Prime

MAK pension scheme cuts investments in equities

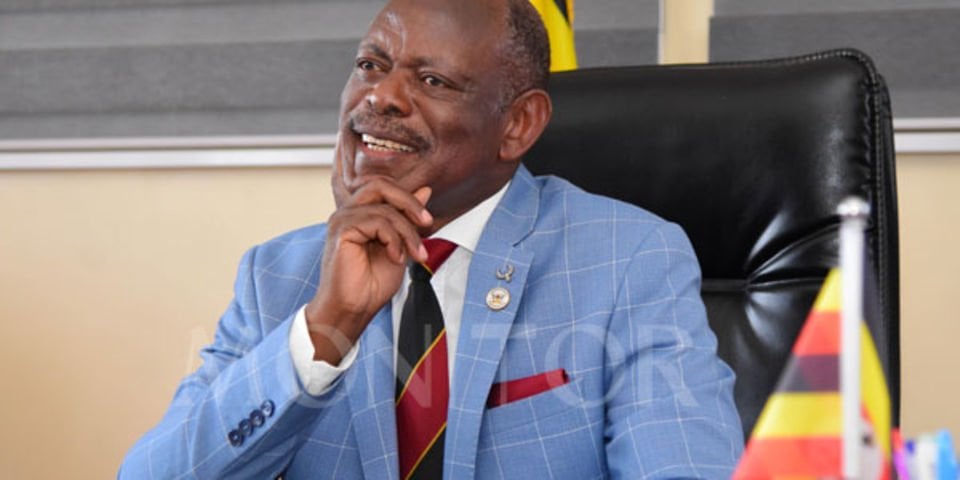

The Makerere University Retirement Benefits Scheme has an active membership of 3,041 people, majority of whom are current and former staff members of Makerere University. Photo / File

What you need to know:

- The Makerere University Retirement Benefits Scheme divested out of some equities to shelter its assets against volatility

Makerere University Retirement Benefits Scheme (MURBS) increased its return on investment by Shs9.7b in the year ended June, due to higher yields on government debt that offset losses recorded from equities.

The staff pension scheme recorded an increase in returns to Sh42.3b, or 29.7 percent, from Sh32.6b.

The scheme has 3,041 active members, majority of whom are current and former staff members of Makerere University. .

During the period, assets increased from Shs299b to Shs352b, supported by the increase in contributions and positive returns on our investments.

“During the year, the Trustees continued to invest in near cash assets like unit trusts to maximise opportunities for daily cash contributions, especially from projects, and also manage the scheme’s liquidity needs,” said Dr Elizabeth Patricia Nsubuga, the schemes chairperson board of trustees, noting that the scheme had also divested away from equities as a way to shelter its assets against high volatility.

Financial market instability has worked against equity investors, creating a Shs246.94m loss for the Makerere University Retirement Benefits Scheme in foreign exchange losses in the year ended June 2023.

Lost a significant portion

A number of pension funds have lost a significant portion of projected revenue from equities, especially from Kenyan stocks after investors in emerging and frontier markets moved their money to developed countries such as US and UK, where interest rates rose due to control of inflation.

National Social Security Fund, the country’s largest pension fund, recently reported that it had lost Shs1 trillion due to foreign exchange losses.

In its 2022 annual report, the Uganda Retirement Benefits Regulatory Authority, said disruptions to the global economy had impacted performance of equities, which as a result had eaten into member returns.

Mr Godwin Kakuba, the scheme’s secretary, said they had asked the regulator to surpass the threshold for investments in government bonds of 80 percent to 86.7 percent.

However, the scheme reported a Sh355m increase in administrative costs but gained from the sale of land and investment income, helping it to report a Shs10.3b increase in net assets to Shs53.96b.

The scheme’s assets are expected to grow once it recoups an outstanding Shs8.12b debt from government, part of which - Shs17b out of 25.3b - according to Dr Nsubuga, had been recovered with Shs5.5b received during the 2022/23 financial year.