Prime

Bank of Uganda’s domestic gold purchase programme a big boost to artisanal miners

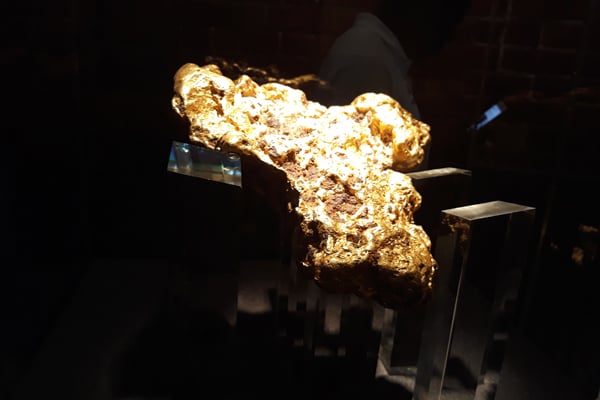

Whereas there is little information on the source of Uganda's gold, it has since 2018 been the country's largest export. Photo / File

What you need to know:

- BoU’s Domestic Gold Purchase Programme is a golden opportunity for artisanal miners and their communities. It is a testament to the Central Bank’s commitment to promoting economic growth and development, and its recognition of the important role that artisanal miners play in our economy.

Uganda has an estimated 90 percent of its gold production mined by the over 31,000 miners in the artisanal sector, and for a long time, artisanal miners have been exploited by middlemen who take advantage of their lack of access to markets and fair prices.

However, the trend could change following the Bank of Uganda’s introduction of the Domestic Gold Purchase Programme in which it will be purchasing gold directly from artisanal miners hence supporting their livelihoods.

Uganda joins a list of other countries in Africa that purchase gold locally to boost their foreign reserves; Zimbabwe in April 2024 introduced ZIG- Zimbabwe Gold (New Domestic Currency) by buying approximately 2.5 tonnes of gold. This is strictly for backing the currency, Nigeria is also buying gold domestically to boost its reserves. The aim is to enhance their reserves, reduce debt, and sustain an improved trade balance.

In addition, Ghana in 2022 also adopted the buying of gold domestically (20 percent) of all gold mined locally, leading to strong liquid monetary gold levels of over 26.6 tonnes (estimated at US$2.1 billion).

According to June 2024 BoU’s State of Economy Report, the programme aims at accumulating foreign currency reserves and addressing the associated risks in the international financial markets.

The programme will also build Uganda’s foreign reserves and minimise risks on reserves investments while supporting the government’s ongoing value addition to minerals and the Import Substitution Strategy by reducing the imports of raw gold into the country.

As of April 30, 2024, Uganda’s foreign exchange reserves totalled approximately $3.5 billion, sufficient to cover 3.2 months of imports. This represents a slight decline from the previous year when reserves stood at 3.4 months of import cover, mainly attributed to an increase and diversity of shocks.

The decline in Uganda’s foreign reserves poses severe challenges to the economy, impacting currency stability, debt management, investment, trade, and socioeconomic wellbeing. Addressing these issues requires prudent fiscal and monetary policies and diversification of the economy.

Speaking to BBC News, BoU Deputy Governor Michael Atingi-Ego said that with the Domestic Gold Purchase Programme, the Central Bank is ensuring that it mitigates the decline of the country’s using the available natural resource.

He said that BoU will ensure that it gives fair pricing for the gold from the miners while at the same time purchasing the gold using the local currency Uganda Shillings to boost the reserves while diversifying the investment portfolio.

Buying from artisanal miners and small-scale miners has a positive spill-over effect on other sectors of the economy with the potential to transform the lives of artisanal miners and their communities.

The programme will provide a stable and predictable income stream, allowing them to plan and invest in their businesses. In addition, it will reduce the reliance on middlemen, who often take advantage of their lack of knowledge and bargaining power.

Gold Purchase Programme is likely to promote responsible mining practices, as the Bank of Uganda is committed to sourcing gold that is mined in an environmentally and socially responsible manner.

The buying of local gold means an upgrade of local artisans whose trade has been informal. The involvement of the Central Bank means that the artisans in mining will have been elevated to a higher recognition level.

The benefits of this programme extend beyond the individual miners, too. By supporting artisanal miners, the programme will also support their families and communities, who depend on them for their livelihoods. It will also promote economic growth and development in rural areas, where mining often takes place.

In a nutshell, the BoU’s Domestic Gold Purchase Programme is a golden opportunity for artisanal miners and their communities. It is a testament to the Central Bank’s commitment to promoting economic growth and development, and its recognition of the important role that artisanal miners play in our economy.

Wilson Manishimwe, Public Relations and Policy Manager, Corporate Image Limited