Prime

Relief for foreign banks after top court clarifies rules

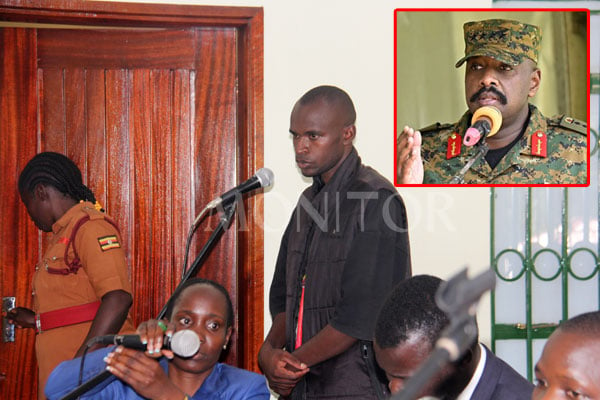

Businessman Hamis Kiggundu addresses the media after he stormed out of the Supreme Court on June 8. This was after Justice Elizabeth Musoke informed court that the ruling in the matter would be held yesterday yet his lawyer had an application to make. PHOTO | ABUBAKER LUBOWA

What you need to know:

- The Supreme Court has adopted a Bank of Uganda position in which the financial regulator clarified that foreign-based banks do not need its licence to lend funds originating from abroad, writes Stephen Kafeero

The Supreme Court has declared syndicated lending legal in Uganda in a ruling which also establishes that foreign banking or non-banking institutions seeking to provide credit facilities to Ugandans are not bound by local laws.

The top court judges cited the Financial Institutions Act, 2004 and the Financial Institutions (Agent Banking) Regulations, 2017 in finding that international financial transactions and syndicated lending is not regulated by local Ugandan law.

Syndicated lending is a financing arrangement where a large loan is provided to a borrower by a group of lenders. In this arrangement, each lender contributes a portion of the loan amount, thereby spreading the risk and diversifying the lending exposure. The borrower, typically a corporation or a government entity, benefits from accessing a bigger pool of money than would be available from a single lender. Syndicated lending is commonly used for large-scale projects or acquisitions, allowing lenders to collaborate and share the credit risk while providing the borrower with the necessary financial resources.

“Similarly, no law was brought to this Court’s attention that forbids foreign financial institutions from extending credit facilities to any financial institution or person in Uganda. If anything, in furtherance of international trade and investment, financial institutions the world over are known to engage in global financial business transactions by dealing with, or through, financial institutions based in other jurisdictions,” the five Supreme Court justices ruled.

"In the case of Uganda,” Chief Justice Owiny Dollo, who rendered the unanimous decision of the court, said, “such international financial business transactions are certainly neither governed by the Financial Institutions Act, 2004, as amended, nor the Financial Institutions (Agent Banking) Regulations, 2017, made pursuant thereto.”

The trial judge, he ruled, erred in holding that the credit agreements between the parties were illegal. In any event, the judges ruled, Judge Adonyo ought to have accorded the parties a hearing to determine the fate of the monies advanced and not determine the matter summarily.

The apex court, as the judges explained, has the responsibility to definitively address the issue of illegality, which has been raised and debated from the High Court all the way up to the Supreme Court. The court emphasised that resolving this issue is crucial in order to prevent excessive delays and resulting injustice that the parties involved would suffer if the case were referred back to the trial court, only to be appealed once again to the Supreme Court.

By resolving the issue, the court said an essential legal point in the appeal would be clarified, providing a clear understanding of the law regarding individuals in Uganda engaging in financial transactions with foreign financial institutions or persons. This, the court says, will allow banking and other financial institutions conducting business in Uganda, as well as those interacting with institutions within the country, to carry out their operations with confidence, knowing that they are protected by the law.

Further, the judges said that having ordered for an audit of the transactions to ascertain the status of the loans between the parties, the trial judge was under a duty to determine the aspects of the dispute between Ham and Diamond Trust Bank Uganda, over which the issue of illegality had not arisen. The omnibus finding of illegality of all the transactions was a miscarriage of justice, they said. The other judges included Faith Mwondha, Percy Night Tuhaise, Mike Chibita and Stephen Musota.

The Supreme Court decision cements a position adopted by the Bank of Uganda in which the financial regulator clarified that foreign-based banks do not need its licence to lend funds originating abroad.

At the time, the Central Bank explained that foreign banks’ lending deposits held in jurisdictions other than Uganda are regulated and supervised by their home authorities and it is not mandatory for a foreign bank to establish a representative office in Uganda in order to conduct lending.

Dr Bazinzi Natamba, the Deputy Director Communications at the Bank of Uganda, told Daily Monitor in a telephone conversation and subsequent email that the bank will issue a statement.

The case between Mr Kiggundu and the two banks will now go to trial in the High Court. The Supreme Court has directed that the case be heard by another High Court judge “basing only on issues of fact arising from the pleadings”.

Background

Mr Kiggundu and his companies, Ham Enterprises Ltd and Kiggs International Ltd(Ham), took credit facilities from Diamond Trust Bank Kenya and Diamond Trust Bank Uganda. The loan facilities were secured by mortgages over various properties, including Kyadondo Block 248 Plot 328 land at Kawuku, FRV 1533 Folio 3 Plot 36-38 Victoria Crescent II Kyadondo, and LRV 3176 Folio 10 Plot 923 Block 9 Land at Makerere Hill Road. Ham also provided personal and corporate guarantees.

Following what the bank termed as the failure by Ham and his companies to pay, DTB-U commenced a recovery process for the money in early 2020. By the time the process started, Mr Kiggundu, according to the DTB lawyers, owed DTB Kenya $4m (Shs14.8b) and DTB Uganda $6.9m (Shs25.6b).

In response, the businessman sued the two banks in the High Court, claiming unfair contractual terms and illegal deductions from his accounts. Additionally, he sought an order directing a full account reconciliation of all financial transactions between the parties.

As a result, DTB agreed to the appointment of an auditor by the court, and Justice Henry Adonyo, the trial judge, issued the order accordingly. However, on August 10, 2020, Mr Kiggundu amended his claim and introduced a new allegation that the loan agreements were illegal and unenforceable due to DTB Kenya lacking a licence to operate in Uganda.

The businessman sought a declaration from court that the demands from both DTB Kenya and DTB Uganda was “illegal and unenforceable”. He, instead, asked that the two banks pay him Shs34.2b as money that was unlawfully deducted from his accounts. He also sought the unconditional removal of mortgages on his properties and discharge of all corporate as well as personal guarantees issued to secure the borrowings.

Consequently, Mr Kiggundu applied to court to stop the appointment of an auditor and for summary judgment on the premise that the defence by DTB Uganda and DTB Kenya was a perpetuation of illegalities. Justice Adonyo issued an order stopping the appointment of an auditor, found that the two banks had engaged in illegal lending and ordered the banks to pay the businessman Shs34.2b.

Justice Adonyo further declared that Mr Kiggundu’s properties and all corporate and personal guarantees issued to secure his borrowings were to be unconditionally released.

With Tuesday’s ruling, the matter now returns to the court to be heard on its merits.