Prime

Young generation needs early exposure to tax regime – Musinguzi

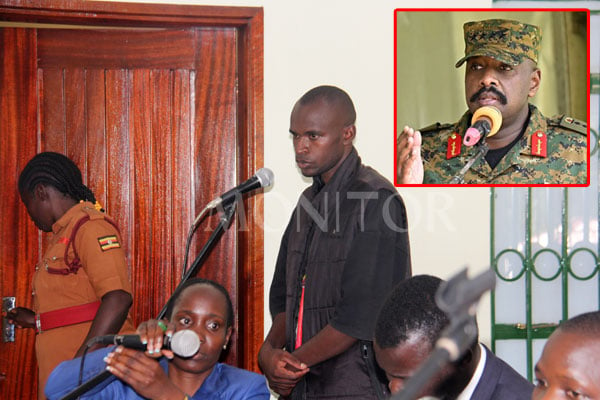

URA Commissioner General, Mr John Musinguzi (2nd left) is optimistic that the early exposure of the tax regime to the young people with a deliberate effort to have them understand reasons why taxes are paid including the benefits that are not individualized is a mission that Ugandans should embrace. Photo | Dan Wandera

What you need to know:

- URA Commissioner General, Mr John Musinguzi, is optimistic that the early exposure of the tax regime to the young people with a deliberate effort to have them understand reasons why taxes are paid including the benefits that are not individualized is a mission that Ugandans should embrace.

The Uganda Revenue Authority (URA) is undertaking a robust program to have the young generation exposed to the tax regime through strategic partnerships and collaboration to widen the tax base and the Gross Domestic Product ratio (GDP) that now stands at 12.1 per cent.

URA Commissioner General, Mr John Musinguzi, is optimistic that the early exposure of the tax regime to the young people with a deliberate effort to have them understand reasons why taxes are paid including the benefits that are not individualized is a mission that Ugandans should embrace.

“For a long time, we have been oscillating between 10, 11 & 13 per cent for the GDP ratio, a figure that is below average in comparison to many countries in Africa. For any nation to know how well the citizens and businesses contribute towards tax, it is measured based on the tax to GDP ratio. The average for Sub-Saharan Africa is 16 per cent. This means that we are still below average in comparison to the developed world that is above 25 per cent, a requirement for any nation to develop,” he said while addressing the Ndejje University Tax Society and staff on Thursday.

Tax education and mobilization has been a challenge for a population where about 52 per cent of the businesses are informal with no proper records.

This translates to non-payment of tax since many don’t know how much should be paid in taxes. Efforts made by the young people such as the Ndejje University Tax Society to mobilize and educate communities about the tax regime are commendable, Mr Musinguzi said.

The government has already introduced tax education into the Primary and Secondary school curriculum. This will be rolled out to the other education institutions.

“We need a nation with people of integrity and honesty willing to have the country develop. Part of the challenge has been the limited knowledge on the part of the tax-payers. This explains why URA is now collaborating with institutions including Universities to overturn the trend,” he added.

“Ndejje University has had a fruitful collaboration and partnership with URA including the signing of A Memorandum of understanding that enabled it to pay the tax obligations in manageable installations although the Covid-19 pandemic severely hampered the arrangement,” the University Vice Chancellor Prof Eriabu Ligujjo said.

The University that has heavily invested in the Science education with a wide spectrum in the Science and Engineering programmes requests for a long term government financial guarantee in a bid to secure low cost financing from International Banks including the VAT on the infrastructure development at the Faculty of Health Sciences where the VAT on the medical school is Shs12Bn.

The University has a challenge and appeals to the Ministries of Finance, Education for a waiver for the interest liability on PAYE of Shs8.3Bn, he said.