Dr Francis Kitaka Jr

Throughout his more than five-decade-long career, Francis Xavier Kitaka operated largely under the radar, steering a prosperous pharmaceutical enterprise among other businesses. However, a fateful business transaction with the government would catalyse a chain of events, culminating in charges, his untimely demise, and the subsequent erosion of his assets, leaving behind mounting debt and a tarnished legacy.

A May 13 decision by Judge Thomas Ocaya of the Commercial Division of the High Court in Kampala offers insights into the struggles of MTK Uganda Ltd and the asset stripping the company founded in 1967 has experienced. The narrative one gleans from court documents is of a once thriving local enterprise on its death bed ready to join the likes of Sembule Steel Mills and many others that have collapsed on the weight of debt.

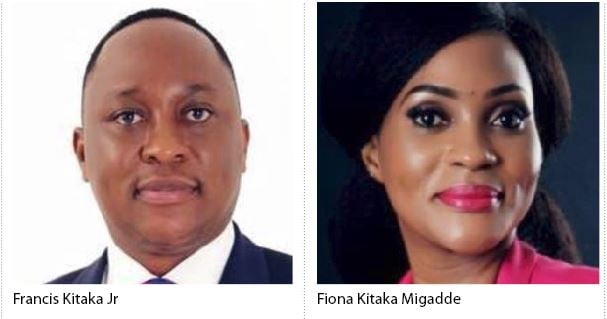

It all started with the infamous charges by the then Col Edith Nakalema-led State House Anti-Corruption Unit against three MTK officials, of obtaining money by false pretence, conspiracy to defraud, and forgery. Fiona Migadde Kitaka, the company chief executive officer; Dr Francis Kitaka Jr, the operations manager and Mr Alex Natukunda, the commercial officer, were charged and remanded to prison over the charges.

Although the Office of the Director of Public Prosecutions found the charges meritless, the damage had already been done.

First, Uganda was hit by the Covid-19 pandemic in 2020 and the 85-year-old industrialist and businessman died of Covid-related complications in September of that year.

MTK sues

In 2022, MTK sued the Attorney General (AG), NCBA Bank (U) Limited, dfcu Bank and Housing Finance Bank (U). MTK wanted the court to order the AG to pay general damages and indemnity for losses arising out of breach of contract and a declaration that the three banks were obliged to collect loans advanced to finance the MTK’s performance under contract with the government from the government, not the company.

Court records show MTK was operating profitably since 1967 in pharmaceutical importation and distribution for both humans and animals. Around August 2017, MTK entered into a framework contract for supply of assorted animal vaccines for two years with the government through the Ministry of Agriculture.

To finance the government deal, MTK obtained various loan facilities from the three banks, which money, the company told the court, was transferred to the various manufacturers of the products to be supplied under the contract. MTK made guarantees to the lenders on account of the success of the deal.

MTK told the court that in 2019, the company was unlawfully and wrongfully accused of supplying the government with fake cattle vaccines. The allegations and ensuing actions by the government adversely affected the plaintiff’s operations and performance.

It also stifled MTK’s capacity to honour its financial obligations to many entities as its contracts with the government was revoked. The delivered goods were rejected and the Agriculture ministry contract was suspended in breach and products that were already procured for supply expired. This as the ministry refused to accept the goods. The stock was destroyed and loss in terms of value, cost of destruction and income from possible sale occurred.

On December 27, 2022, the Housing Finance Bank lawyers wrote to the court, bringing to its attention that they filed their defence on August 5, 2022, which was admitted on September 27, 2022, as did dfcu, which filed its defence on August 2, 2022. The two banks, court records show, informed the court that after cross-checking with the court records, they established that there was neither an application for taking out summons for directions nor any court orders extending time within which to take out summons for directions by MTK.

On April 18, 2023 Justice Ocaya, court records show, found that MTK had abandoned its case against the three commercial banks.

Dfcu counter sues

Dfcu counter-sued MTK and Fiona Kitaka for breaching a loan agreement with MTK and a guarantee agreement with Ms Kitaka. They sought to recover the unpaid loan amount along with interest at a 30 percent rate, compensation for breach of contract, and reimbursement for legal expenses. Dfcu told the court that MTK owed the bank $6,677,197 (Shs25b), which Ms Kitaka had guaranteed.

According to dfcu, MTK approached the bank and applied for a trade finance of $3.5m (Shs13b). Later, MTK applied for an increase of the facility by $1.5m (Shs7b) to bring the total facility to $5m (Shs19b) for 12 months, which the bank granted.

MTK offered various securities, including land and property, to secure the loan. These securities included properties in Kampala like the entity’s Nasser Road headquarters and Mbarara, as well as land in Mukono. A debenture was placed on MTK’s assets, and personal guarantees were provided by Francis Xavier Kitaka and Ms Fiona Kitaka. Despite repeated demands and reminders, dfcu told the court, MTK and Ms Kitaka failed to fulfil their obligations under the loan agreement. Consequently, the bank appointed auctioneers who sold the properties in Mbarara and Mukono, generating Shs1.7b, leaving $5,220,009 unpaid.

MTK and Ms Kitaka did not file a defence to the counterclaim by dfcu or participate in the post pleadings process of the suit, court documents show. As a result, dfcu’s lawyers applied for default judgment on July 10, 2023.

While dfcu had asked the court to grant it general damages, court said there was no “circumstance” for the grant of general damages. Court also rejected dfcu’s claim for interest of 35 percent and instead awarded it 12 percent per annum on the decretal amount from the date of filing the suit to payment in full.