it in dollars), the apex bank would consider involving the country’s national mining company that is still in development. The company is part of the central bank’s strategy to support the country’s mining sector, aiming to acquire up to 15 percent equity in medium and large mining operations.

Gold revival

One of the most significant changes in the world of money has been happening by stealth rather than through any policy announcement. Gold has regained a solid yet unofficial role in the world’s monetary system in a barely noticed, gradual process that cannot now be overlooked.

Willem Middelkoop, a member of the Official Monetary and Financial Institutions Forum (OMFIF) Advisory Board and founder of the Dutch-based Commodity Discovery Fund believes this is the result of several interlinked reasons. And one of them is the declining trust

in the dollar following western countries’ freezing of $300 billion of Russian foreign exchange reserves after the Ukrainian invasion.

Mr Middelkoop argues that when the government prints a lot of money to buy its own bonds (a process called quantitative easing), it can affect how reliable those bonds are. This isn’t just a problem for regular banks and investment managers, but also for many central banks around the world.

These central banks bought a lot of these bonds, and now those bonds aren’t as dependable as they used to be for keeping their money safe, he says. This has had a significant side effect. For instance, he explains that European central banks that hold gold might start using the increased value of their gold reserves to cover losses on their balance sheets. They prefer this option over asking their governments for more money, especially during times when the government budgets are tight.