Prime

Bank of Uganda looking into $10m Bitature loan

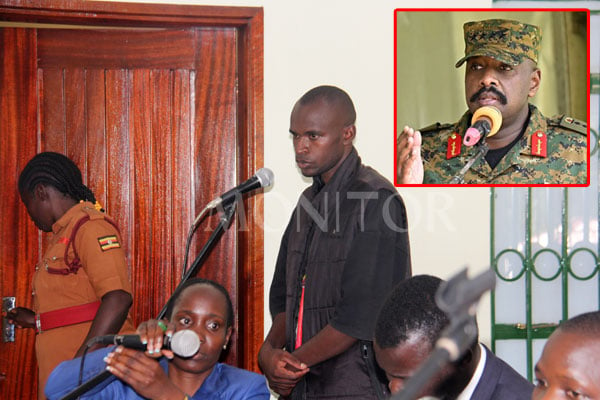

The chairperson Simba Group of Companies, Patrick Bitature and Tumubweine Twinemanzi, executive director for supervision at BoU.

What you need to know:

- The banking regulator took interest in the matter after lawyers of Vantage announced plans to auction the businessman’s prime properties.

The Central Bank has started inquiries to assess if there are any risks to the commercial banking landscape from the high-profile debt war between Simba Group, a leading local set of companies owned by businessman Patrick Bitature, and Vantage, a South-African based lender.

The banking regulator took interest in the matter last month after lawyers acting on behalf of Vantage took out an advert announcing plans to auction three prime properties belonging to the businessman within 30 days.

The Executive Director in-charge of Supervision at Bank of Uganda, Dr Tumubweine Twinemanzi, wrote to Vantage’s lawyers of Kirunda and Wasige Advocates, following the publication of the auction notice. The letter was written on May 18 but this is the first time it has come to light.

“The potential market valuation of the listed properties for sale and their commonality in ownership, together with our own market intelligence, makes it highly probable that the affected debtor is a systemic borrower within the financial sector,” Mr Twinemanzi wrote.

BoU clarity

The Central Bank official asked for clarification about the background to the auction notice, as well as “any further but related information, which in your view, Bank of Uganda as a financial sector regulator, should be made aware”.

ALSO READ: Lender, lawyers fight over Bitature property

The interest from Bank of Uganda is the first sign of concern from the regulator about whether other local banks have lent money to Simba Group, and whether those loans are in good standing. There is no evidence that Simba Group has not met any loan obligations with any other lenders.

Following the publication of the auction notice, both parties have made details of the transactions public. Vantage says it lent Mr Bitature and his various companies $10 million in 2014 of which he has “not paid back one cent” despite the loan term ending in 2019.

This publication exclusively reported that of this sum, eight million dollars was to settle an earlier loan owed to Crane Bank. Bank of Uganda later took over and liquidated Crane Bank after insider-lending allegations.

The lenders say the loan to Mr Bitature’s companies has now ballooned to $32 million after accrued and compounded interest, and penalties, kicked in.

ALSO READ: Leaked papers reveal Bitature offshore links

Lawyers representing the borrower initially said Mr Bitature had signed the loan agreements under duress. After Justice Musa Ssekaana of the High Court ruled, in a separate but related application, that Vantage was not properly registered in Uganda in order to sue or be sued, the lawyers said Simba Group was unable to pay a non-existent firm.

Mr Bitature clarified matters in a personal statement he released last month in which he acknowledged receiving the loan but said difficulties arising from delays in Uganda’s oil and gas sector had undermined his companies’ ability to repay the loan.

Mr Bitature has interests in hotels, residential real estate, telecoms, and energy. He was recently appointed chairman of the board of Bollore Logistics Uganda, a French company that has won the contract to do most of the logistics work on the oil fields and pipeline currently under development in western Uganda.

A response from Vantage’s lawyers to the Central Bank seen by Monitor calls on the regulator to conduct a wider audit and tighten the rules for borrowers from foreign lenders.

“A lot of this (foreign) lending may be outside the banking sector but relating to securities that are shared with the banks. In those cases you may want to consider running a wider sensitivity analysis on the sector,” they wrote.

Vintage’s position

“We believe you would agree that borrowers such as Simba, and more recently Ham Enterprises, who trade in the procurement and avoidance of debt obligations, present a major risk to Uganda’s financial sector. The publicity around such defaults seems to suggest the entrenchment of a culture (and ease) of evasion of loan obligations.”

The reference to Ham Enterprises refers to an on-going legal battle between the company owned by businessman Hamis Kiggundu and Diamond Trust Bank, which has operations in Uganda and Kenya.

The businessman has claimed that a loan he received from the Kenyan branch of the bank through the Ugandan operation flouted local banking rules and should not be recovered. About Shs120 billion is at stake and the matter remains pending before the courts.

Mr Twinemanzi and Central Bank officials have been contacted for comment. Mr Robert Kirunda, Vantage’s lead lawyer in Uganda, refused to comment on what he said was “confidential communication” to Bank of Uganda.