In 2020, Saleh Mukwanga, a father of three, and resident of Buwenge in Jinja District, lost his national identity card and, thereafter, reported the matter to the police.

At the time, Mukwanga was planning to travel out of the country and needed a passport. He later proceeded to the National Identification and Registration Authority (Nira) to process a replacement ID. While the process of replacing the card dragged on, Nira issued a letter to Mukwanga, introducing him to the citizenship and immigration office where he went to secure a passport.

Mukwanga then travelled to Dubai, United Arab Emirates, in February 2021, where he spent 22 months. But unknown to him, some fraudsters had acquired his lost identity card, which they used to register a fake company for a ponzi scheme.

A ponzi scheme involves fraud that lures investors and pays profits to earlier investors with funds from more recent investors.

So, when Mukwanga returned to Uganda in November 2022, he started receiving calls from strange numbers, asking him to deliver vehicles spare parts. Mukwanga had worked at Kisekka market, a popular downtown hub for secondhand automobile parts.

“They would ask for car spare parts like lights and mountings. They would also inquire about my workplace. I didn’t know that my contacts would be used to track me,” he said.

In January 2023, Mukwanga was tracked and intercepted by unidentified security personnel at Entebbe while on his way to Dubai.

“We were detained at Entebbe Airport Police post until around 4pm when the Police Flying Squad arrived. I broke down immediately as I cast my eyes on them. We were in the queue when a police officer stopped and asked me to confirm whether I was Saleh Mukwanga. I asked him what the matter was, but he only said I would not continue with the journey.

The fake company, Hennam Solutions-SMC Ltd, that was registered with his identity, was used to defraud Ugandans of hundreds of millions of shillings. Police records showed three phone numbers were registered using Mukwanga’s identity card, company and an Airtel Mobile Money, and a merchant code were used to transact business.

The fraudsters also used the same card to open a bank account with Stanbic Bank for Hennam Solutions-SMC Ltd, with the help of a former cleaner at the bank and obtained a Tax Identification Number (TIN) from the Uganda Revenue Authority.

While all these happened, the said institutions did not do due diligence on the documents and identity card submitted, prompting Mukwanga to issue notice of intention to sue.

Unmasking the fraud

With the complete setting of the Hennam Solutions, the fraudsters created an app through which unsuspecting victims would deposit money on which they would purportedly earn huge profits.

Hamza Ssenyonga, a businessman in Bugiri District, was one of the victims who lost Shs10 million. Ssenyonga said before he was defrauded, he did a background check with the Uganda Registration Services Bureau (URSB) and found the company was truly registered under the name of Mukwanga. He said he also spoke to some of the people who had allegedly benefitted and they all convinced him to put his money in the business.

“I injected in the business Shs10.2 million, which I was told, would, after five days, earn me Shs15 million. But nothing came on the day I should have earned. I asked the owner and he urged me to be patient. When I asked why I had not received the money, he said it could have been the problem of Internet network,” he said.

A well-placed source at URSB, who did not want to be named, said given the current automated online system, it would not be possible to trace the real owners of such stolen identities.

The source said the system only recognises whether the name of the person registering the company matches the card and the NIN and once it is confirmed, the company is registered without the applicant going physically to URSB offices.

“The verification is done to prove that the ID used is actually an original ID issued by Nira. But because we don't interface physically, that makes it a little bit challenging. It works in the same way as registering a car through the URA portal that only requires an ID.

When a week passed and Ssenyonga did not receive the money, he sensed danger. He then took a decision to report the case to police and later to the headquarters of the Criminal Investigations Directorate.

It was at this point that the police tracked down Mukwanga, arrested him and brought him for questioning at Kibuli CIID headquarters.

Shs2.5 billion suit

After the interrogation, the police cast their nets wide and swooped on Innocent Tinyefunza, 33, a real estate dealer, who was charged with electronic fraud.

While the case is still pending, Mukwanga’s legal representatives have issued a notice to sue about six entities, including banks, telecom companies, regulatory authorities, and Mr Tinyefunza, demanding compensation of Shs2.5b.

Through Mulindwa and Co Advocates, Mukwanga said he has suffered financial and mental anguish because the institutions mandated to carry out due diligence failed in their duties.

A mobile money dealer takes the details of a client off his National ID. Wrong elements can use a stolen or copied ID to impersonate the owner, committing crimes or fraudulent activities, which in turn can land a registered owner in trouble. Photo | File

“We, therefore, demand that our client is compensated in the sums of Shs2.5 billion for the emotional and physical damage he went through during arrest, identity theft and inconvenience suffered within two weeks from date hereof. We also demand that a refund is made on transaction charges made on all transactions made between Stanbic Bank, Airtel Uganda and- Hennam Solutions,” the letter of intention to sue reads in part.

Unraveling the maze

Mr David Birungi, the public relations manager at Airtel Uganda, did not confirm nor deny whether the firm issued the merchant code and a mobile number under the name of Saleh Mukwanga. But an earlier police statement recorded by Martha Kagoya, an employee of Airtel, who worked on the document, confirmed issuing the merchant code.

Ms Kagoya, in her statement to the police, a copy of which this publication has obtained, said she opened the Airtel account and gave Hennam Solutions the merchant code after undertaking the due processes, including visiting the business premises at Nkumba on Entebbe Road. She also said she took the coordinates of the premises.

But Mukwanga’s lawyers said the coordinates provided matched a location in Ghana, not in Uganda.

“That they proceeded to Airtel Money Commerce Uganda Ltd (AMCUL) where the corporate manager, a one Martha Kagoya, opened and issued a merchant collection Account (Merchant Code 101002381) on the basis of a falsified visitation report conducted on Hennam in Entebbe Municipality, yet the coordinates in the report stated the address of Hennam to be of Latitude 6.111231 Longitude 0.12181, which matched a location in Ghana.

"That (AMCUL) was negligent and or complicit and did not carry out due diligence. Our client's National lD is not linked to registration of any number on Airtel, yet they executed a contract with Hennam for their beneficial interest,” the lawyers argued.

Our independent online search for the said latitudes and longitudes also showed the location of the said coordinates to be in Lower Manya, Ghana, dispelling the assertion by Kagoya that she took the coordinates of the premises at Entebbe.

While all the back-and-forth continues, Mukwanga is stuck with his passport confiscated as evidence, pending the disposal of the case. “They are still holding onto my passport, which means I can’t return to Dubai where I had a job,” he said.

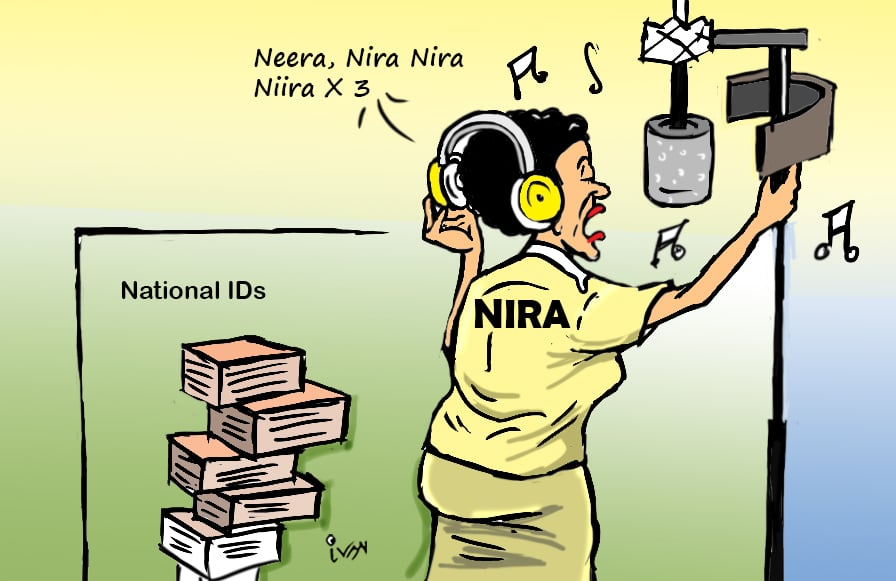

The magnitude of ID loss

Many Ugandans have become negligent and when they lose their identity cards, very few take the trouble of reporting the loss to police and even fewer go for replacement because of the charges involved. As of yesterday, a total of 379 lost and found national identity cards from Mubende were reported at the Nira website. Similar or more numbers are reported from other districts across the country.

In 2022, following an operation conducted by the Environmental Protection Police to evict wetland encroachers on the Lubigi wetland in Nansana Municipality, Wakiso District, the security teams allegedly found Terwane Hakim, aka Umaru, a 43-year-old, in possession of 10,722 National IDs, 68 Ugandan passports, 237 Ugandan driving permits, two motor vehicle number plates, warrant cards and ATM cards for different banks, among other documents.

Over the years, criminals have perfected the art of identity theft both online and offline. They use the stolen identities to commit fraud, including acquiring loans using forged identities, engaging in robberies and a host of other criminal activities, and implicating the owners of the identity cards.

In May, Mr Joseph Okello, a cybercrime expert, told this publication that criminals steal personal information to impersonate individuals or conduct fraudulent activities. This, he said, includes opening bank accounts, applying for loans, and mobile money transactions. He said the banks, via their so-called wallets, microfinance institutions, and mobile money entities, find themselves vulnerable to cyber-attacks.

“They are prime targets for cybercriminals seeking to steal funds, commit fraud, or compromise customer data. This leads to significant losses and can erode public trust in the banking systems,” Mr Okello said.

Others use the stolen identity for loan staking, where they get approval for multiple loans or lines of credit within a short period using online platforms. For example, police in Mbale City arrested a police impersonator in a microfinance institution, who had reportedly forged the signature of a former district police commander (DPC) to get a loan using personal details of another police officer.

Another suspect was also arrested after a tip-off by a staff of a microfinance institution. Police also said one of the staff of the said microfinance was also arrested.

“The suspects were using civil servant’s documents to get loans through forged bank statements, stamps of various offices such as the chief administrative officers (CAOs), district police commanders (DPC), among others. They also forged appointment letters, national ID, employee IDs to get loans,” Mr Taitika said. He said the suspects were arrested inside the microfinance entity while trying to get a loan of Shs4.2 million.

Mr Taitika said many banks and microfinance entities have lost millions of shillings to such scams.

Data from the annual police crime report indicates that in 2023, there was an increase in economic crimes such as financial fraud, which resulted in more than 12,924 cases of economic crimes compared to 13,207 cases in 2022.

The same report shows that obtaining money by false pretence registered the highest number of cases in economic crimes with 10,709 followed by forgeries and uttering false documents with 868 cases. Police recorded 245 cases of cybercrimes last year and 43 cases of bank and other corporate fraud were registered in 2023.

Dangers of losing one’s identity card

Identity theft: Wrong elements can use a stolen or copied ID to impersonate the owner, committing crimes or fraudulent activities, which in turn can land the registered owner in trouble.

Fraudulent transactions: A National ID can be used to open bank accounts, obtain loans, or conduct financial transactions under someone else’s name and when found out, can also land the owner in trouble.

Criminal activities: Wrong elements can use a National ID to conceal their true identity while engaging in criminal activities, making it harder for authorities to track them and the easiest person to be implicated will be the registered card owner.

Voter manipulation: A National ID can be used to register multiple times or impersonate voters, compromising the integrity of elections.

Access to sensitive information: Wrong elements can use a National ID to gain access to sensitive information, such as government databases or secure facilities.

Human trafficking: A National ID can be used to smuggle people across borders or exploit them for forced labour.

Terrorist activities: Wrong elements can use a National ID to conceal their true identity while engaging in terrorist activities.

Land grabbing: A National ID can be used to fraudulently acquire land or property under someone else’s name.

Benefits and services fraud: Wrong elements can use a National ID to access benefits, services, or subsidies meant for the ID owner.

Blackmail and extortion: A National ID can be used to blackmail or extort the owner, threatening to reveal sensitive information.

What to do when you lose your National ID

When you have lost your identity card, immediately report to the police, bank or Nira. Where you suspect that your stolen identity is being used to commit fraud, do the following:

● Report and notify the law enforcement agencies about your lost ID.

● Apply for a replacement ID. If either your National ID or passport or drivers licence or whatever identification you have lost, immediately apply for a replacement document.

● Report the loss to the bank and freeze your ATM card or credit card to protect your bank accounts from being emptied by the fraudsters.

● Where you suspect theft of your identity, and where you believe you are a victim of an identity theft, file an identity theft report.

● Should you suspect that someone is using your identity, protect your account by changing your password and using unique and strong credentials to log into your account.

● You can also request a background check on your name and personal data to identify arrests, criminal charges, or debt collections that you don’t recognise. If you notice anything suspicious, call local law enforcement and file a police report.

● Be vigilant at all times to protect your identity and the people close to you from fraud.