Prime

Great Lakes govts keen to stop bloody minerals

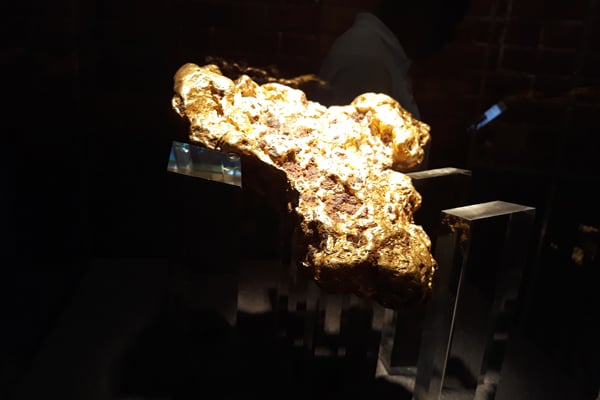

An artisanal gold miner in Agata village, Buteba Sub-county, Busia District uses a pump to siphon water from a flooded mine in 2023. PHOTO/ DAVID AWORI

What you need to know:

- Since time immemorial, Uganda has been accused of being involved in dubious gold deals, not only in the DRC, but also in Venezuela and South Sudan.

The recent gold scuffle at Kyengera, which happened two weeks after the US government had flagged Uganda as a transit country and market for smuggled minerals from the Great Lakes region, highlights gaps in the traceability system exploited by unscrupulous traders.

The smuggling is not only limited to private individuals but also state actors. Former prime minister Milton Obote was, for one, named in a 1965 scandal in which he reportedly received the precious metal and ivory from rebels in the Democratic Republic of the Congo (DRC) after furnishing them with firearms procured from Tanzania.

Since time immemorial, Uganda has been accused of being involved in dubious gold deals, not only in the DRC, but also in Venezuela and South Sudan. Don Bwesigye Binyina, a mineral and energy economics expert, reckons the recent establishment of a number of refineries in both Kampala and Entebbe has made the country a magnet for all forms of illicit minerals.

“If you go to Dubai and engage most of the gold dealers you will discover that more than 90 percent of the traders in gold have lost money in Uganda through scams,” he told Sunday Monitor, adding that red flags from the US, UN group of experts, international NGOs should not come as a surprise.

With this understanding of geopolitics, Binyina notes that the vulnerability of smuggled minerals sucks in Angola, Burundi, the Central African Republic, the Republic of Congo, Kenya, Rwanda, South Sudan, Sudan, Tanzania, and Zambia. Why? While the governments have a responsibility to control all mineral transactions within their borders after consenting to the regional frameworks under the International Conference of the Great Lakes Region (ICGLR), some of them are shy to implement it.

Exploitation

The challenge artisanal and small miners face is that they can’t afford the traceability bills demanded by foreign firms managing them. Most times the much-maligned miners are forced to sell to middlemen at the mining sites. Industrial players told Sunday Monitor that some of these middlemen of cartels aligned with refiners in the global commercial cities of the global north also deprive governments of the actual information and knowledge on supply chains.

The exploitation of the artisanal miners continues even as the member states commit to stopping the illegal exploitation of minerals by signing the ICGLR natural resources protocol. The protocol introduced six tools, including the regional certification mechanism. Under the tool, each country is expected to have a minerals database.

The ICGLR is supposed to establish a regional database where each country shares its resources. The movement of these resources from one country to another is typically through that regional framework. Besides facilitating tracking, it helps countries know the quantities of the minerals moved within the region.

For that to happen, the same tool introduces the traceability system and that system is essentially supposed to be run by national governments. That system enables the mapping of the entire mineral acreage within the country.

It also helps in locating where mines are, what resources are being produced from the mine, who is in charge of that resource, who the mineral dealers are, and who the traders are interfacing with at that mining site. Binyina, who once served as the chairperson of the ICGLR Regional Audit Committee overseeing the implementation of responsible mineral supply chains in the Great Lakes Region, notices an anomaly. Governments have been slow to implement and domesticate these tools at a regional level.

Chain of custody

Uganda recently passed the minerals and mines regulations. The regulations require investments in systems which require budgets and money, but in the 2024/2025 financial year, the minerals budget was chopped. Funding is needed to procure a national traceability system otherwise called the chain of custody system. The system traces the minerals from wherever they are coming from, including mining sites, to the refinery.

With the tracking system, the minerals without a certificate of origin are red-flagged. Consequently, the Government of Uganda needs to pick the tab for a system industrial players estimate to cost between $1.5 million (Shs5.6b) to $5 million (Shs18.5b).

The system has two elements. First, you develop an ICT solution which tracks the movement of minerals from the mine site up to the refinery or point of export. The system must have every stakeholder involved in the movement of the minerals, including transporters, dealers, and security agencies.

The second element is human resources to be deployed at the mining site. They must be technically trained people and have an element of building capacity.

Optimism

Irene Batebe, the Permanent Secretary (PS) in the Energy ministry, acknowledged the challenges in the mining industry driven by informal artisanal miners. She is, nevertheless, betting on the mining and minerals law 2022 to be a game changer.

A major plank of the law compels her ministry to organise the artisanal and small-scale miners into some kind of formal structure as part of the reorganisation, the biometric registration of artisanal miners is ongoing. It is hoped that the exercise will help the country have an electronic register of miners, a measure that is set to facilitate the tracking of their operations.

“Once we implement this, we should be able to ensure tracking and better mineral movement in the country,” PS Batebe told Sunday Monitor.

The online cadastral system registration, however, faces challenges, causing delays in issuing of licences.

“The challenge with many of these companies is they submit incomplete information and then we have a back and forth until all conditions are fulfilled,” Batebe sprang to the defence of her ministry following accusations by a manager at the Chamber of Mines, Petroleum and Gas who put the wait for issuance of a licence at nine months.

As one of the stop gaps, Sunday Monitor was told mining officials continue engaging artisanal miners to understand the requirements of the law. Submission of authentic information is also impressed upon them.

The formation of a public company to allow the government to participate actively in commercial interests in the sector is expected to have a twofold impact—reduce scams and generate income for the Treasury. The Uganda Mining Company has already been incorporated and is only awaiting Cabinet approval.

BoU gold reserves

PS Batebe, who said “all the required building blocks [are] in place”, also told Sunday Monitor that her ministry is also supporting Bank of Uganda’s (BoU) domestically gold reserve programme. This follows the Central Bank’s announcement in July that it intends to initiate a domestic gold purchase programme with the objectives of building the country’s foreign reserves and minimising risks on reserves investments.

The gold purchase programme targets gold from both local artisanal miners and some refining companies. The Central Bank comes back on the gold market after a 30-year lull. Observers contend that this will offer credibility to an industry that has struggled to shake off the public suspicion of the scams in the sector.

Besides, the United Arab Emirates-based Blaze Metals after attaining the United Nations Global Compact participation status, also committed to supporting East Africa’s precious metal value chains with the capacity for responsible sourcing standards.

Through its charity organisation—the Ghana-based Oheneba Poku Foundation—the firm promises to invest in changing the narrative across the entire mineral value chain for East Africa minerals to trade easily on the world’s precious metal markets.

The initiative announced on August 23, comes at a time when East Africa’s mineral exports are facing increased global scrutiny largely for failing to comply with the ethical and responsible mining standards.

Best practices

The Oheneba Poku Foundation said it will reduce environmental degradation practices through land restoration measures, and support artisanal and small miners to acquire skills in safe mining practices. It added that it will also be alive to environmentally friendly mining techniques, access to efficient tools, proper health and safety tools and supporting community projects such as education and health care to reduce the risks associated with mining

The foundation also seeks to help East African artisanal and small-scale miners who dominate the sector formalise their businesses. Such a development will enhance the mineral traceability and certification scheme and reduce mineral smuggling and illegal exploitation of tin, tungsten, tantalum, and gold.

“Our participation in the United Nations Global Compact marks a significant step forward in our journey to becoming a global leader in sustainable and ethical mining,” said Prince Oheneba Kofi Poku, CEO of Blaze Metals.

Challenges

The challenge artisanal and small miners face is that they can’t afford the traceability bills demanded by foreign firms managing them. Most times the much-maligned miners are forced to sell to middlemen at the mining sites.

Industrial players told The Monitor that some of these middlemen of cartels aligned with refiners in the global commercial cities of the global north also deprive governments of the actual information and knowledge on supply chains.