Taxman salutes its new sheriff in town

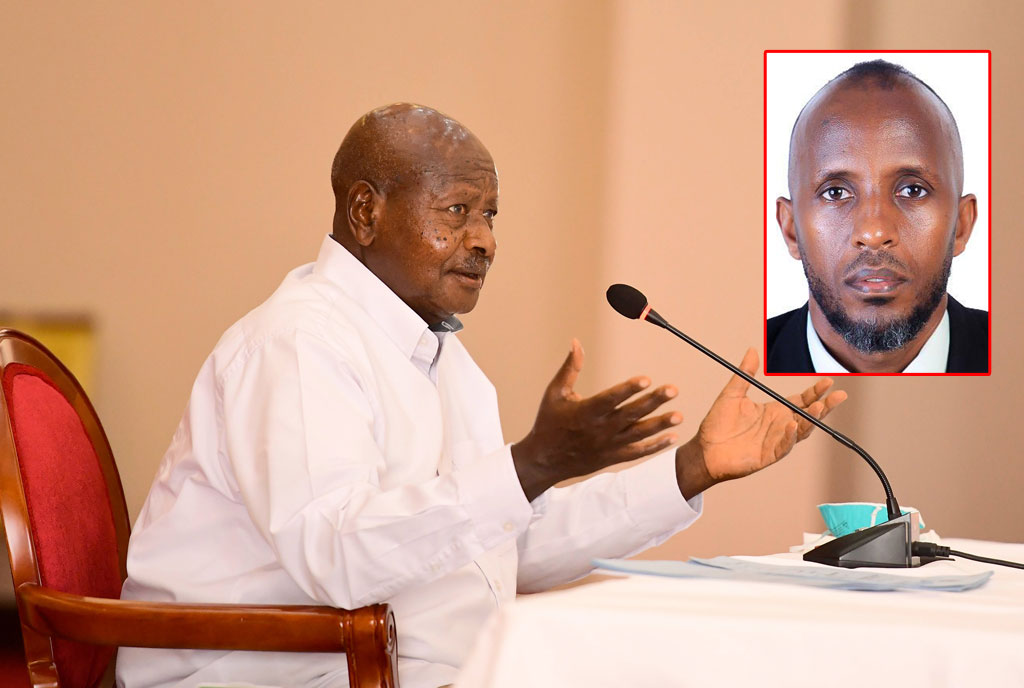

URA commissioner general John Musinguzi Rujoki (L) and David Kalemera, the head of the newly created State House Revenue Intelligence and Strategic Operations Unit. PHOTO/COMBO

What you need to know:

- President Museveni announced the creation of the State House Revenue Intelligence and Strategic Operations Unit last week.

The URA spokesperson says the creation of the unit marks a pivotal step in the fight against corruption

The Uganda Revenue Authority (URA) has welcomed the establishment of the new State House unit which will monitor the tax body.

President Museveni announced the creation of the State House Revenue Intelligence and Strategic Operations Unit last week and appointed Mr David Kalemera to head it.

The appointment was met with mixed reactions regarding the history of Mr Kalemera. On April 21, 2022, found guilty of conspiracy to commit a felony contrary to Section 390 of the Penal Code Act, and also using falsified customs documents contrary to Section 203 (h) of the East African Community Customs Management Act, 2004.

Mr Ibrahim Bbosa, the URA spokesperson, said the creation of the unit marks a pivotal step in the fight against corruption within the tax administration system and reinforces government commitment to operational integrity.

“Corruption significantly hinders revenue mobilisation and economic growth. URA emphasises integrity and transparency in building a strong tax framework. The new unit aligns with our principles of Ethical Leadership, Resolute Staff, and Robust Systems and Processes,” Mr Bbosa said in a statement released yesterday.

Mr Bbosa said URA has witnessed rampant cases of corruption over the years and measures have been put in place to curb the vice.

“Our anti-corruption measures, supported by policies like the Code of Conduct, Offense Schedule, and Lifestyle Audit Policy, have shown positive results. The Comprehensive Integrity Strategy has led to a 9.7 percent improvement in integrity scores, instilling public confidence in our dedication to excellence and our goal of achieving a 22.6 percent improvement,” he said.

He added that some of the strategies include the digital strategy, which focuses on technological advancements and system enhancements to ensure simplicity, accessibility, and transparency in the tax body’s services.

“The Whistleblower Platform allows individuals to report corruption practices confidently, directly aiding revenue recovery and economic progress. URA’s Change and Culture Transformation initiative promotes core values of Patriotism, Professionalism, and Integrity, motivating our workforce to deliver exceptional service. Disciplinary actions, including dismissals and legal proceedings, underscore our commitment to maintaining an untainted workforce,” Mr Bbosa said.

He said the new State House Revenue Intelligence and Strategic Operations Unit will significantly strengthen URA’s efforts to prevent revenue losses and enhance tax collection.

“We urge all stakeholders to join us in creating a transparent, accountable, and efficient tax administration system for a corruption-free society and a brighter future for Uganda,” he said.

Background

In 2020, Mr Museveni said he had forced several URA staff to resign and fired others over corruption. The President said there had been a lot of corruption in URA, which he had cleaned by sacking the culprits.

A 2021 report by the Inspectorate General of Government said using the data on prevalence and size of bribes in taxation, the estimated total cost of bribes paid by citizens to tax officials was about Shs27 billion per year.

The report said the estimated loss for the public budget due to misreporting and underreporting of value-added tax by firms was nearly Shs107 billion and that in sum, the total cost of corruption in taxation was estimated to be nearly Shs136 billion per year.