Prime

NMG organises symposium to empower SMEs

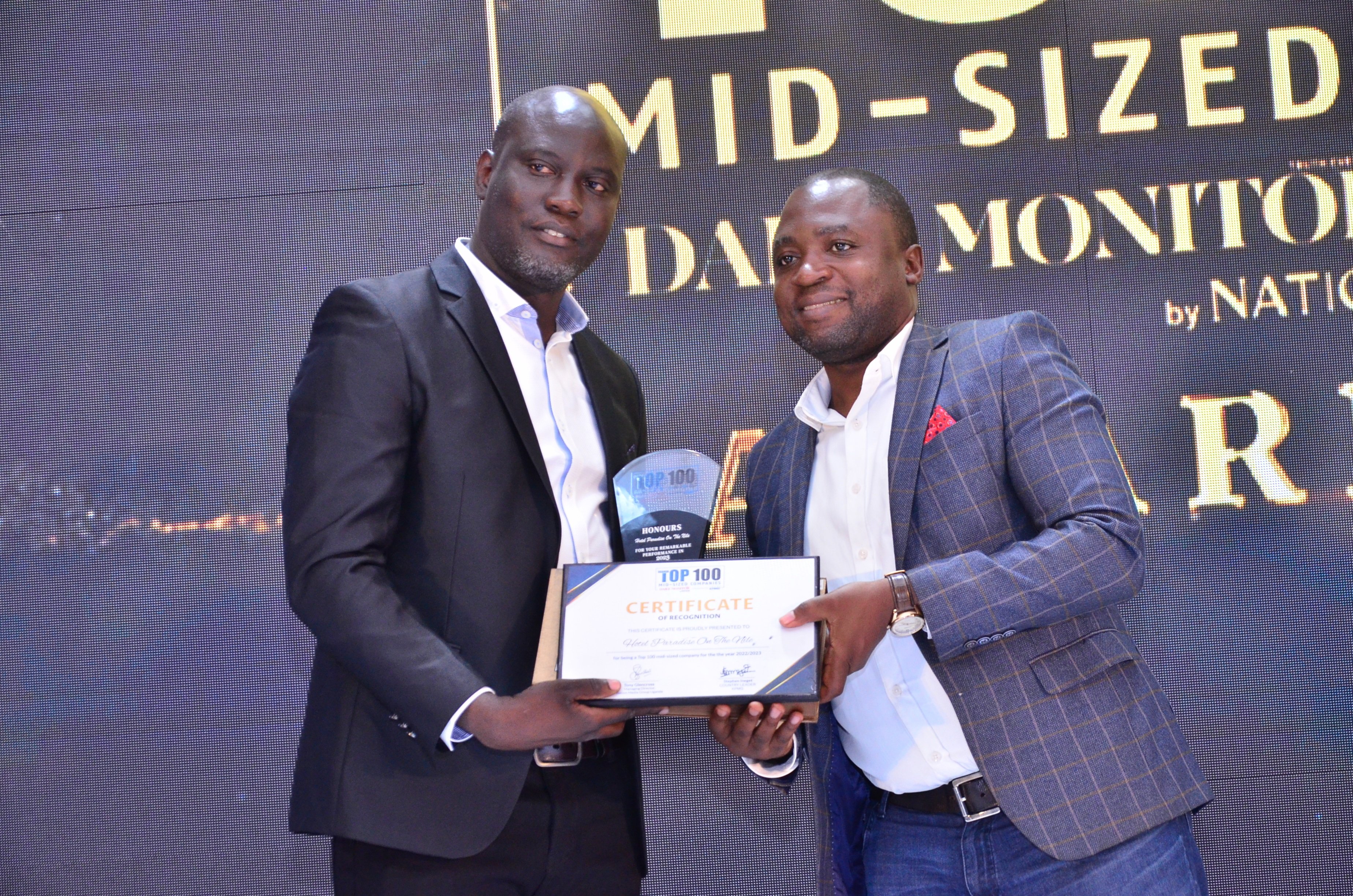

Mr Andrew Otim (left) of Hotel Paradise receives a plaque from Mr John Walugembe, the executive director of the Federation of Small and Medium Enterprises, at Top 100 Mid-Sized Companies gala dinner in Kampala in 2023. PHOTO | FILE

What you need to know:

- Some of these challenges are expected to be addressed at the MSME Symposium to be held tomorrow at Hotel Africana under the theme, “Breaking Barriers for MSME Acceleration.”

The Nation Media Group Uganda (NMG-U) has organised a symposium to discuss key issues affecting Micro, Small, and Medium Enterprises (MSMEs).

For a while, MSMEs have been grappling with several issues ranging from taxes to the most recent Electronic Receipting and Invoicing System (Efris).

According to traders, the issues are hampering the recovery of their businesses from the effects of Covid-19 and hindering their contribution to economic growth.

Some of these challenges are expected to be addressed at the MSME Symposium to be held tomorrow at Hotel Africana under the theme, “Breaking Barriers for MSME Acceleration.”

NMG-U owns NTV U, SparkTV, The East African, the Daily Monitor, and KFM.

Mr Sam Barata, the general manager, commercial at NMG-U, said the symposium aims to empower MSMEs by providing them with the tools and insights needed to overcome the challenges and elevate their businesses to new heights.

“The NMG SME symposium will delve into the issues affecting Small and Medium Enterprises (SMEs) and provide possible solutions. We will also bring in experts in the areas of investment and tax,” Mr Barata said, emphasising the importance of collaboration for businesses to grow and improve in the post-Covid era.

Mr Haruna Kisirinya, a business manager at NMG-U, said the symposium is an inaugural event intended to bridge the gap between MSMEs, the business community, policymakers, and the government to address the various challenges faced by SMEs.

He noted that the platform will also help in creating partnerships and synergies that will lead to SME growth and expansion.

“SMEs play a critical role in the economy, employing approximately 2.5 million people and contributing about 80 percent to Uganda’s GDP,” Mr Kisirinya said.

“Yet, they face several challenges, as seen in the Daily Monitor classified ads where many are closing shop and others are losing their property,” he added.

He further added that the symposium will assist SMEs in maximising the opportunities presented by the Shs72 trillion budget for the Financial Year 2024/2025, as well as unveiling a platform on the Daily Monitor where issues affecting them will be reported, along with opportunities.

Notably, two years ago, the government established the Small Business Recovery Fund (SBRF) to provide soft loans to SMEs that had suffered financial distress during Covid-19. The government provided Shs100 billion, equally matched by banks, to extend credit to the target beneficiaries at a 10 percent interest rate,.

The government has allocated about Shs1.6 trillion to the Small Business Recovery Fund (SBRF) . The symposium will feature players from the financial sector, tax authorities, and company registration.

Background

Most of the MSMEs are household enterprises which form part of the 90 percent of Ugandan households that earn less than Shs10 million annually. But since most of them are informal, this limits their ability to access formal financing.

According to Financial Sector Deepening Uganda (FSD-Uganda), about 70 percent of all MSMEs in the country have unmet credit needs, with their demand for credit estimated Shs31.4 trillion ($8.8 billion).